GE Matrix

Summary

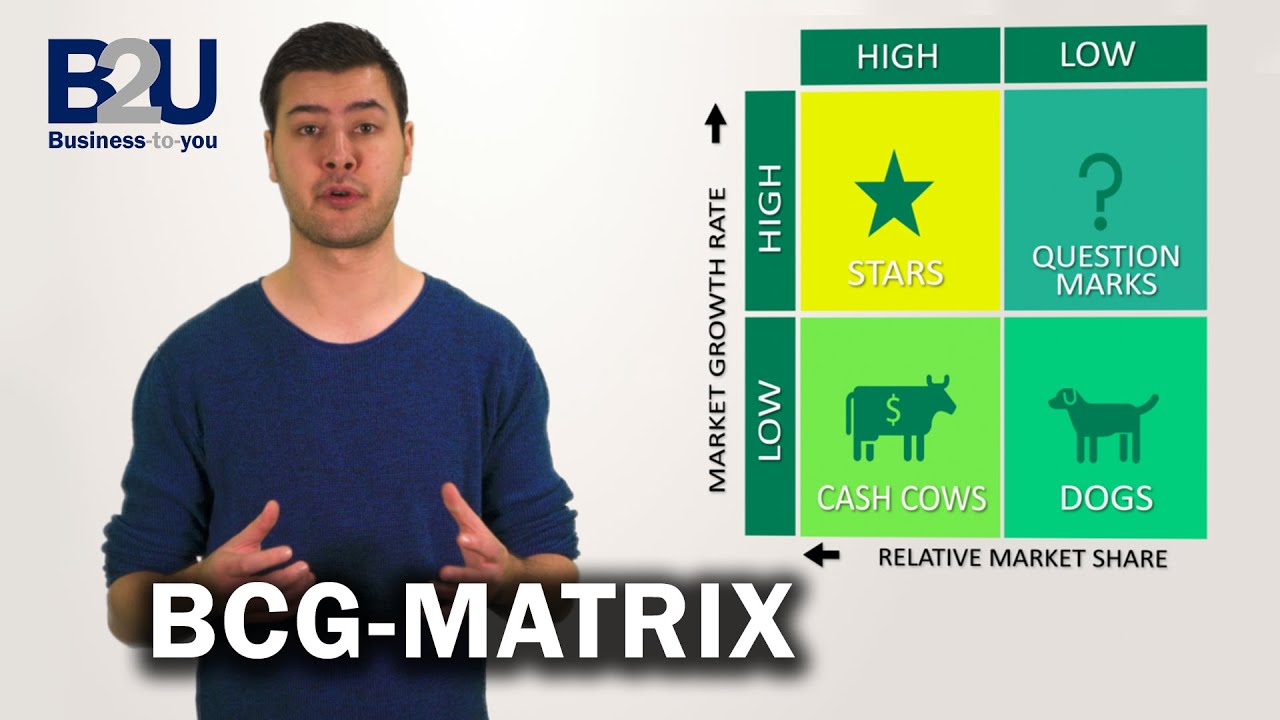

TLDRThe video explains the GE (General Electric) Matrix, a strategic management tool used for portfolio analysis. It guides companies in evaluating multiple divisions or product lines, considering factors like business strength and industry attractiveness. The matrix helps identify which business units or products to invest in, maintain, or divest. Using a three-zone approach—green for growth, yellow for selective investment, and red for harvest/divestment—companies can make informed strategic decisions. The discussion also contrasts the GE Matrix with the simpler BCG Matrix, highlighting GE Matrix's multi-factor approach for prioritizing investments and optimizing returns across various strategic business units.

Takeaways

- 😀 Portfolio analysis helps companies evaluate their various products, divisions, or business units to make strategic investment decisions.

- 😀 Strategic Business Units (SBUs) are individual divisions or products that are analyzed separately within the company’s portfolio.

- 😀 The GE Matrix (General Electric/McKinsey Matrix) is a multi-factor tool for assessing business strength and industry attractiveness.

- 😀 The X-axis of the GE Matrix represents business strength, including factors like market share, financial assets, and operational efficiency.

- 😀 The Y-axis of the GE Matrix represents industry attractiveness, including market growth, profitability, and potential opportunities.

- 😀 SBUs are positioned in the GE Matrix to determine investment strategies: green (invest/grow), yellow (selective investment), red (harvest/divest).

- 😀 The matrix provides a more nuanced approach than the BCG Matrix, which only considers market growth and relative market share.

- 😀 Portfolio analysis guides resource allocation, indicating where to invest more, maintain selectively, or withdraw resources.

- 😀 Example applications include companies like Apple, where different products and services are treated as separate SBUs in the analysis.

- 😀 Investment decisions should be revisited as market conditions and business positions change to optimize growth and profitability.

- 😀 Using a structured matrix approach allows organizations to balance risk and opportunity across multiple products and markets.

Q & A

What is the purpose of portfolio analysis in strategic management?

-Portfolio analysis helps organizations evaluate their range of products or business units (SBUs) to make informed strategic and investment decisions, including where to invest, maintain, or divest resources.

What does SBU stand for and what is its role?

-SBU stands for Strategic Business Unit. It is a division within a company with its own products, market, and strategy, allowing for focused management and resource allocation.

Can you give an example of SBUs using Apple products and services?

-Yes. Apple’s SBUs include products like iPhone, iPad, iPod, MacBook, and services like Apple Store, iTunes, and Apple Music, each considered a separate business unit for strategic analysis.

What is the difference between BCG Matrix and GE Matrix?

-The BCG Matrix focuses on market growth and relative market share using a 4-quadrant framework. The GE Matrix (General Electric Matrix) is a multi-factor 9-cell matrix that evaluates business strength and industry attractiveness, offering more detailed strategic guidance.

What factors determine industry attractiveness in the GE Matrix?

-Industry attractiveness is determined by factors such as market growth rate, market size, profitability, competitive intensity, and potential opportunities in the market.

What factors determine business strength in the GE Matrix?

-Business strength is determined by factors like market share, financial assets, product quality, technological capability, and relationships with stakeholders.

How are investment decisions guided by the GE Matrix zones?

-In the GE Matrix, products in the green zone (high attractiveness & strong business) are recommended for growth investments. Yellow zone products require selective investment, and red zone products (low attractiveness & weak position) are candidates for harvesting or divestment.

What does it mean to 'harvest' a product in the portfolio analysis context?

-Harvesting a product means reducing or withdrawing investment to maximize short-term profits while minimizing costs, typically applied to products in low attractiveness and weak business strength positions.

How should a new product in a green zone be treated according to the GE Matrix?

-A new product in the green zone should receive significant investment to expand its market presence, as it shows high industry attractiveness and strong business potential.

Why is the GE Matrix considered more detailed than the BCG Matrix?

-The GE Matrix incorporates multiple factors for both industry attractiveness and business strength, providing a nuanced 9-cell framework, unlike the BCG Matrix which uses only two factors (market growth and relative market share) in a 4-quadrant model.

What practical steps should a company take when using portfolio analysis for multiple SBUs?

-A company should categorize each SBU or product based on its market attractiveness and business strength, position it in the GE Matrix, analyze investment needs, and decide whether to invest, maintain, or divest according to the matrix zone placement.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

5.0 / 5 (0 votes)