FINANCE MAJOR(BANKING) MOST IMPORTANT TOPICS |GAUHATI UNIVERSITY|CORE PAPER| B.Com 3RD SemesterFYUGP

Summary

TLDRThis video provides a comprehensive overview of key banking and finance concepts, focusing on critical RBI regulations, asset classifications, and risk management. Topics include Corporate Governance Measures, Prudential Norms, Non-Performing Assets (NPA), Basel I, II, III differences, and Capital Adequacy Ratios (CAR). The video is designed to help students prepare for banking exams, offering useful guidelines on income recognition and various types of financial risks. The presenter emphasizes the importance of understanding these concepts thoroughly and encourages viewers to subscribe, like, and share the content to help others in their exam preparation.

Takeaways

- 😀 Understanding RBI's corporate governance measures is essential for exams and practical finance discussions.

- 😀 Prudential norms are crucial for maintaining financial stability and health in banking institutions.

- 😀 Knowing the meaning and classification of Non-Performing Assets (NPAs) is vital for finance and banking exams.

- 😀 The concept of 'Out of Order' accounts should be studied, as it is relevant in banking operations.

- 😀 Income recognition guidelines, as well as RBI's asset classification rules, must be thoroughly understood.

- 😀 Familiarize yourself with the differences between Basel I, Basel II, and Basel III, which regulate capital adequacy and risk management.

- 😀 The Capital to Risk-Weighted Assets Ratio (CRAR) is a key metric for assessing a bank's financial strength and stability.

- 😀 Different types of financial risks—credit risk, market risk, and operational risk—should be understood in depth for banking exams.

- 😀 Study the development and guidelines related to the Basel Committee's capital adequacy framework.

- 😀 Make sure to understand the meaning of Tier 1 and Tier 2 capital in the context of banking regulations.

- 😀 The speaker encourages engagement with online resources and supports the channel for further learning and exam preparation.

Q & A

What is the significance of corporate governance measures taken by RBI?

-Corporate governance measures by RBI are crucial for ensuring transparency, accountability, and sound management practices in the banking sector. These measures help maintain the integrity and stability of financial institutions.

What is the meaning of Prudential Norms in banking?

-Prudential norms are a set of guidelines and regulations issued by RBI to ensure the financial soundness of banks. These norms help mitigate risks and promote the overall health of the banking system.

What does NPA (Non-Performing Asset) mean?

-An NPA refers to loans or advances that are in default or in arrears, typically when a borrower fails to repay the loan or interest for a specified period, generally 90 days or more.

What is the definition of an Out-of-Order account?

-An Out-of-Order account is one where the account balance remains continuously below the minimum level required or where a significant portion of the credit facilities have not been serviced for a long period.

What is income recognition in banking, and why is it important?

-Income recognition refers to the guidelines set by RBI for recognizing and recording income earned by banks, especially in cases of interest, fees, and other financial transactions. Proper income recognition ensures that banks report their earnings accurately and consistently.

What are the different types of bank assets, and how does asset classification work?

-Bank assets are classified into categories such as performing and non-performing, based on the borrower's repayment capacity. RBI's asset classification guidelines help banks categorize their loans into standard, substandard, doubtful, and loss assets to assess risk and provisions.

What are Capital Adequacy Norms, and why are they important?

-Capital Adequacy Norms refer to the regulations that determine the minimum capital that banks must hold to absorb potential losses. These norms are important to ensure that banks have sufficient capital buffers to withstand financial crises and ensure solvency.

What is the difference between Basel I, Basel II, and Basel III?

-Basel I, Basel II, and Basel III are international regulatory frameworks developed by the Basel Committee on Banking Supervision to set minimum capital requirements for banks. Basel I primarily focused on credit risk, Basel II introduced operational and market risks, and Basel III strengthened the framework with stricter capital and liquidity requirements.

What is the meaning of Capital to Risk-Weighted Assets Ratio (CRAR) and its significance?

-The Capital to Risk-Weighted Assets Ratio (CRAR) is a measure of a bank’s capital adequacy, calculated by dividing the bank’s capital by its risk-weighted assets. A higher CRAR indicates a stronger financial position and better capacity to absorb risks.

