Japan Just CRASHED The US Market!

Summary

TLDRThe video discusses the economic conflict between the Bank of Japan and the Federal Reserve, which has led to a global market upheaval. Japan's unexpected interest rate hike challenges the Fed's dominance, causing market chaos. The video delves into the economic strategies of these central banks, the risks of the Japanese yen carry trade, and the potential implications for global financial markets and individual investments. It also examines the 'impossible trilemma' of monetary policy, capital flow, and exchange rates, and speculates on the future paths of monetary policy in response to current economic pressures.

Takeaways

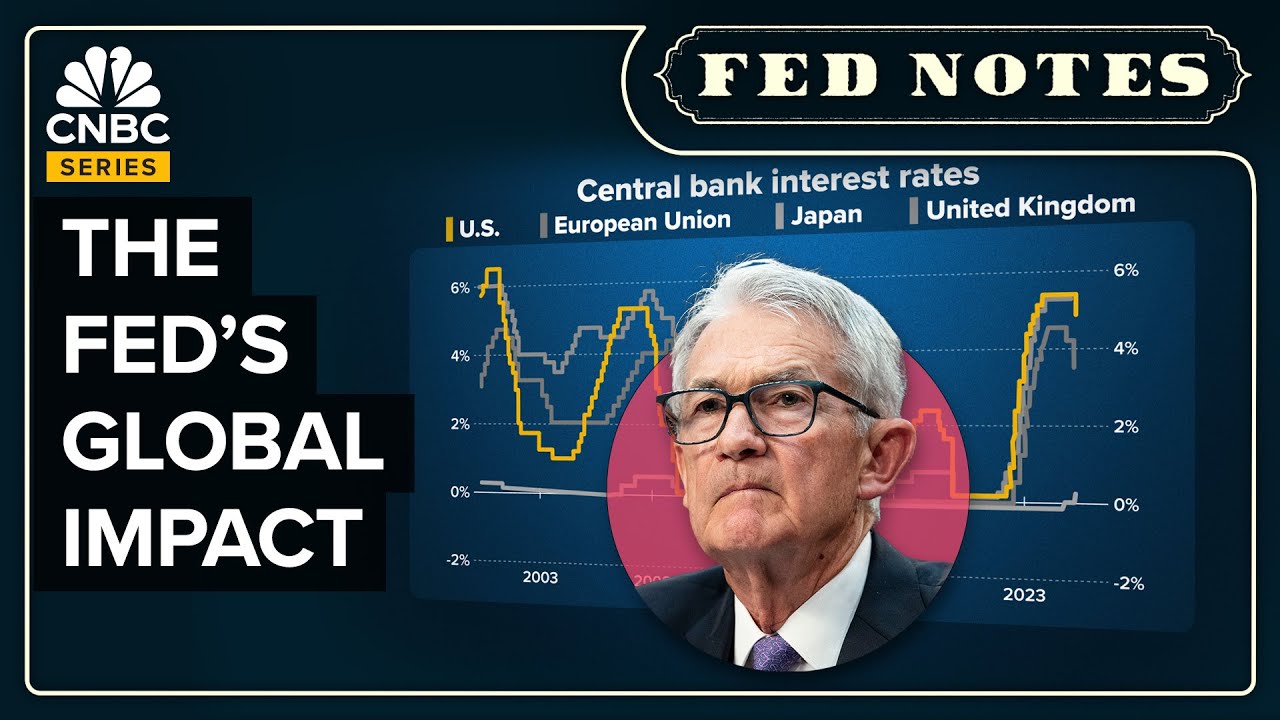

- 🌐 The Bank of Japan's unexpected interest rate hike challenged the Federal Reserve's dominance and caused global market turmoil.

- 📉 Japan's move was a response to the 'Lost Decades' of economic stagnation and stagflation, where traditional monetary policy failed to stimulate growth.

- 💹 The sudden change in Japan's monetary policy led to a sharp rise in the Japanese Yen's value against the US Dollar, impacting global currency markets.

- 🏦 The 'impossible trilema' faced by Japan and other nations involves the balance between free capital flow, a fixed exchange rate, and an independent monetary policy.

- 🔄 The carry trade, which profited from the low-interest rates in Japan, led to a massive short position against the Yen, creating systemic risk.

