How to Spot Trend Reversals Using Powerful Indicator Combination Part 2

Summary

TLDRThis video script introduces a contrarian trading strategy using Bollinger Bands and chart patterns to identify potential trend reversals. It explains the concept of reverting to the mean and how extreme price movements are likely to return to normal levels. The script teaches viewers to spot M tops and W bottoms in conjunction with Bollinger Bands to find short-term reversal opportunities. It also emphasizes the importance of risk-reward analysis and the imperfect nature of trading patterns, suggesting that they may only be successful 40-45% of the time.

Takeaways

- 📈 Trend Following: The traditional approach is to buy and hold when the trend is up, and sell or hold short when the trend is down.

- 🔄 Against the Trend: The script introduces a new concept of trading against the trend, focusing on potential reversals.

- 📊 Bollinger Bands: A statistical tool used to measure volatility and identify price extremes, consisting of a simple moving average (SMA) and two standard deviation bands.

- 🔍 Reverting to the Mean: The concept that prices will revert to their average after reaching an extreme, which is the basis for using Bollinger Bands to predict reversals.

- 📌 M Tops and W Bottoms: Chart patterns that indicate potential reversals; an M top has two highs with the second being slightly higher, while a W bottom has two lows with the second being slightly lower.

- 📈 Setup for Reversal: A reversal setup involves an M top or W bottom with the first point outside the Bollinger Bands and the second point inside, indicating a potential trend reversal.

- 📊 Candlestick Confirmation: After identifying the pattern on a line chart, switching to a candlestick chart and waiting for a close below the M top or above the W bottom confirms the reversal.

- 📉 Short-Term Reversal: The patterns discussed are more effective for short-term moves rather than indicating a complete trend change.

- 📚 Market Psychology: The patterns are based on supply and demand dynamics and market psychology rather than just technical formations.

- ⚠️ No Guarantee: No trading pattern works 100% of the time; most patterns may only be successful 40-45% of the time, so it's important to consider risk and reward.

- 📝 Homework for Traders: The script encourages viewers to analyze the risk and reward of the discussed patterns and to consider the risk-to-reward ratio for potential trades.

Q & A

What is the main concept discussed in the script about trading strategies?

-The script discusses a contrarian trading strategy that involves identifying potential reversals against the trend using M tops and W bottoms in conjunction with Bollinger Bands.

What is the principle of 'reverting to the mean' in the context of trading?

-Reverting to the mean is a statistical concept that suggests prices will move to extremes and then return to their average or mean level. It is used to predict potential reversals in price trends.

What are Bollinger Bands and how are they used in trading?

-Bollinger Bands are a technical analysis tool that consists of a simple moving average (SMA) flanked by two standard deviation lines above and below it. They are used to measure volatility and identify potential reversal points in the market.

How does the script define an M top pattern?

-An M top pattern is defined as a situation where the market goes up, comes down, and then makes a slightly higher high, forming an 'M' shape, which is a potential sign of a reversal in an uptrend.

What is a W bottom pattern and how does it differ from an M top?

-A W bottom pattern occurs when the market goes down, comes up, and then goes down again to a point that is slightly lower than the first low, forming a 'W' shape. It is the opposite of an M top and signals a potential reversal in a downtrend.

What are the steps to identify a potential reversal using Bollinger Bands and M tops?

-The steps are: 1) An up move occurs. 2) The first point of the M top is outside the Bollinger Band. 3) The second point of the M top is inside the Bollinger Band and higher than the first point. A reversal is confirmed when the market closes below the M pattern on a candlestick chart.

Why is it important to switch to a candlestick chart after identifying the pattern on a line chart?

-Switching to a candlestick chart allows traders to confirm the reversal with a closing price below the support area of the M or W pattern, providing a clearer signal of a potential trend change.

What is the significance of the closing price in confirming a reversal pattern?

-The closing price is significant because it confirms the market's acceptance of the new price level. A close below the support area of an M pattern or above the resistance area of a W pattern indicates a confirmed reversal.

How reliable are these patterns in predicting market reversals according to the script?

