4 INSANE Pullback Trading Strategy

Summary

TLDRThis video teaches aggressive trading strategies to turn $90 into $110,000. It emphasizes the importance of risk-taking, combining different strategies, and understanding market liquidity points. The presenter discusses using breaker blocks, equal highs, and supply/demand zones to maximize profits and minimize losses, while advising viewers to be patient and not fight the market trends.

Takeaways

- 💰 Aggressive Risk-Taking: The speaker emphasizes the importance of taking risks and being aggressive in trading to achieve significant returns.

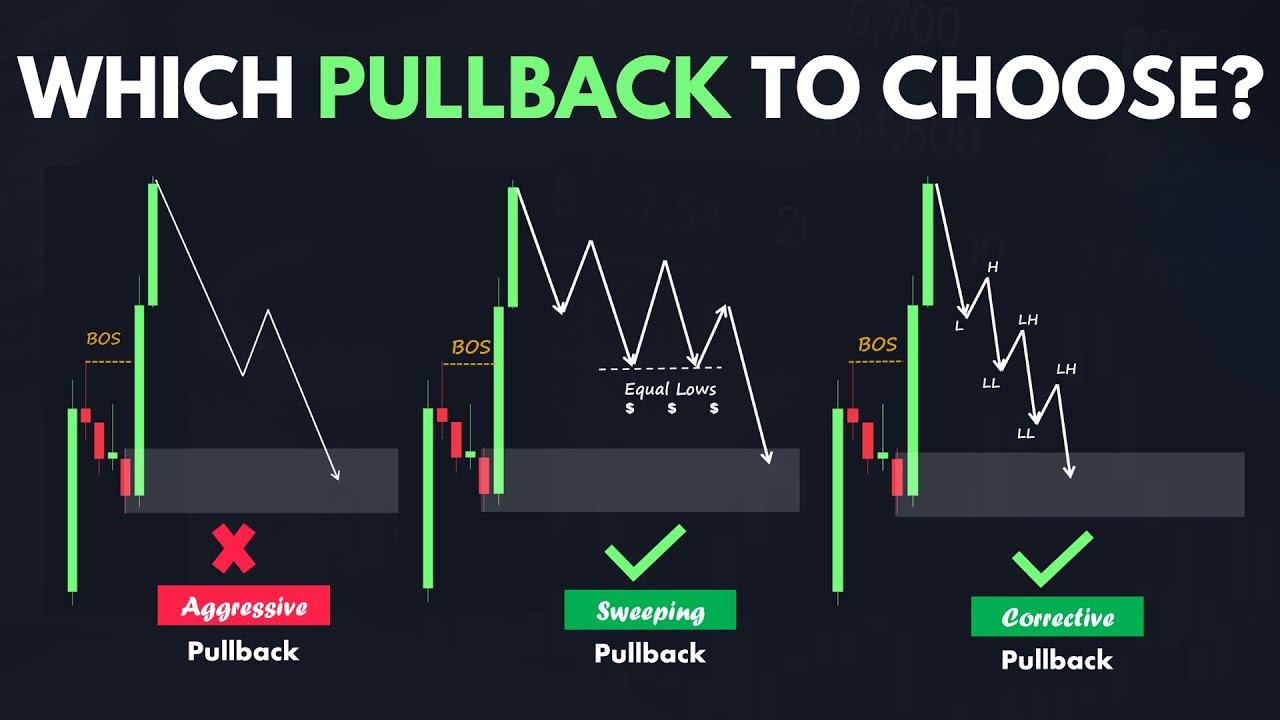

- 📈 Trend Confirmation: It's crucial to confirm whether the market trend is bearish or bullish before making trades.

- 🔍 Liquidity Points: Identifying equal highs in the market, referred to as liquidity points, can significantly improve win rates.

- 📊 Price Action: Observing how price gravitates towards certain points can provide insights into potential market movements.

- 🚀 Profit Maximization: The speaker suggests taking profits when they meet expectations, rather than holding onto trades indefinitely.

- 🔄 Trade Consistency: Using a combination of strategies can help maintain consistency in trading results.

- 📉 Risk Management: The speaker advises against using stop losses, instead advocating for risking everything to potentially achieve greater gains.

- 🔎 Higher Time Frame Analysis: Confirming market trends and resistance or demand zones on higher time frames can provide more accurate trading signals.

- 🌐 Market Magnets: Prices tend to gravitate towards areas of liquidity, whether above or below current market levels.

- 🔄 Trend Following: Following the prevailing market trend, especially when supported by trend lines and liquidity, is key to successful trading.

Q & A

What is the main premise of the video the speaker is presenting?

-The speaker is teaching viewers how to aggressively trade in financial markets to turn a small investment into a significant profit, using specific strategies and trading techniques.

What is the first rule mentioned by the speaker for successful trading?

-The first rule is to risk aggressively, implying that one should be bold and take calculated risks to achieve substantial growth in trading.

What does the speaker mean by 'the violent taketh it by force' in the context of trading?

-This phrase, likely a reference to the Bible, is used to emphasize the need for assertiveness and aggressive action in trading to achieve success.