What are Tier 1 and Tier 2 capital in banking?

-Tier 1 capital consists of a bank's core capital, including equity capital and disclosed reserves. Tier 2 capital includes supplementary capital such as subordinated debt, hybrid instruments, and revaluation reserves. These capital categories help banks absorb losses and maintain financial stability.

What are the different types of risks faced by banks, and how are they categorized?

-Banks face various risks such as credit risk, market risk, and operational risk. Credit risk arises from the possibility of a borrower defaulting, market risk involves fluctuations in financial markets, and operational risk refers to losses due to failed internal processes or external events. Proper risk management is essential for maintaining financial stability.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Management of Commercial Banking

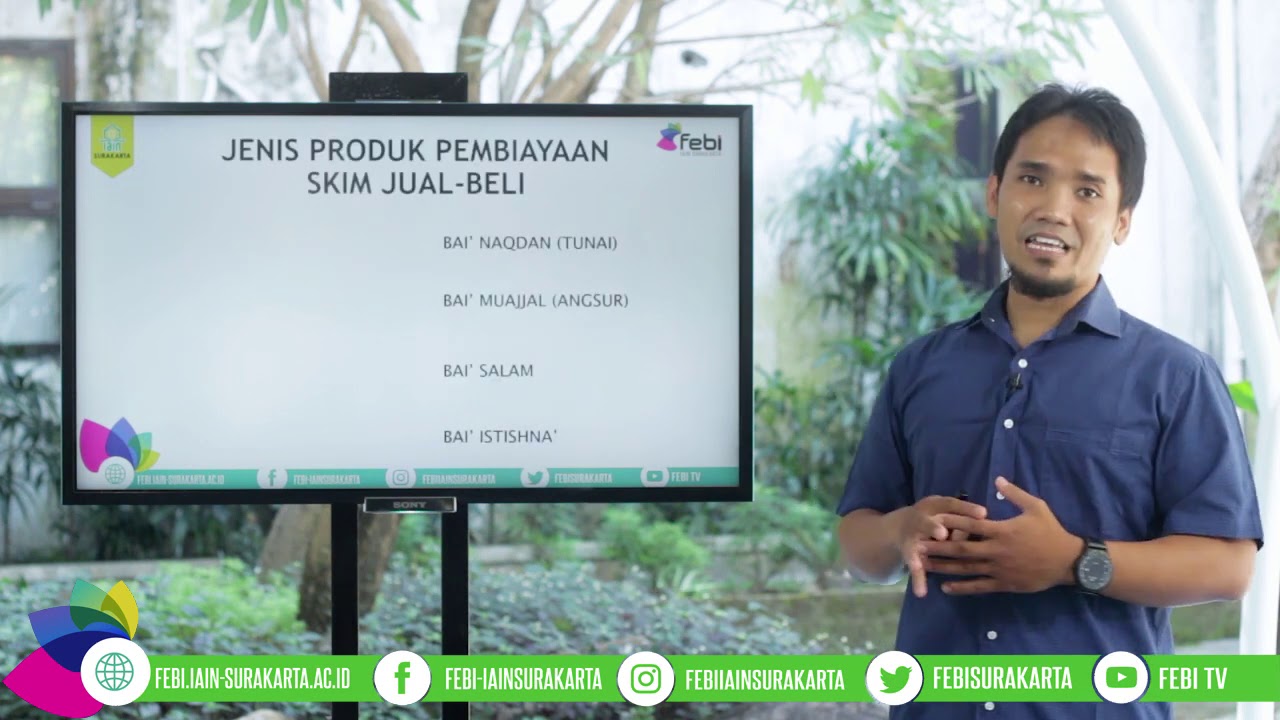

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

What is Asset management? Importance of Asset management | Asset management softwares.

materi Lembaga jasa Keuangan Kelas 10 Pertemuan 1

Manajemen Keuangan Bab 1 Prinsip-Prinsip Manajemen Keuangan

Banking Law Part 1 The Concept

5.0 / 5 (0 votes)