-The script suggests that no pattern is 100% reliable, and most patterns may work only around 40 to 45 percent of the time. It's important to test these patterns within a trading system and consider risk-to-reward ratios.

What is the homework suggested by the script for further understanding of the discussed patterns?

-The script suggests analyzing the risk and reward of a trade using the discussed patterns, calculating the maximum loss and average profits, and evaluating if the risk-to-reward ratio makes sense.

Why does the script mention that patterns are not the only factor in market psychology?

-The script mentions that patterns are essentially a reflection of supply and demand dynamics in the market. They are tools to interpret market psychology but should not be solely relied upon for trading decisions.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

This NEW Indicator Is Beyond Your Imagination! It Will Blow Your Mind!

The Only Strategy I’ve Used For 10 Years (Proven)

MHV Trading Strategy(BBMA Oma Alley)

This One Trading Strategy Works Everyday (Simple, Easy & Proven)

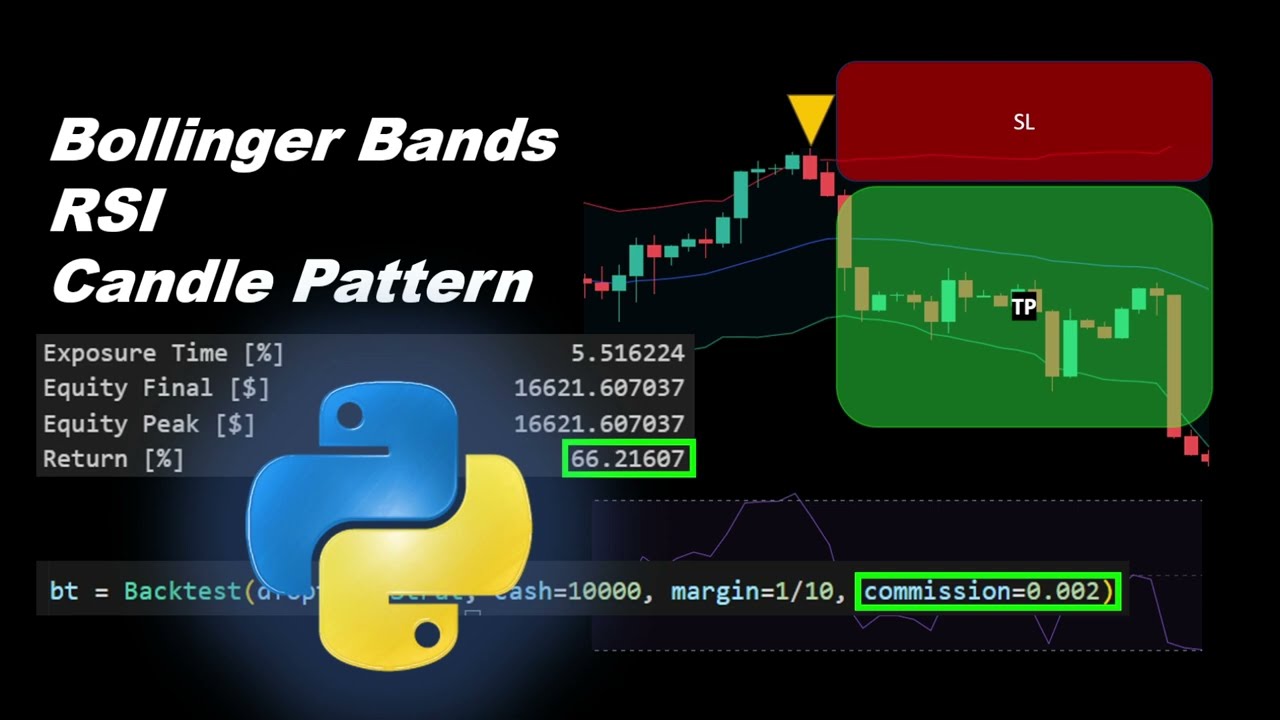

Maximize Trading Profits with Python Optimize Your Strategy Using EMA, Bollinger Bands & Backtesting

Profitable Strategy Using Bollinger Bands and RSI Automated in Python

5.0 / 5 (0 votes)