Corporate Accounting Cycle: Post-Closing Trial Balance

Summary

TLDRIn this video lesson from TLC Tutoring Company, viewers learn how to prepare a post-closing trial balance for a corporation, completing the accounting cycle. The instructor demonstrates transferring balances from the general ledger to the trial balance sheet, emphasizing that temporary accounts like revenues, expenses, and dividends are zeroed out, while permanent accounts such as assets, liabilities, and equity retain their balances. The updated retained earnings are highlighted, and the importance of verifying that debits equal credits is reinforced. The tutorial provides practical guidance, encourages hands-on practice with downloadable Excel resources, and offers tips for smooth preparation of the next accounting period.

Takeaways

- 😀 The video focuses on Step 10 of the corporate accounting cycle: preparing a post-closing trial balance.

- 😀 To prepare a post-closing trial balance, you need the general ledger and a post-closing trial balance template.

- 😀 Permanent accounts (assets, liabilities, equity) carry forward their balances to the post-closing trial balance.

- 😀 Temporary accounts (revenues, expenses, and dividends) are zeroed out during the closing process.

- 😀 Retained earnings should be updated to reflect the new balance from the financial statements.

- 😀 Each account’s balance from the ledger is transferred to the trial balance on the same side (debit or credit).

- 😀 Accumulated depreciation, accounts payable, and other credit accounts are placed on the credit side.

- 😀 The post-closing trial balance ensures that debits equal credits after closing entries are made.

- 😀 This step confirms that all temporary accounts have been properly closed and the accounting system is ready for the next period.

- 😀 Using Excel templates and workbooks can make the post-closing trial balance process easier and reduce errors.

- 😀 Consistent practice and reviewing accounting tutorials can improve understanding of the accounting cycle.

Q & A

What is the main topic of this TLC Tutoring Company accounting lesson?

-The lesson focuses on ending the accounting cycle for a corporation by preparing a post-closing trial balance.

What two main resources are mentioned as helpful for following along with the lesson?

-The Excel spreadsheet and workbook available on the TLC Tutoring Company website.

What is the purpose of a post-closing trial balance?

-Its purpose is to ensure that all temporary accounts (revenues, expenses, dividends) have been zeroed out and that permanent accounts carry forward the correct balances into the new accounting period.

Which accounts are considered temporary and should have a zero balance in a post-closing trial balance?

-Revenues, expenses, and dividends are temporary accounts and should be zeroed out.

How should the balances from the general ledger be transferred to the post-closing trial balance?

-Balances from the general ledger are copied to the trial balance exactly as they appear: debit balances go on the debit side, and credit balances go on the credit side.

What is the significance of retained earnings in the post-closing trial balance?

-Retained earnings is updated to reflect the net effect of closing temporary accounts and represents the cumulative earnings that carry forward to the next accounting period.

Can you give examples of permanent accounts mentioned in the lesson?

-Examples include cash, accounts receivable, supplies, prepaid rent, equipment, accounts payable, common stock, preferred stock, and treasury stock.

Why are the temporary accounts zeroed out during the post-closing process?

-Temporary accounts are zeroed out so that the next accounting period starts fresh, with revenues, expenses, and dividends beginning at zero.

How can someone check that the post-closing trial balance is correct?

-By ensuring that total debits equal total credits and that all temporary accounts have zero balances while permanent accounts carry the correct balances.

What practical advice does the instructor give for mastering accounting topics?

-The instructor emphasizes practicing as much as possible, exploring other available tutorials and practice problems, and using resources from the website to reinforce learning.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Jurnal Penutup, Buku besar setelah penutupan, Neraca saldo setelah penutupan | PART 3

Neng Ida Soniawati–Ekonomi XII-SMAN 1 Babakan Madang-Jurnal Penutup & Pembalik – Nov2022#pgtkjabar

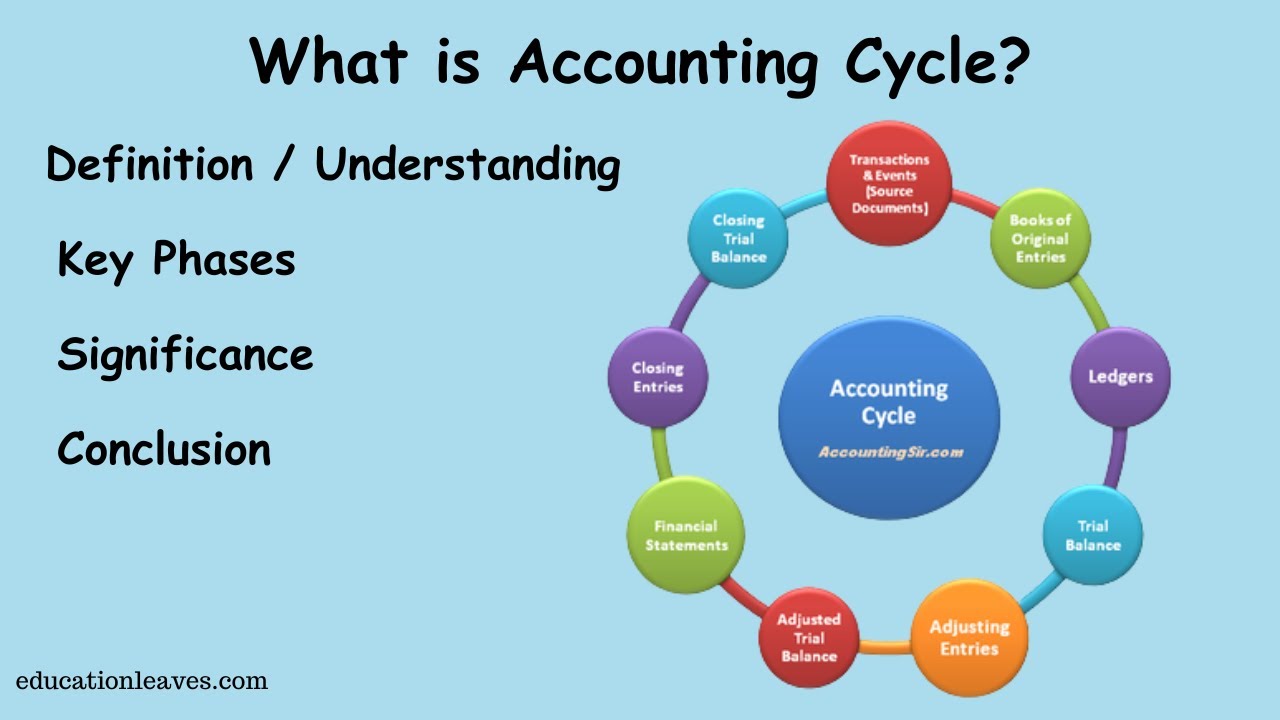

What is Accounting cycle? | Key phase, Significance of Accounting cycle

CLOSING ENTRIES: Everything You Need To Know

Accounting Cycle Step 1: Analyze Transactions

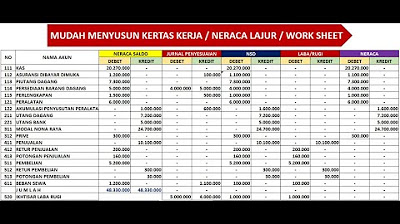

KERTAS KERJA - NERACA LAJUR - WORK SHEET - PERUSAHAAN DAGANG

5.0 / 5 (0 votes)