What Is Money and How Does It Work?

Summary

TLDRIn this informative video, Marco from Whiteboard Finance explores the nature of money, its functions, and its evolution. He highlights three primary functions of money: as a store of value, a unit of account, and a medium of exchange. The discussion then transitions to the types of money, tracing the shift from commodity and representative money to fiat currency, which relies on government trust. Marco concludes by outlining six key characteristics of effective money: durability, portability, divisibility, uniformity, limited supply, and acceptability. This engaging overview encourages viewers to think critically about the role of money in their lives.

Takeaways

- 😀 Money is defined as a medium of exchange that has evolved over time from commodities to fiat currency.

- 💰 The three primary functions of money are: as a store of value, a unit of account, and a medium of exchange.

- 📈 As a store of value, money retains its worth over time, allowing individuals to save rather than spend immediately.

- 📏 Money acts as a unit of account, providing a common measure to compare the value of various goods and services.

- 🔄 The medium of exchange function allows for the facilitation of trade, enabling commerce and transactions.

- ⚖️ Historically, money has taken many forms, including salt, seashells, and cattle, reflecting its evolution.

- 🔑 Representative money was introduced as a certificate or token exchangeable for a commodity, leading to the creation of fiat money.

- 🏦 Fiat money relies on government trust rather than a physical commodity, making it susceptible to inflation.

- 🪙 Key characteristics of money include durability, portability, divisibility, uniformity, limited supply, and acceptability.

- 📊 Understanding the nature and characteristics of money is essential for effective personal finance management.

Q & A

What are the three primary functions of money discussed in the video?

-The three primary functions of money are: 1) Store of value - it retains its value over time. 2) Unit of account - it provides a common measure for valuing goods and services. 3) Medium of exchange - it facilitates trade and commerce.

How does money serve as a store of value?

-Money serves as a store of value because it allows individuals to save their earnings and use them later without losing value, unlike perishable goods.

What does the term 'unit of account' mean in relation to money?

-Unit of account means that money acts as a measuring stick for assigning value to goods and services, making it easier to compare prices.

What is meant by money being a medium of exchange?

-Money as a medium of exchange means it is widely accepted for transactions, allowing people to trade goods and services without bartering.

What historical examples of money are mentioned in the video?

-Historical examples of money mentioned include salt, seashells, bartering goods, and commodities like gold and silver.

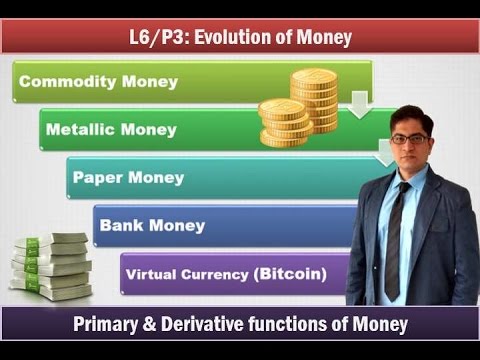

What is the difference between commodity money and representative money?

-Commodity money is based on a physical item with intrinsic value, like gold or silver, while representative money is a token or certificate that represents a claim to a commodity's value.

What is fiat money, and how did it come to be used?

-Fiat money is currency that has no intrinsic value and is not backed by physical commodities. It is accepted because of government decree, which was established when the U.S. abandoned the gold standard in 1971.

What are the six characteristics of money discussed in the video?

-The six characteristics of money are durability, portability, divisibility, uniformity, limited supply, and acceptability.

Why is durability important for money?

-Durability is important because money must withstand physical wear and tear to remain in circulation over time, unlike perishable items.

How does limited supply affect the value of money?

-Limited supply helps maintain the value of money because if it can be produced easily, it may lead to inflation, reducing its purchasing power.

What conclusion does Marco draw about understanding money?

-Marco emphasizes that understanding money's characteristics and functions is crucial for mastering personal finance and building wealth.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Commercial Real Estate For Beginners | Step By Step Tutorial

