BC te Explica #108 - O que é a política monetária do Banco Central

Summary

TLDRIn this video, Gisele from the Central Bank explains the concept of monetary policy and how it affects inflation. The Central Bank uses inflation targets to keep inflation in check, and this is achieved through setting the SELIC interest rate. By adjusting the SELIC rate, the bank can either encourage or discourage consumption. A higher SELIC rate makes loans more expensive, reducing spending and, in turn, lowering inflation. The Central Bank’s actions in managing the banking system’s resources ultimately help maintain a stable economy, contributing to sustainable growth and improving living standards.

Takeaways

- 😀 The Central Bank's main mission is to combat inflation using monetary policy.

- 😀 The National Monetary Council (CMEN) sets an inflation target for the year, considering the economic conditions of similar countries like Chile and Mexico.

- 😀 The Central Bank uses monetary policy to ensure inflation stays close to the set target.

- 😀 The SELIC rate, Brazil's basic interest rate, is set by the Central Bank's Monetary Policy Committee (COPOM) to control inflation.

- 😀 The SELIC rate affects other interest rates in the country, making money more expensive or cheaper based on its value.

- 😀 High SELIC rates result in higher interest on loans, which discourages consumption and helps control inflation.

- 😀 The Central Bank's main tool for controlling inflation is adjusting the money supply in the banking system by buying and selling government bonds.

- 😀 When there’s excess money in the banking system, the Central Bank sells government bonds to reduce this amount.

- 😀 If there's a shortage of money in the banking system, the Central Bank buys government bonds to inject liquidity.

- 😀 While the Central Bank’s actions don't directly affect individuals, they influence the banking system and, indirectly, personal finance such as loans and interest rates.

- 😀 The ultimate goal of the Central Bank’s monetary policy is to keep inflation low and stable, contributing to sustainable economic growth and improving people's living conditions.

Q & A

What is the main mission of the Central Bank?

-The main mission of the Central Bank is to combat inflation using monetary policy.

What is monetary policy?

-Monetary policy is the set of tools the Central Bank uses to control inflation and manage economic stability, including adjusting interest rates and managing the money supply.

How does the Central Bank combat inflation?

-The Central Bank combats inflation through a system called inflation targets, where it aims to keep inflation close to a predetermined target by adjusting the SELIC interest rate.

What is an inflation target?

-An inflation target is a specific inflation rate set by the National Monetary Council (CMN) for a given year, based on factors like inflation in similar economies (e.g., Chile, Mexico).

What is the SELIC rate?

-The SELIC rate is the basic interest rate in Brazil's economy, determined by the Central Bank's Monetary Policy Committee (COPOM), and it affects other interest rates in the economy.

How does the SELIC rate affect daily life?

-A high SELIC rate makes loans more expensive, which discourages borrowing and consumption, leading to a reduction in inflation. For example, higher interest rates may make it harder to afford purchases like cars or household appliances.

What is the role of COPOM in setting the SELIC rate?

-COPOM (Monetary Policy Committee) is responsible for defining the SELIC rate that is necessary to keep inflation within the target set by the Central Bank.

How does the Central Bank manage the money supply in the banking system?

-The Central Bank manages the money supply by buying or selling government bonds. If there is too much money in the system, it sells bonds to reduce the supply; if there is too little money, it buys bonds to inject more money into the system.

How does the Central Bank's monetary policy influence the banking system?

-The Central Bank's actions impact the banking system by affecting the available resources for banks. If a bank lacks money, it may pay higher interest rates to acquire resources, which influences the basic interest rate and makes it harder to keep inflation under control.

Why is controlling inflation important for economic growth?

-Controlling inflation ensures stable prices, which contributes to sustainable economic growth and improves the population's living conditions by maintaining purchasing power and reducing uncertainty in the economy.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Mengenal Kebijakan Moneter Bank Indonesia

KEBIJAKAN MONETER - PEMBAHASAN SOAL EKONOMI KELAS 11 | Edcent.id

Mengapa Bank Indonesia Tidak Di Bawah Pemerintah?

What is the purpose of the central banks? (May 2013)

Kebijakan Moneter dan Fiskal - Ekonomi SMA Kelas 11 - Digidik Bimbel Online Gratis

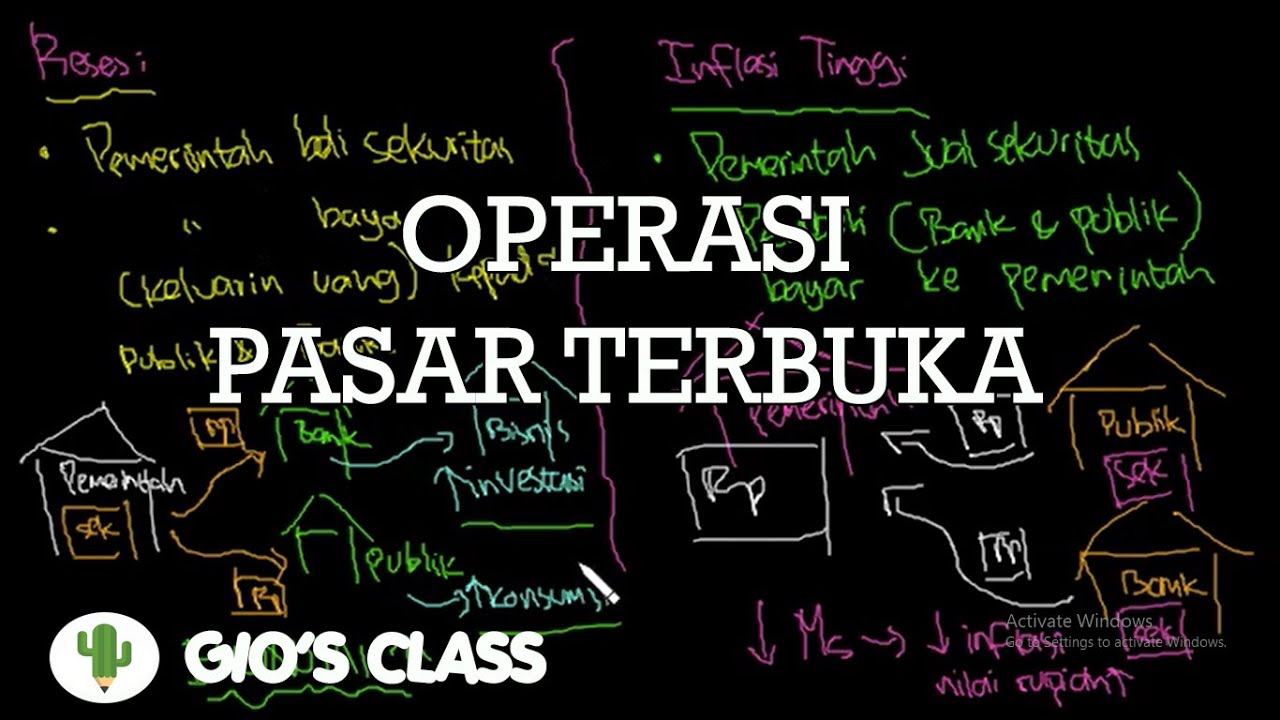

Operasi Pasar Terbuka

5.0 / 5 (0 votes)