Session 12: Estimating Hurdle Rates - Debt & its Cost

Summary

TLDRIn this session of a corporate finance class, the focus is on understanding the second method of financing—debt. The speaker defines debt, explains the components of debt, and discusses its cost. Key aspects include contractual payment obligations, tax-deductibility, and potential loss of control if obligations are not met. The speaker also covers how to estimate the cost of debt using a risk-free rate and default spreads, using examples of companies with different credit ratings. The session further explores how to calculate after-tax cost of debt and its role in determining the cost of capital.

Takeaways

- 😀 Debt is one of the two main components of capital financing, alongside equity, and understanding it is crucial for calculating the cost of capital.

- 😀 Debt is defined by three key characteristics: contractual payment obligation, tax-deductible payments, and loss of control in case of default.

- 😀 Not all liabilities are classified as debt. For example, accounts payable and supplier credit are not considered debt unless they explicitly carry an interest cost.

- 😀 Lease commitments, even if they are not classified as debt by accountants, should be treated as debt because they involve contractual obligations and are often tax-deductible.

- 😀 The cost of debt is the long-term borrowing rate a company faces today, not just the current short-term rate.

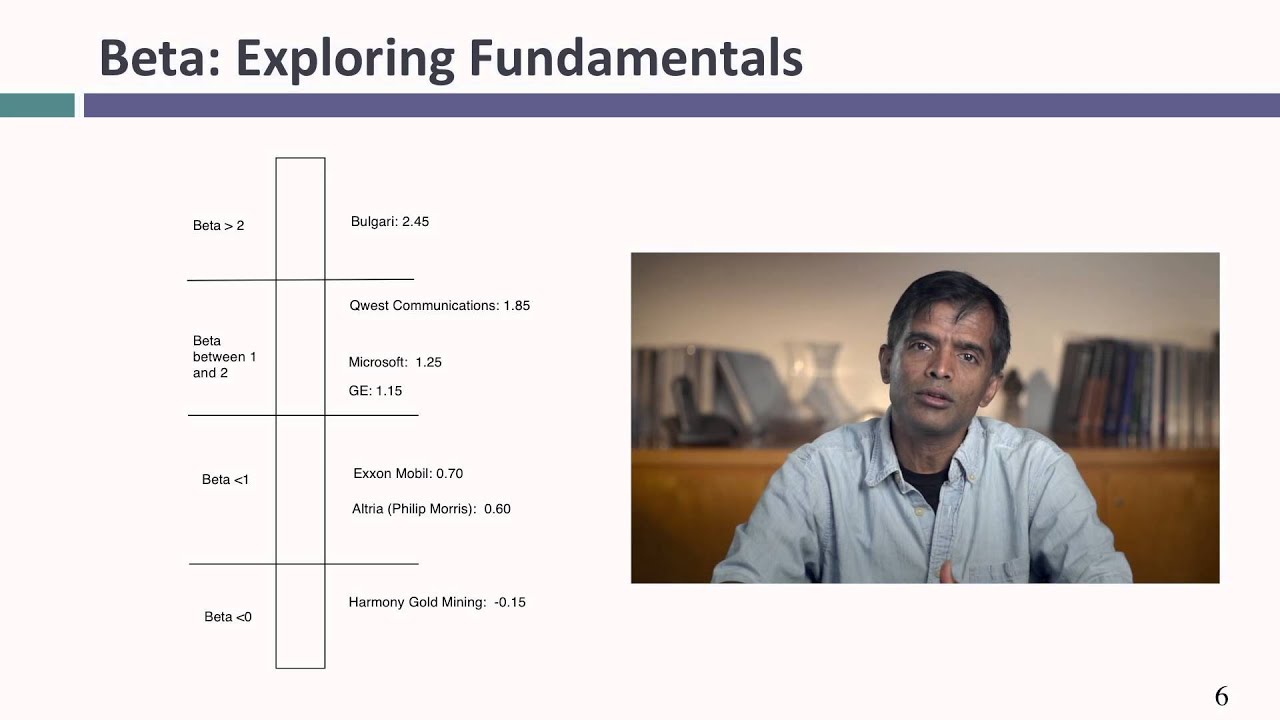

- 😀 The cost of debt consists of two components: the risk-free rate and a default spread based on the company's credit risk.

- 😀 Ratings agencies, like S&P and Moody's, help in determining the default spread, but if a company lacks a rating, an interest coverage ratio can be used to estimate it.

- 😀 The interest coverage ratio is a simple but effective measure of a company’s ability to pay interest, and it can be used to estimate synthetic ratings for non-rated companies.

- 😀 When estimating cost of debt, it's important to use the same currency for both the cost of debt and the cost of equity, ensuring consistency.

- 😀 The after-tax cost of debt is calculated by applying the marginal tax rate to the pre-tax cost of debt, as interest payments are generally tax-deductible.

- 😀 Country risk is important when calculating the cost of debt, as companies in emerging markets face both company-specific and country-specific default risks.

Q & A

What is the primary objective of this session in the corporate finance class?

-The primary objective of this session is to lay the foundations for understanding debt as a source of financing, to define debt, and to attach a cost to it in order to ultimately calculate the cost of capital.

What are the three characteristics that define debt according to the speaker?

-The three characteristics that define debt are: 1) A contractual commitment to make payments (interest and principal), 2) The tax-deductibility of those payments, and 3) The risk of losing control of the firm if the payments are not made.

How does the speaker differentiate debt from equity in terms of payment obligations?

-Debt is distinguished from equity because, with debt, there is a contractual obligation to make interest and principal payments. In contrast, equity holders are not contractually obligated to receive dividends.

What items on a balance sheet may be tricky to classify as debt, and why?

-Accounts payable and supplier credit are tricky to classify as debt because they do not explicitly involve interest expenses. However, if a company incurs implicit interest costs, like discounts lost for early payment, then those items can be considered debt.

How does the speaker suggest handling lease commitments in relation to debt?

-The speaker suggests treating lease commitments as debt, as they involve contractual payments that are typically tax-deductible and can lead to bankruptcy if not honored.

What is the speaker’s approach to calculating the cost of debt, particularly for long-term debt?

-The cost of debt is calculated as the long-term rate at which a company can borrow today, factoring in the risk-free rate and the company’s default spread, which reflects the credit risk associated with the company.

Why does the speaker use the long-term cost of debt even for short-term debt?

-The long-term cost of debt is used as a proxy because it reflects the rate at which the company can borrow in the future, which ensures that investments will be able to cover the rolled-over cost of debt, not just the immediate cost.

How are default spreads used in estimating the cost of debt, and what role do ratings agencies play?

-Default spreads are added to the risk-free rate to reflect the credit risk of a company. Ratings agencies like S&P and Moody’s provide ratings, which can be used to determine the appropriate default spread for a company.

What is the purpose of using the interest coverage ratio when a company lacks a credit rating?

-The interest coverage ratio, which measures the safety margin a company has to cover its interest expenses, is used to estimate the company’s credit rating when no official rating is available.

What is the significance of the after-tax cost of debt in financial calculations?

-The after-tax cost of debt is important because interest payments are tax-deductible. The effective cost of debt is reduced by the tax benefit, and the after-tax rate reflects the true cost of borrowing for the company.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Session 1: Corporate Finance: What is it?

Presupuesto de Capital

Session 13: Estimating Hurdle Rates- Financing Weights & Cost of Capital

Session 6: Estimating Hurdle Rates - Equity Risk Premiums - Historical & Survey

Session 9: Estimating Hurdle Rates - Betas and Fundamentals

Corporate Finance Laws and Regulations: Module 1 of 5

5.0 / 5 (0 votes)