Turn $4 Into $277,000 [By Doing Nothing]

Summary

TLDRIn this video, Tom promises to reveal a strategy to turn $4 into $280,000 effortlessly, regardless of market conditions. He emphasizes the importance of a long-term mindset, disciplined dollar-cost averaging, and investing in good businesses. Tom also discusses market volatility, the Fed's potential rate cuts, and the benefits of investing in lagging asset classes like small caps and real estate. He stresses the need for patience, discipline, and community support to achieve financial success.

Takeaways

- 💰 The video promises a method to turn $4 into $280,000 with zero effort, regardless of market conditions.

- 📈 The speaker emphasizes that the strategy works irrespective of whether the market is bullish or bearish, and is applicable in any economic climate.

- 🎯 The method is described as a 'cheat code' for investors and is said to be incredibly simple, requiring no upfront investment or stress.

- 👥 The speaker thanks the community for their growth, highlighting the rapid increase in subscribers and the value of the community.

- 📊 The script discusses market volatility, specifically referencing the S&P 500's performance and predicting trends based on historical data.

- 📉 The video mentions that August is historically a weak month for the stock market, suggesting a strategy of dollar-cost averaging during this period.

- 🏦 The Federal Reserve's interest rate decisions are discussed, with expectations of a rate cut and its potential impact on the market.

- 💹 The speaker outlines a plan for both scenarios of market movement: continuing to invest during upswings and accelerating investments during downturns.

- 💼 The importance of having a long-term mindset and the discipline to invest consistently is stressed, with the assertion that patience leads to success.

- 🌐 The script highlights various asset classes and companies that are currently undervalued, suggesting these as potential investment opportunities.

- ☕ The video concludes with a practical example of how small daily savings, such as avoiding Starbucks purchases, can accumulate to significant investment capital over time.

Q & A

What is the main claim Tom makes in the video about turning $4 into $280,000?

-Tom claims that by consistently investing a small amount, like $4 a day, into the stock market over a long period (20 years), and using a strategy of dollar-cost averaging, one can potentially turn that small investment into a significant sum like $280,000.

What does Tom suggest is the secret to this investment strategy's success?

-The secret to the strategy's success, according to Tom, is picking good businesses to invest in, having patience, and consistently using dollar-cost averaging, especially during market downturns.

How does Tom define a 'good business' in the context of his investment strategy?

-While Tom does not explicitly define what makes a 'good business', he implies that it involves companies that are fundamentally strong, have good management, and are likely to perform well over the long term.

What is the role of dollar-cost averaging in Tom's investment strategy?

-Dollar-cost averaging is a technique where an investor consistently invests a fixed amount of money at regular intervals, regardless of the price of the shares. This approach reduces the risk of making a large investment at the wrong time and helps to average out the cost over time.

How does Tom address the concern of market volatility in his strategy?

-Tom acknowledges market volatility but advises viewers to expect it and to not be phased by it. He suggests that his community members are prepared for such volatility and view it as an opportunity to invest more when prices are down.

What is the significance of the 'cheat code' Tom mentions in the video?

-The 'cheat code' Tom refers to is a metaphor for an investment strategy that he believes is simple, effective, and works regardless of market conditions. It suggests a method that can potentially give investors an advantage.

How does Tom respond to the criticism that his strategy requires a long time to see significant returns?

-Tom defends the long-term nature of his strategy by emphasizing the importance of patience and discipline in investing. He argues that the market has historically rewarded those who can withstand short-term volatility.

What does Tom suggest as an alternative for those who cannot afford to invest right now?

-For those who cannot afford to invest, Tom advises focusing on increasing their income and creating free cash flow before considering investing. He also suggests cutting back on non-essential expenses, like daily Starbucks purchases, to free up funds for investing.

How does Tom use historical data to support his investment strategy?

-Tom uses historical data to show that despite various crises and market crashes over the past 15 years, the market has consistently recovered and provided significant returns to long-term investors.

