Pattern Recognition - Fiber OTE NYO and Asian Session

Summary

TLDRThis video script emphasizes the importance of daily practice in spotting trading patterns through price action analysis. It illustrates how to identify and trade off hard time frame levels and short-term highs using the Eurodollar as an example, highlighting the value of repetition and hindsight in learning.

Takeaways

- 📚 The examples provided are meant for learning and activating the reticular activating system, which helps in recognizing patterns in real-time trading.

- 🔍 It's crucial to watch new uploads and study old videos to fill in the gaps in your trading knowledge.

- 👀 Those who view these examples as useless hindsight are less likely to benefit from them, emphasizing the importance of learning through repetition.

- 📈 The speaker uses the Eurodollar as an example to illustrate how to spot patterns in price action.

- 📉 The concept of 'run one sell stop' is introduced, highlighting the importance of recognizing equal lows in price action.

- 📊 The speaker explains how to use hindsight to gain insight into price movements, particularly by looking at high and low points in the market.

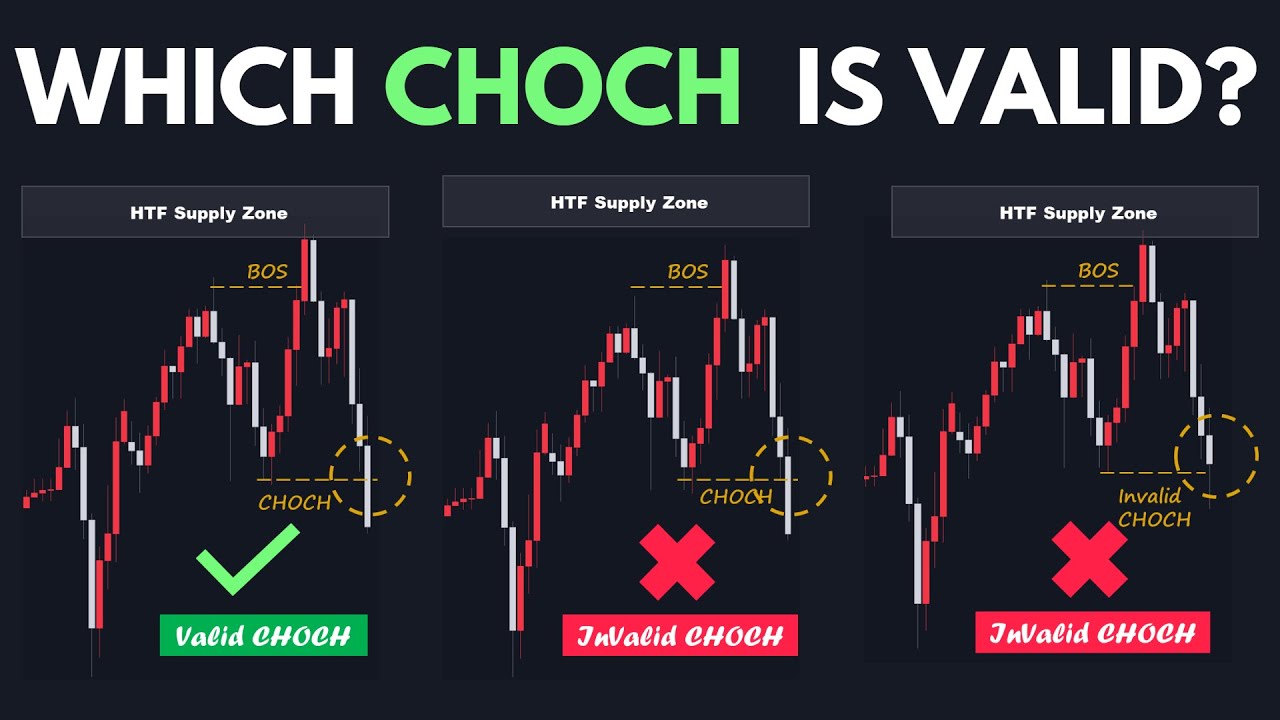

- 🎯 The focus is on identifying a 'bullish breaker', which is a high between a low and a stock run, and using this to predict future price movements.

- 📌 The use of a 15-minute time frame is suggested to wait for a short-term high to be broken, indicating a change in market structure.

- 📈 Fibonacci levels are used to determine optimal trade entry points, emphasizing the importance of respecting the bodies of the candles.

- 📉 The speaker demonstrates how to use the low to the high of a market structure to predict future price movements, including first and second targets.

- 🌐 The script includes an example from the Asian session, showing how a short-term high can be used to predict a symmetrical price swing.

Q & A

What is the main purpose of the video script?

-The main purpose of the video script is to educate viewers on how to spot trading patterns in real time by studying price action routinely and repeatedly.

What is the reticular activating system mentioned in the script?

-The reticular activating system is a part of the brain that plays a role in alertness and attention, which in the context of the script, helps in recognizing trading patterns.

Why is it important to watch new uploads and study old videos?

-It is important to watch new uploads and study old videos to fill the gaps in trading knowledge and to familiarize oneself with recurring patterns in trading.

What is the significance of looking at a higher time frame level to spot patterns?

-Looking at a higher time frame level helps in identifying the formation of trading patterns before they unfold, which can be crucial for making informed trading decisions.

What does the term 'sell stop run' refer to in the context of the script?

-In the script, 'sell stop run' likely refers to a situation where the price action indicates a potential breakaway from a support level, prompting a sell order.

What is meant by 'bullish breaker' in the script?

-A 'bullish breaker' in the script refers to a price action that breaks a short-term high, indicating a potential upward trend.

Why is it necessary to refer to the 15-minute time frame after identifying a hard time frame price level?

-Referring to the 15-minute time frame allows traders to look for a short-term high to be broken, which is a signal for a potential trade entry.

What role does the Fibonacci tool play in the trading strategy discussed in the script?

-The Fibonacci tool is used to measure the potential extent of a price move after a breakout, helping to identify optimal trade entry and exit points.

How does the script suggest using the body of the candles for trade entry?

-The script suggests using the body of the candles to identify the high and low points for trade entry, focusing on the respect of the bodies and the first target being the old high.

What is the significance of the 'symmetrical price swing' mentioned in the script?

-The 'symmetrical price swing' refers to a pattern where the price action mirrors itself, often reaching the same high or low points, which can be a reliable indicator for trade entries and exits.

How does the script suggest traders refine their trading strategy?

-The script suggests refining the trading strategy by looking for hard time frame levels, short-term highs to be broken, and using the body of the candles to anchor reference points for trade entries.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

5.0 / 5 (0 votes)