Tìm Điểm Cân Bằng Trên Biểu Đồ: Xác Định Vùng Cung Cầu Chia Sẻ Những Chiến Lược Giao Dịch Đỉnh Cao

Summary

TLDRThe video script delves into the intricacies of market trading, focusing on the use of volume profile analysis to identify market phases and trading opportunities. It discusses the importance of recognizing no demand and no supply situations, the significance of support and resistance levels, and the concept of market balance zones. The speaker illustrates how to apply these theories to predict market movements and make informed trading decisions, emphasizing patience and understanding market dynamics.

Takeaways

- 📈 The speaker discusses the concept of utilizing multiple timeframes for trading, such as H4, M15, and M30, to coordinate and make profits without being bound by a specific timeframe.

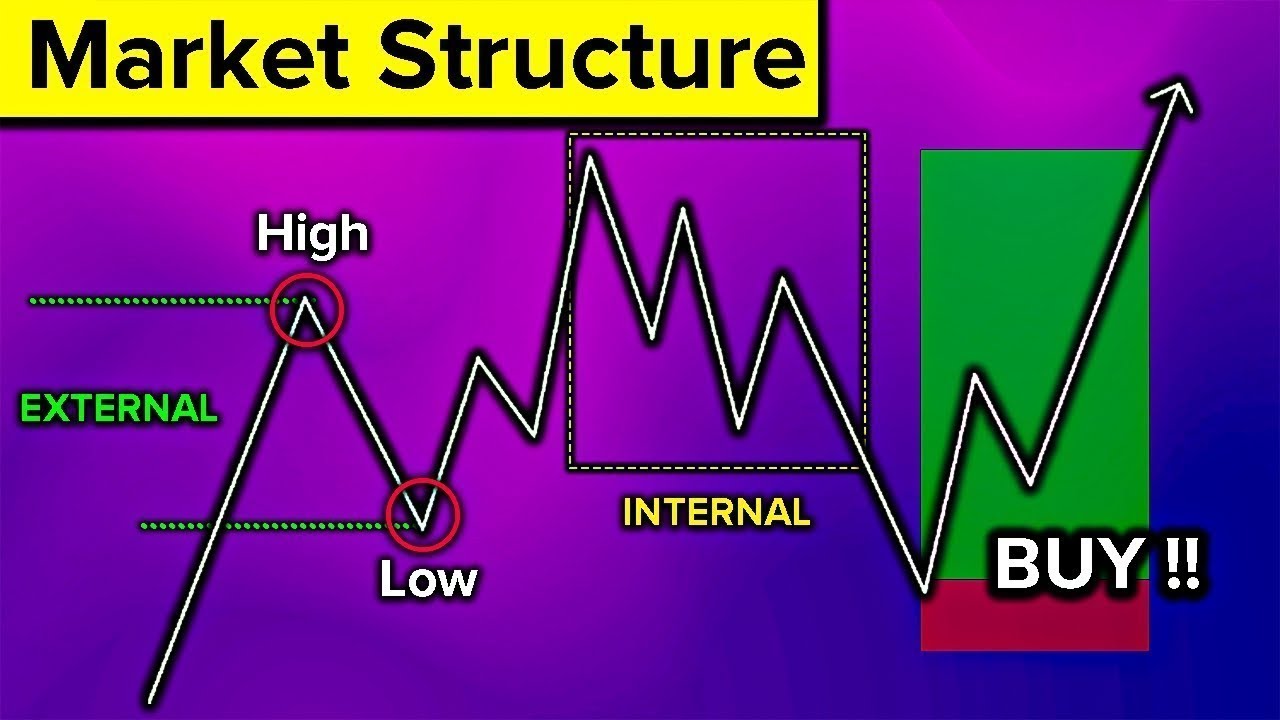

- 💡 The trading strategy involves understanding market auctions, which are divided into three phases: the market converging (accumulation), the market in balance (equilibrium), and the market breaking out (distribution or re-accumulation).