What is the role of the community that Tom mentions in the video?

-The community Tom refers to serves as a support network for investors who share his investment philosophy. It provides a platform for discussion, education, and mutual encouragement to stick to the investment principles outlined in the video.

How does Tom suggest viewers prepare for the potential Federal Reserve rate cuts?

-Tom suggests that viewers should have a plan in place for both scenarios: if the market goes up, they should continue dollar-cost averaging; if the market goes down, they should increase the pace of purchases, effectively buying more stocks at lower prices.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

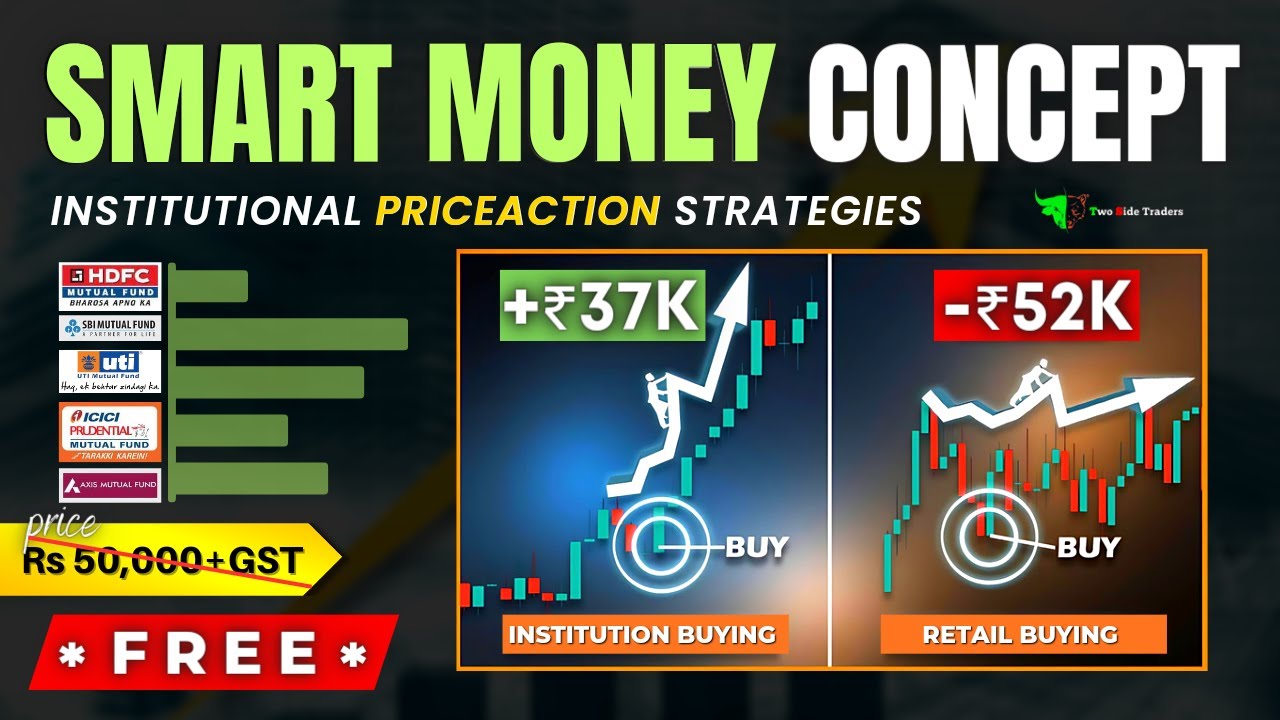

A Huge Discovery About Price Action for ALL Strategies and Traders

Trading Starts with Supply and Demand

Hur månadssparar jag i fonder? | Nordnet Academy

How Operator TRAPS New Traders | *FREE Advance Price Action Trading | Smart Money Concepts In Hindi

Tom Lee: “This Is The Best Investing Opportunity This Decade”

How To Never Lose Money In The Stock Market Again

5.0 / 5 (0 votes)