Secret Way To Identify High Probability Market Structure Shifts..

Summary

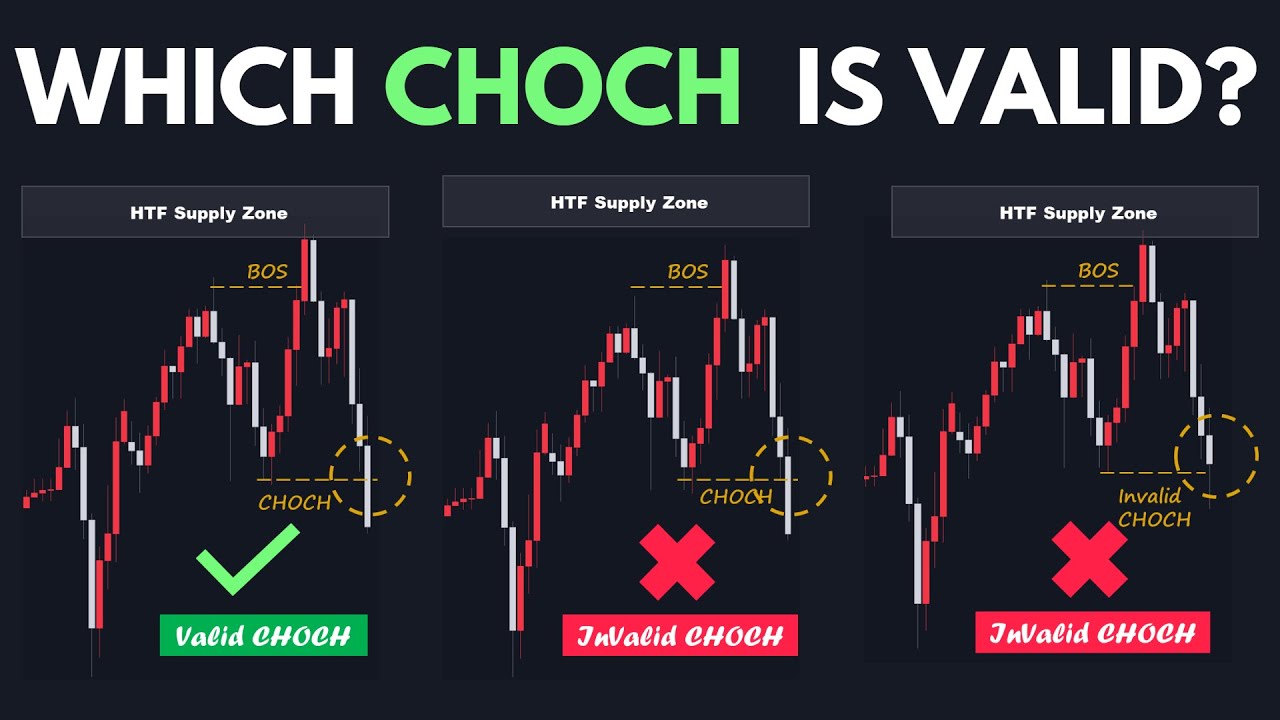

TLDRIn this video, Fez explains how to identify high-probability market structure shifts (also referred to as changes of character). He covers the key differences between liquidity sweeps and market structure shifts, demonstrating how to recognize them on various timeframes. Fez emphasizes using trend analysis, liquidity levels, and fair value gaps to spot these shifts effectively. He shares practical examples, illustrating how traders can make informed entries based on these shifts, offering strategies for both bullish and bearish market conditions. The video is aimed at helping traders improve their technical analysis skills.

Takeaways

- 😀 Understand the difference between a liquidity sweep and a market structure shift (CHoC). Liquidity sweeps clear out liquidity levels but don’t necessarily signal a trend reversal, while market structure shifts indicate a change in the trend direction.

- 😀 Look at the trend first: Identify whether the market is bullish or bearish to help determine if you’re seeing a liquidity sweep or a true market structure shift.

- 😀 Use higher time frames (like the daily chart) to identify significant highs and lows to spot market structure shifts more accurately.

- 😀 High probability market structure shifts happen when price breaks structure after filling a fair value gap (bullish or bearish). Wait for these breaks to confirm a shift before entering trades.