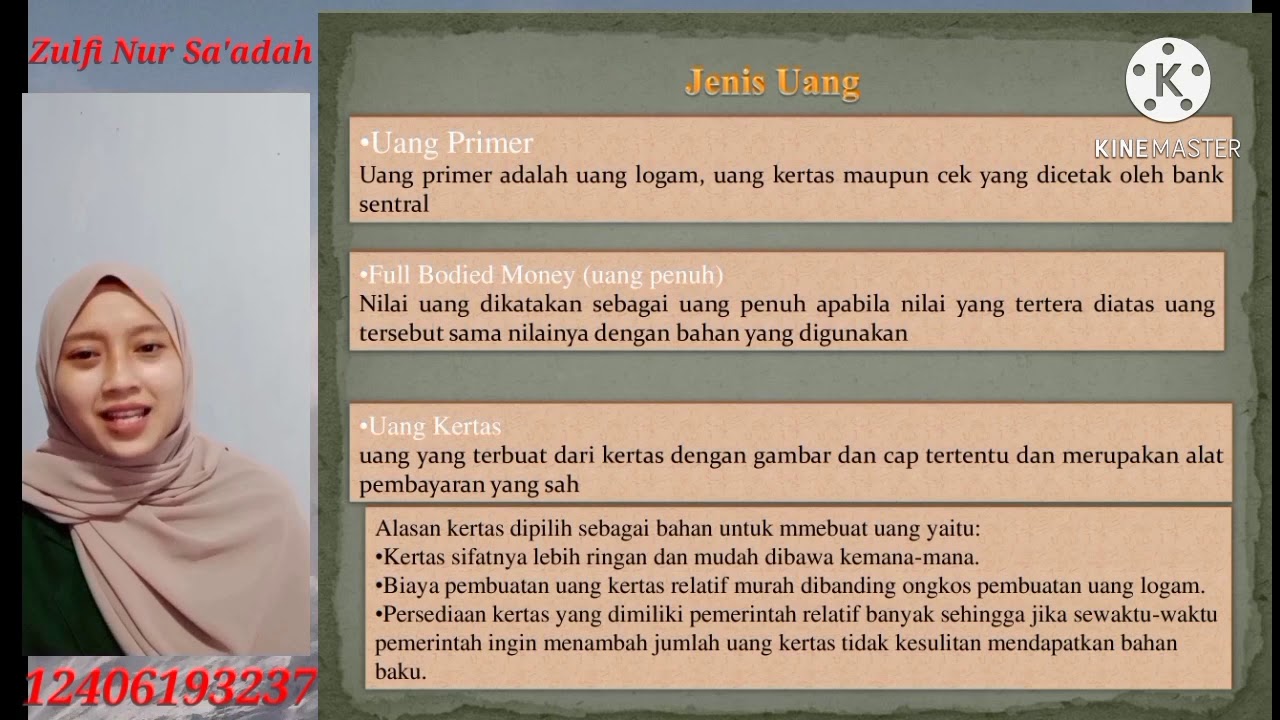

1a Teori Dasar Uang

KONSEP UANG DALAM PERSPEKTIF ISLAM || TUGAS UTS || MANAJEMEN KEUANGAN SYARIAH 3F || IAIN TULUNGAGUNG

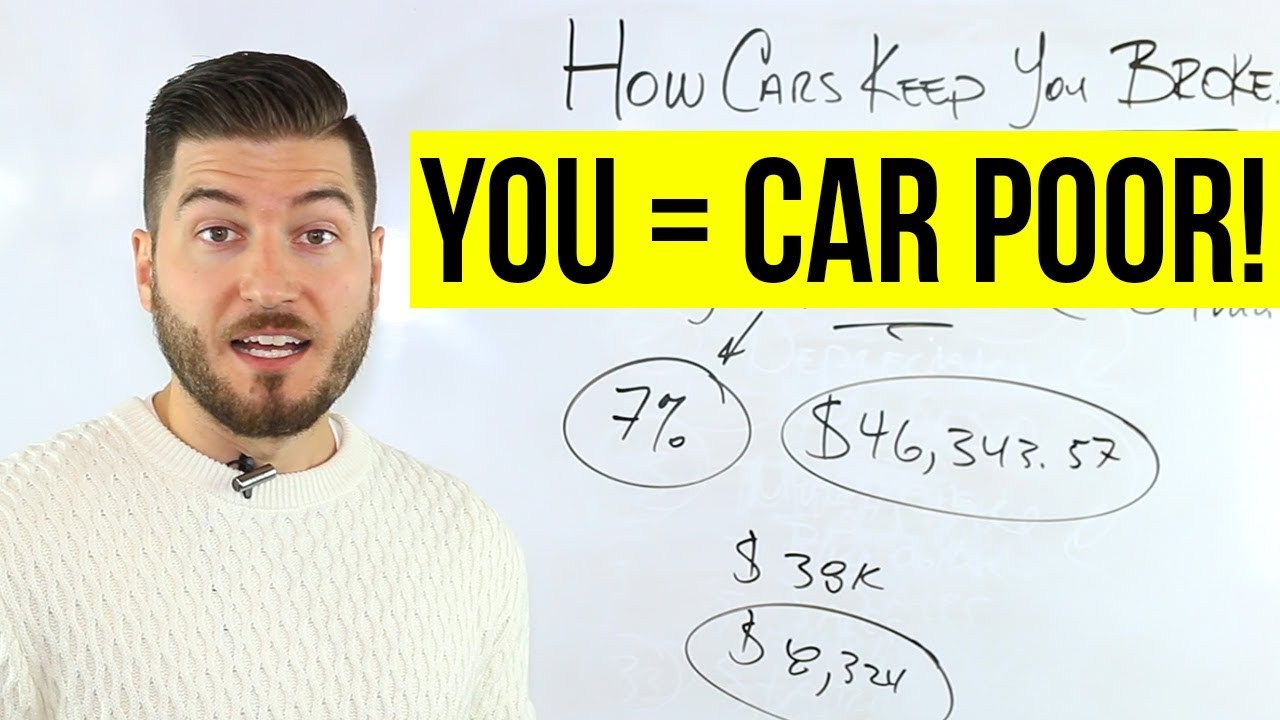

How Cars Keep You BROKE! (The Truth)

Introduction to Treasury Management Process

L3/P7: Money- Evolution, Types and functions

5.0 / 5 (0 votes)