How To Build Wealth For Beginners

Summary

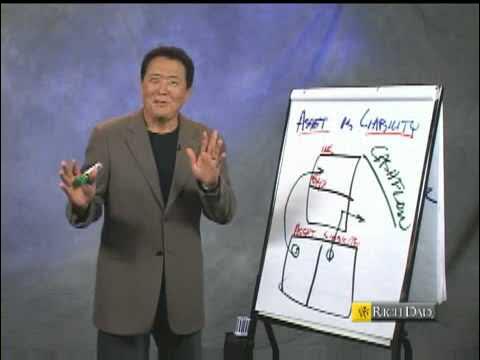

TLDRIn this video, the speaker discusses the fundamentals of wealth creation, emphasizing the importance of generating cash flow through assets rather than merely accumulating money. He highlights the significance of life insurance for wealth perpetuation and stresses the need for delayed gratification and long-term planning. The speaker also defines true wealth as the ability to create value for others, not just having money. Additionally, the video advocates for teaching financial literacy to the next generation to ensure that wealth is preserved and passed down. The overall message encourages thoughtful financial preparation and sustainable wealth-building strategies.

Takeaways

- 😀 **Wealth is not just about money** – It’s about your ability to create value for others. True wealth comes from generating value, not from accumulating money.

- 😀 **Cash flow is key to wealth building** – Focus on building income-producing assets that generate cash flow, not just saving money or accumulating assets that don’t yield income.

- 😀 **Delayed gratification is essential** – Wealthy people understand the importance of investing in assets that will pay off in the future, even if the rewards aren’t immediate.

- 😀 **Life insurance is a tool for wealth perpetuation** – Life insurance isn’t just for income replacement; it helps pass on wealth to future generations without it being taxed.

- 😀 **Financial literacy is crucial for your heirs** – It’s not enough to accumulate wealth; you must also teach your children financial literacy so they can maintain and grow the wealth after you're gone.

- 😀 **Generational wealth requires planning** – Planning for the future means creating a financial strategy that extends beyond your lifetime, using tools like life insurance and income-producing assets.

- 😀 **Wealth is about choices** – Having life insurance allows your family the choice to grieve without the pressure of financial distress, giving them the freedom to focus on healing.

- 😀 **Don’t avoid thinking about death** – It’s important to recognize that everyone will eventually pass, and planning for that inevitability with life insurance ensures your wealth is protected.

- 😀 **Assets, not liabilities, are the foundation of wealth** – Avoid using your money to buy things that don’t create additional wealth. Invest in assets that produce long-term value.

- 😀 **Building wealth requires sacrifice** – Sometimes, it means working hard now and delaying instant gratification in order to accumulate assets that will generate passive income in the future.

Q & A

What is the core difference between wealth and money according to the speaker?

-The core difference is that wealth is not about how much money you have. Wealth is defined as your ability to create value for others, while money is simply a medium of exchange that can accumulate over time. True wealth is the ability to generate income and assets that provide value beyond yourself.

Why does the speaker emphasize life insurance as an important tool for building wealth?

-Life insurance is emphasized because it can serve as a tool for wealth perpetuation. It provides a tax-free death benefit, allowing wealth to pass on to future generations without the financial burden of taxes, ensuring that the wealth you've built continues even after you die.

What role does life insurance play in the financial stability of a family during difficult times?

-Life insurance allows a family to avoid the immediate financial burdens caused by the death of a loved one. It provides financial stability, allowing family members the time and space to grieve without the stress of having to immediately return to work or deal with financial hardships.

How does the speaker differentiate between middle-class and wealthy people's approach to finances?

-The speaker explains that middle-class individuals focus on good credit and borrowing money to pay off liabilities, while wealthy people focus on generating assets that produce passive income. Wealthy individuals prioritize building a portfolio of assets that create continuous cash flow.

What is the 'Income Producing Assets (IPA) Window' mentioned by the speaker, and why is it critical to wealth-building?

-The 'Income Producing Assets (IPA) Window' refers to the investments or assets that generate income over time. This is critical to wealth-building because, unlike liabilities, these assets produce a continuous cash flow, which is necessary for long-term financial success and wealth accumulation.

What does the speaker mean by 'delayed gratification' in the context of wealth creation?

-Delayed gratification refers to the ability to resist immediate pleasures or desires in order to focus on long-term financial goals. It involves making sacrifices now, such as investing in assets or foregoing luxuries, in order to build a more secure financial future.

Why does the speaker mention the need to raise financially literate children?

-The speaker stresses the importance of teaching financial literacy to children because it ensures that future generations will know how to manage, protect, and grow the wealth that has been accumulated. Without financial knowledge, wealth can be easily squandered.

How does the speaker define 'true wealth'?

-True wealth is defined as the ability to create value for others. It's not about hoarding money or accumulating assets, but about being able to provide something of worth to others, which in turn generates wealth over time.

What is the importance of setting up your life with clear financial priorities, according to the speaker?

-Setting up your life with clear financial priorities ensures that you take systematic actions to build and preserve wealth. Prioritizing steps like acquiring life insurance and investing in income-producing assets lays the foundation for financial stability and long-term wealth.

What does the speaker mean by 'cash perpetuation'?

-Cash perpetuation refers to the idea of creating systems that allow wealth to continue generating income even after you have passed away. This can include life insurance policies, investments, and other assets that maintain their value and income potential for future generations.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

The BIGGEST Lie About Money They Don’t Want You to Know

Robert Kiyosaki - Assets vs Liabilities

PAYDAY HACK: Do This With Your Next Paycheck to Build Wealth (Step-By-Step)

Grant Cardone's Top Rules for Getting Rich

8 Assets That Make People Rich and Never Work Again - Financial Freedom, Passive Income, Cash Flow

How to Buy Anything Without Touching Your Savings

5.0 / 5 (0 votes)