- 😀 In a bullish market structure shift, look for a higher high, a higher low that fills a bullish fair value gap, and then a break of structure to the upside.

- 😀 In a bearish market structure shift, look for a lower low, a lower high that fills a bearish fair value gap, and then a break of structure to the downside.

- 😀 An alternative method to identify market structure shifts is to wait for a fair value gap after a liquidity sweep without immediate structure breaks. Price reacts to the gap, and you enter once the structure breaks.

- 😀 The fair value gap model emphasizes entering trades after price reacts to these gaps and breaks the structure, not just waiting for the break of highs or lows.

- 😀 Always verify that the liquidity sweep occurred on a higher time frame, and assess the context to avoid mistaking it for a market structure shift.

- 😀 For high-probability market structure shifts, ensure that after the liquidity sweep, price fills the fair value gap, breaks structure, and leaves a new gap before entering trades.

- 😀 To successfully execute trades, focus on following the trend, identify liquidity levels, and trade with the trend to increase the likelihood of profitability.

Q & A

What is the difference between a liquidity sweep and a market structure shift?

-A liquidity sweep refers to the action of price moving through a liquidity level, such as a high or low, without fundamentally altering the market structure. In contrast, a market structure shift (or change of character) occurs when there is a clear break in the trend, often characterized by the price breaking significant highs or lows, indicating a potential reversal.

How can you identify a liquidity sweep?

-To identify a liquidity sweep, you first need to observe the overall market trend. If the trend is bullish and price sweeps a liquidity level (e.g., a high or low), it could be considered a liquidity sweep rather than a market structure shift. Analyzing the trend direction helps distinguish between a simple sweep and a more significant structural change.

What role does the higher time frame play in identifying market structure shifts?

-Higher time frames, such as the daily time frame, help to identify significant highs and lows, which can be crucial in confirming a market structure shift. If price takes out liquidity on a higher time frame and then shows a shift in structure on a smaller time frame, it can be considered a high-probability market structure shift.

What is the significance of fair value gaps in identifying market structure shifts?

-Fair value gaps are important because they represent areas where price has moved quickly, leaving behind a gap in the market. When price revisits and fills these gaps, it can signify a shift in market structure, either bullish or bearish, depending on the direction and context of the price action.

How does a liquidity sweep differ from a market structure shift when using a bullish trend as an example?

-In a bullish trend, a liquidity sweep would occur when price moves through a high or low to capture liquidity, without reversing the trend. In contrast, a market structure shift would occur when price breaks significant highs or lows, suggesting a reversal or change in trend direction.

How can you confirm a market structure shift on a smaller time frame?

-To confirm a market structure shift on a smaller time frame, you look for the price breaking significant structures (like highs or lows) that were previously marked on a higher time frame, often after a liquidity sweep or a fill of a fair value gap.

What does the term 'fair value gap' mean in the context of market structure shifts?

-A fair value gap refers to a price gap that occurs when price moves rapidly, leaving an imbalance. These gaps represent areas where price might return to fill, which can then signal potential market shifts when they are revisited and filled.

What is the key factor in determining whether a market structure shift is high-probability?

-A high-probability market structure shift occurs when price fills a fair value gap, sweeps liquidity, and then breaks the structure (high or low) that was previously formed. The combination of these elements confirms a strong likelihood of a trend reversal or continuation.

Can you trade without waiting for a break of structure? If so, how?

-Yes, it is possible to trade without waiting for a break of structure by observing the creation of fair value gaps. After a liquidity sweep, a price reaction that fills a fair value gap can also indicate a market structure shift, even without breaking the high or low directly.

What is the recommended approach to setting stop losses when trading market structure shifts?

-When trading market structure shifts, a common approach is to place the stop loss just below or above the most recent market structure (such as the fair value gap or liquidity level). This helps to protect the trade from false signals while maintaining a favorable risk-to-reward ratio.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

The 3 Types of ICT MSS/CHoCH Everyone Should Know [High Probability]

What A HIGH PROBABILITY Market Structure Shift Looks Like!

Advanced Market Structure Course (step by step) SMC

How To Easily Identify a Fake CHOCH

How To Predict The ICT Market Maker Model LIVE

Change of Character Simplified - Smart Money Course

5.0 / 5 (0 votes)