- 📈 The Federal Reserve's aggressive rate hikes in 2022 caused the Yen to plunge, prompting Japan to intervene in the currency markets to stabilize its currency.

- 🌪️ Japan's rate hike to shake off short sellers has had a domino effect, causing a potential deflationary crisis and market instability.

- 💔 The high debt-to-GDP ratio in Japan poses a significant challenge to normalizing interest rates without causing severe economic repercussions.

- 🌳 The dilemma faced by Japan and other nations is whether to risk a currency crisis or a deflationary crash, which could lead to a Great Depression-like scenario.

- 💰 The script suggests that governments are likely to choose inflation over deflation, potentially leading to a new wave of asset inflation beyond what was seen in 2020.

- 🚀 The presenter forecasts a 'Quantum wave leap' in technology and asset prices, advising viewers to understand market cycles to make informed investment decisions.

Q & A

What is the main conflict discussed in the video script between the Bank of Japan and the Federal Reserve?

-The main conflict discussed is the unexpected move by the Bank of Japan to raise interest rates, challenging the Federal Reserve's dominance and causing global market chaos.

Why did Japan's decision to raise interest rates cause such a significant impact on the global markets?

-Japan's decision was unexpected and went against the trend of keeping rates near zero, which caught the market off guard and led to a sharp increase in the Japanese Yen's value against the US Dollar.

What is the 'Lost Decades' referred to in the script, and how does it relate to Japan's economic situation?

-The 'Lost Decades' refers to the period of economic stagnation in Japan, characterized by market crashes and lack of growth, where Japan struggled with stagflation and had interest rates at zero or negative for an extended period.

What is the 'impossible trilemma' mentioned in the script, and how does it affect a country's financial policy?

-The 'impossible trilemma' is a situation where a country can only have two of the following: free flow of capital, a fixed exchange rate, and an independent monetary policy. It affects financial policy by forcing a country to choose between these options, impacting their economic strategy and global financial relations.

How does the Federal Reserve's aggressive rate hiking cycle affect the Japanese Yen?

-The Federal Reserve's aggressive rate hikes made the US Dollar stronger, which in turn caused the Japanese Yen to plunge in value as investors moved towards the higher-yielding US assets.

What is the 'carry trade' mentioned in the script, and why is it significant in the context of Japan's financial situation?

-The 'carry trade' is a strategy where investors borrow money in a country with low-interest rates (like Japan) and invest it in a country with higher returns. It is significant because it created a massive risk for the market when Japan raised its interest rates, causing a rapid unwinding of these trades and putting downward pressure on the Yen.

Why did Japan's verbal warning about taking action on currency if needed come after the Yen's value continued to plunge?

-Japan's verbal warning was an attempt to deter short sellers who were betting against the Yen and to stabilize its currency. However, the continued plunge indicated that market participants were not convinced by the warning and continued to sell the Yen short.

What is the potential consequence if Japan were to normalize its interest rates with the Federal Reserve's rates?

-Normalizing interest rates with the Federal Reserve could lead to Japan paying a significant portion of its GDP in interest on its debt, which could be unsustainable given its high debt-to-GDP ratio.

What are the two main choices Japan faces in response to the current financial challenges, as outlined in the script?

-The two main choices are to either allow the Yen to continue to fall, leading to a currency crisis, or to attempt to save the currency by fighting off short sellers, which could lead to a deflationary crisis.

How does the script suggest governments typically respond to financial crises, and what does this imply for the future of asset prices?

-The script suggests that governments typically choose to print more money to avoid a deflationary crash, which can lead to inflation and push asset prices to new highs, as seen in the aftermath of the 2020 economic shutdowns.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

🚨 END THE FED: US Congressman Exposes the Fed and Introduces a Bill to Abolish It

Trader’s calendar on December 19: USD may suffer losses

BANK PALING BERKUASA DAN KEBAL HUKUM : BANKNYA BANK SENTRAL SELURUH DUNIA

How Fed Rate Cuts Affect The Global Economy

IRÃ ATACA E PETRÓLEO DESPENCA -9% | Ataque teatral e o fim da tensão geopolítica

Will markets crash again? | Is US facing a recession? | Impact on Indian economy | Fed’s next steps

5.0 / 5 (0 votes)