What is the importance of combining different strategies according to the speaker?

-Combining different strategies is crucial to avoid relying solely on one method, such as the breaker block, which alone might not yield significant results and could lead to losses.

What are 'liquidity points' in the context of the trading strategies discussed?

-Liquidity points, specifically 'equal highs liquidity,' are price levels where the market tends to gravitate towards, acting as targets or points of interest for traders.

How does the speaker suggest traders should approach stop losses?

-The speaker advises against using stop losses, instead suggesting that traders should risk more and trust the market to eventually reward them if they follow the right strategies.

What is the significance of the 50% zone in trading as mentioned by the speaker?

-The 50% zone refers to a midpoint within a trading range or block, where the speaker suggests that prices are likely to react strongly, leading to potential trading opportunities.

What does the speaker mean by 'spamming your points' in the context of trading?

-This refers to the strategy of making multiple entries at different price points to maximize the chances of a profitable trade, as opposed to placing a large single bet.

Why is it important to look at higher time frames when trading according to the speaker?

-Higher time frames provide a broader perspective and can confirm whether the price is rejecting from a significant zone, which is crucial for making informed trading decisions.

What is the speaker's advice on how to handle losses in trading?

-The speaker suggests that instead of obsessing over charts during a loss, traders should take a break, have fun, and check back later, maintaining a long-term perspective.

How does the speaker define a 'strong demand zone' in trading?

-A 'strong demand zone' is identified by the speaker as a price area where the market has shown significant buying interest, leading to a rejection of selling attempts and potential upward price movement.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

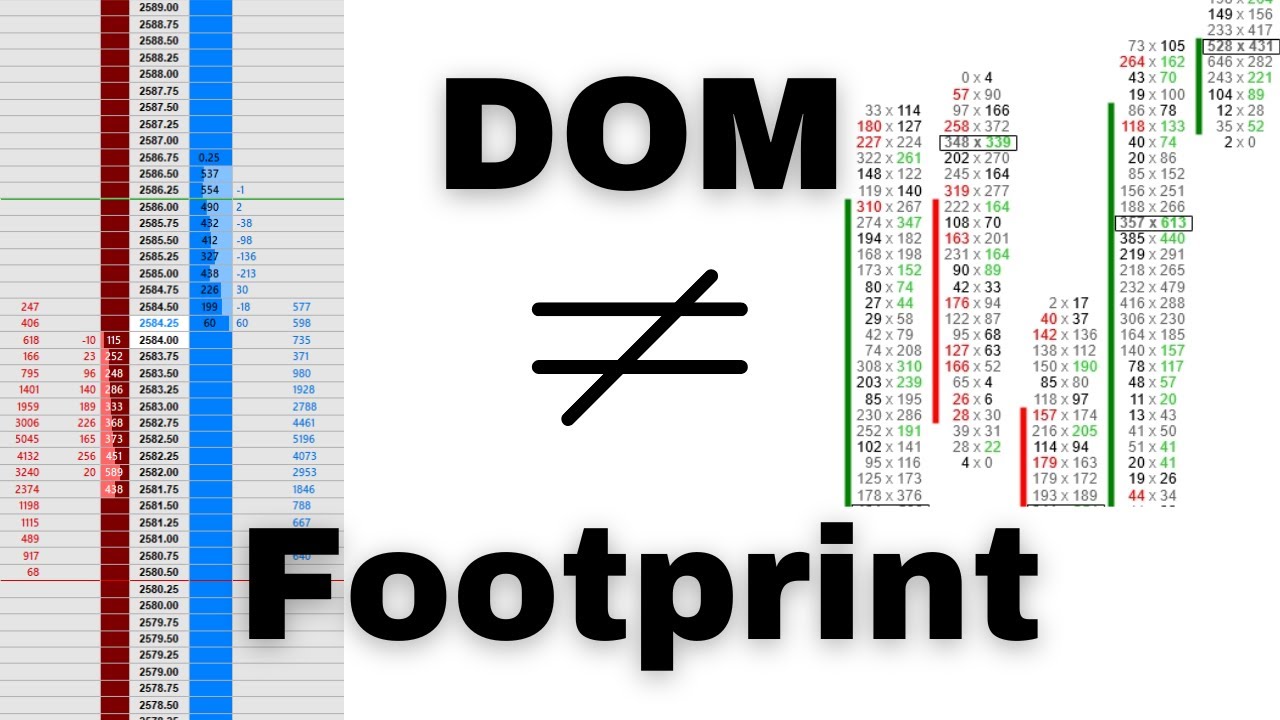

Understanding The Differences Between a DOM and Footprint Chart

How I Turned 5 SOL Into 1000 SOL (Get Rich with Memecoins FULL GUIDE)

Best Pullback Trading Strategies In Forex - The Pullback Mastery Guide

How I Scale Call Funnels To $750k/Month And Beyond (Info/Coaching)

Stop Blocking, Start Countering! How to Drill Counters Like a Pro (from a Pro Drilling Session)

Tutorial Trading Untuk Pemula Dari Nol

5.0 / 5 (0 votes)