Hurricane Helene expected to be one of the costliest storms in U.S. history

Summary

TLDRHurricane Helene has wreaked havoc across the Southeast, with estimated property damages ranging from $15 billion to $26 billion and potential total losses reaching up to $110 billion, marking it as one of the most costly storms in U.S. history. While insured losses are projected between $5 billion and $8 billion, many affected homeowners lack flood insurance, leaving them vulnerable. FEMA provides emergency grants, but these do not replace comprehensive insurance coverage. Freedlander highlights that standard insurance policies cover wind damage, but flood damage requires specific flood insurance, which only about 6% of homeowners possess.

Takeaways

- 🏚️ Hurricane Helene caused significant destruction in the Southeast, leading to costly rebuilding efforts.

- 💰 Moody's Analytics estimates the storm will result in $15 to $26 billion in property damage.

- 📊 An actuary suggests the overall loss could reach up to $110 billion, making it one of the most expensive storms in U.S. history.

- 📋 Homeowners will rush to file claims after the storm, presenting challenges for insurance companies.

- 🔍 The expected insured losses from Helene are estimated between $5 billion to $8 billion, which is relatively low for a Category 4 hurricane.

- 📉 In comparison, Hurricane Ian caused about $50 billion in insured losses, highlighting the differences in impact.

- 🌊 The broader $110 billion figure includes economic impacts, while the $5 to $8 billion focuses on insured losses.

- 🚫 Many losses, particularly flood damages in regions like Southern Appalachia and parts of Georgia, are not covered by standard insurance policies.

- 💧 Only about 6% of U.S. homeowners have flood insurance, with even lower coverage rates in severely affected areas.

- 🤝 FEMA offers emergency grants for disaster recovery, but these grants do not replace the need for insurance coverage.

Q & A

What is the estimated range of property damage caused by Hurricane Helene?

-Moody's Analytics predicts the storm will cause between $15 billion and $26 billion in property damage.

How does the potential loss from Hurricane Helene compare to other storms?

-The loss could cost up to $110 billion, making Helene one of the most expensive storms in U.S. history, compared to Hurricane Ian's estimated $50 billion insured loss.

What is the expected insured loss range for private insurers due to Hurricane Helene?

-Catastrophe modelers indicate the insured loss for private insurers will be between $5 billion and $8 billion.

Why is there a discrepancy between the total estimated loss and the insured loss?

-The total loss includes economic impacts and flood losses that are not covered by insurance, particularly in areas with low flood insurance take-up rates.

What percentage of homeowners in affected areas have flood insurance?

-The average take-up rate for flood insurance in the impacted areas is under 1%, with about 6% of U.S. homeowners having flood policies overall.

What kind of assistance does FEMA provide for flood losses?

-FEMA offers an emergency grant program that individuals and families can apply for, but it is not a replacement for insurance and typically provides only a small amount to help with initial recovery.

What is the difference in coverage between flood damage and wind damage?

-Wind damage is covered by standard homeowners, renters, or condo insurance policies, while flood damage or storm surge is only covered by flood insurance.

What can homeowners do if they suffer losses from flood damage without insurance?

-Unfortunately, homeowners without flood insurance are often left without support for flood-related damages, relying on FEMA grants which are insufficient for full recovery.

What regions were particularly affected by flood losses from Hurricane Helene?

-Southern Appalachia and parts of Georgia experienced significant flood losses that are not covered by standard insurance.

How does the insurance industry's response to Hurricane Helene differ from past storms?

-Insurance companies are preparing for a substantial number of claims due to the storm, but the overall projected insured losses are much lower compared to similar past events.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Amerika Berlutut pd Badai Monster yang Bekukan AS: Badai Kiamat Salju & Angin Hancurkan Amerika!

The World's Worst Computer Virus: The I Love You Virus (Demonstration)

A Short Summary | Hurricane David

How The Tokyo Olympics Became The Most Expensive Summer Games Ever | So Expensive

Hurricane Milton: more than a million people warned to evacuate

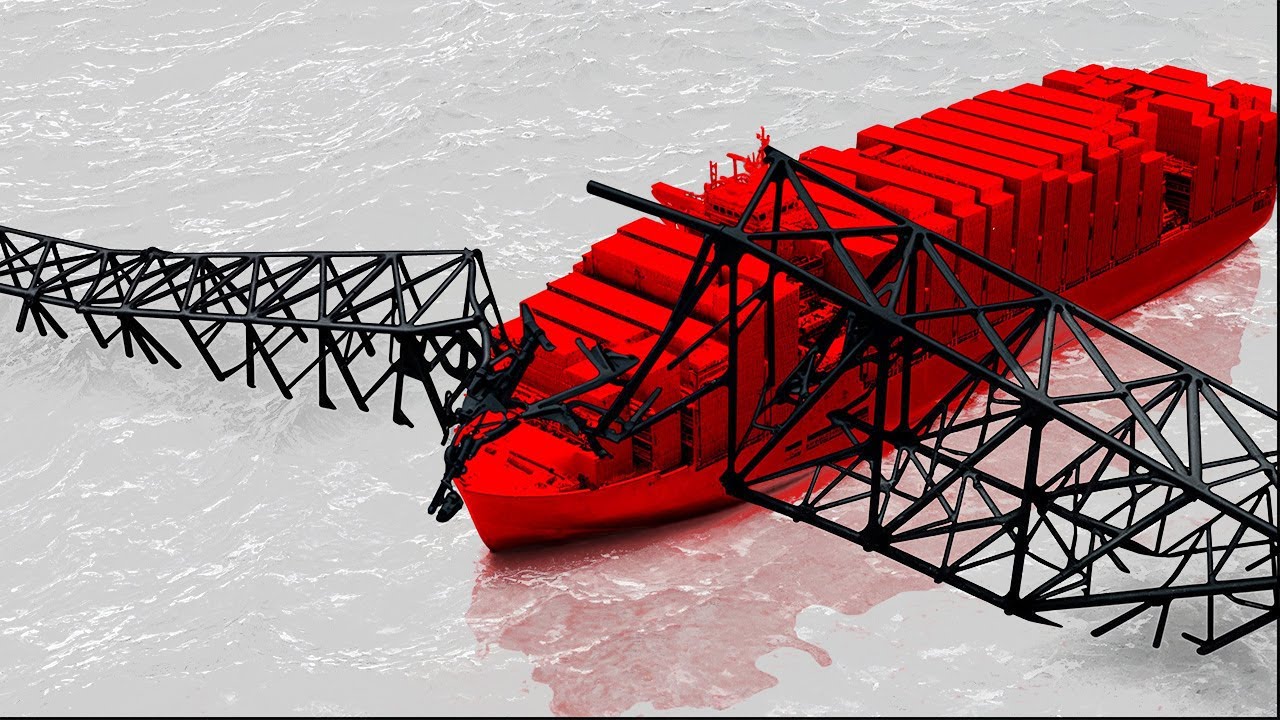

How One Error Caused The Baltimore Bridge Disaster

5.0 / 5 (0 votes)