- 🔍 The importance of identifying 'no demand' and 'no supply' zones in the market is highlighted, which are critical for predicting price movements and making trading decisions.

- 📊 The use of volume profile analysis is emphasized to understand the market's behavior at different price levels and to identify potential entry and exit points for trades.

- 🛑 The concept of 'stop volume' is introduced as a phase where the market stops at a certain price level, which is a potential turning point for the traders to consider.

- 🔑 The 'Mino structure' is identified as a key pattern that signals a new price acceptance area, indicating a change in market dynamics and a potential shift in the trading strategy.

- 🚀 The speaker mentions that the second phase of the market auction is often the most profitable for traders, but it requires careful analysis of the preceding and following phases to predict and capitalize on it.

- 📉 The script talks about the potential for price to 'break down' when there is a lack of buying interest at certain levels, leading to a potential shorting opportunity.

- 📈 Similarly, a 'break out' scenario is discussed where there is strong buying momentum, indicating a potential long position opportunity for traders.

- 🤔 The importance of patience and the ability to wait for the right trading setup is stressed, rather than chasing every market movement.

- 👍 The speaker encourages traders to combine technical analysis with a bit of luck, patience, and market understanding to make informed trading decisions.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is the analysis of market trading strategies, specifically focusing on the use of volume profile and understanding market behavior in terms of supply and demand.

What are the three stages of the auction market mentioned in the script?

-The three stages of the auction market mentioned are: the market converging or 'folding' to a certain boundary, forming a 'balance area' or 'value zone'; the market reaching a 'stop volume' phase which is a weak phase where the price can slip; and the final stage which is the market accepting a new price level, known as the 'fourth phase of the market' or the 'new price acceptance area'.

What is the significance of the 'no demand' zone in trading?

-The 'no demand' zone signifies an area where buyers are not willing to purchase at the current price level. This can indicate a potential turning point in the market, where if the price attempts to fall back into this zone and fails to break through, it could lead to a buying opportunity.

What is the concept of 'Mino structure' in the context of the video?

-The 'Mino structure' refers to a market structure that indicates a new price acceptance area. It is a key point in the market's movement and is associated with the stop volume phase, suggesting a potential change in the market direction.

How can traders use the 'Swing' concept in their analysis?

-Traders can use the 'Swing' concept to identify pivot points or turning points in the market. A 'Swing' can indicate a change in market direction, and when combined with other indicators such as volume analysis, can provide insights into potential trading opportunities.

What is the importance of 'volume' in the context of the script's trading strategies?

-Volume is crucial in the script's trading strategies as it helps to confirm the strength of a market move. Low volume can indicate a lack of buying interest, while high volume can confirm the validity of a price movement, especially when testing support or resistance levels.

What does the script suggest about the relationship between price and volume during a 'no supply' situation?

-The script suggests that during a 'no supply' situation, the price may rise with increasing volume, indicating strong buying momentum. However, if the price attempts to rise with decreasing volume, it could be a sign of weakening momentum and a potential reversal.

How does the script differentiate between a 'demand' zone and a 'supply' zone?

-A 'demand' zone is characterized by buyers being willing to purchase at higher prices, often indicated by high volume at those levels. Conversely, a 'supply' zone is where sellers are willing to sell at lower prices, often shown by a lack of buying interest or low volume.

What is the significance of the 'candlestick' patterns mentioned in the script?

-Candlestick patterns in the script are used to identify key market behaviors. For example, a 'candlestick with small volume and large wicks' can indicate a 'clog supply' situation where buyers are unable to push the price lower, suggesting potential resistance.

How can the 'volume profile' be used in conjunction with other indicators to make trading decisions?

-The 'volume profile' can be used in conjunction with other indicators like supply and demand zones, price action, and candlestick patterns to make informed trading decisions. It helps traders to visualize the concentration of trading activity at different price levels and identify potential support and resistance areas.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführen5.0 / 5 (0 votes)