Is Dollar-Cost Averaging Better Than Lump-Sum Investing?

Summary

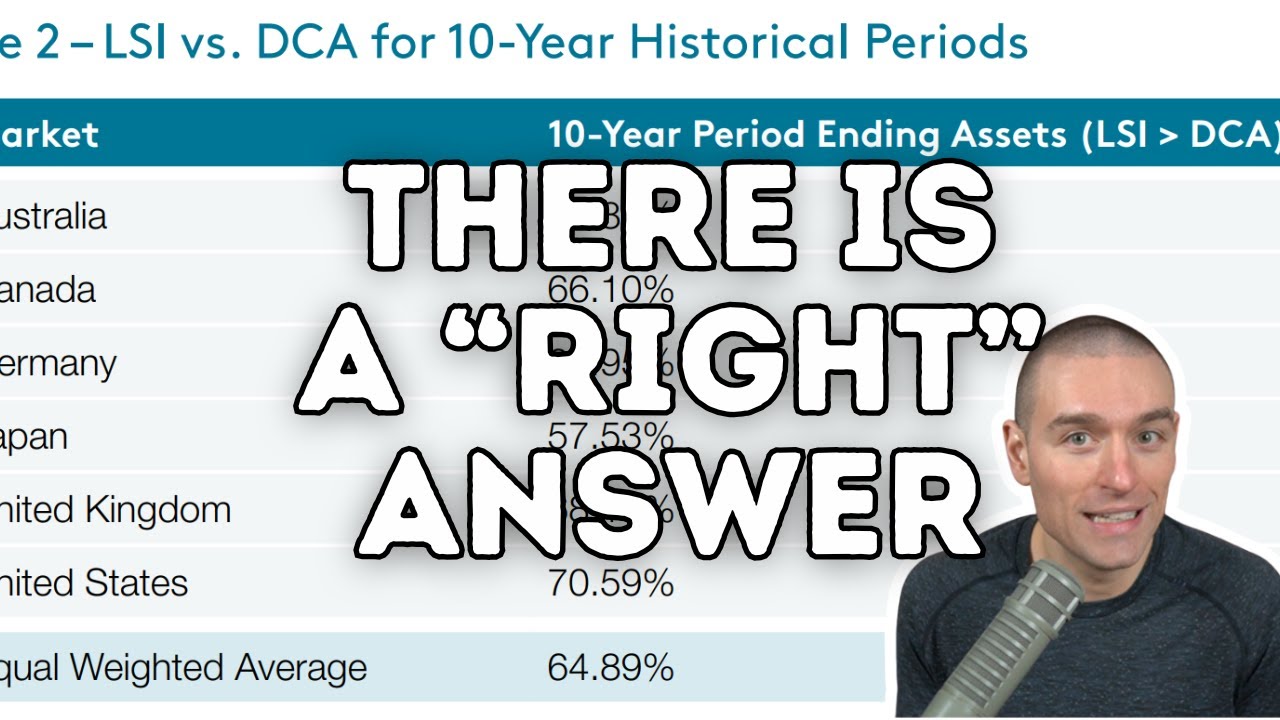

TLDRThis video explores the debate between dollar-cost averaging (DCA) and lump-sum investing. DCA involves investing a fixed amount regularly, while lump-sum investing puts all funds to work immediately. Each method has pros and cons: DCA reduces risk and lowers average costs when prices drop, but may miss out on gains if prices rise. Lump-sum investing offers greater returns when markets rise, but higher risk if they fall. An analysis of historical S&P 500 data shows lump-sum investing often edges out DCA, though both can be effective depending on individual goals and risk tolerance.

Takeaways

- 💰 Lump-sum investing involves putting a large amount of money into a security all at once, while dollar-cost averaging spreads the investment over time.

- 📉 Dollar-cost averaging lowers the average cost per share if the stock price falls but increases the average if the stock price rises over time.

- 😌 Dollar-cost averaging offers psychological comfort by minimizing the risk of losing a large amount of money at once.

- 💼 Lump-sum investing may lead to greater gains if the stock price rises quickly, but it also carries the risk of higher losses if the stock falls.

- 📈 Historically, lump-sum investing has outperformed dollar-cost averaging in 66 out of 76 20-year periods according to Schwab's analysis.

- 🔄 Dollar-cost averaging can generate additional costs due to more frequent trading, which may erode some of the potential benefits.

- 🏆 In the long run, lump-sum investing typically provides slightly better returns compared to dollar-cost averaging, but the difference may not be significant.

- 📊 The best strategy for long-term investors is to decide their appropriate market exposure and invest as soon as possible, regardless of current market levels.

- 🔎 Dollar-cost averaging is useful for investors who prefer disciplined, regular contributions and wish to avoid the stress of investing a large sum all at once.

- 🛠 A hybrid approach combining lump-sum investing with portfolio management strategies like rebalancing can offer a balanced approach to risk and returns.

Q & A

What is dollar-cost averaging (DCA)?

-Dollar-cost averaging is the strategy of continuously investing the same amount of money in a security over time, regardless of fluctuating prices, instead of investing the entire amount at once.

What are the benefits of dollar-cost averaging?

-The benefits include reducing the anxiety of risking the entire investment at once, potentially lowering the average price per share if the stock price falls, and limiting losses if the stock drops after the initial purchase.

What are the risks of dollar-cost averaging?

-The risks include buying at higher prices if the stock rises over time, missing out on potential gains from lump-sum investing, and possibly incurring additional trading or transaction costs.

What is lump-sum investing?

-Lump-sum investing involves investing all available funds into a security at once, instead of spreading it out over time.

What are the benefits of lump-sum investing?

-The primary benefit is the potential to maximize gains if the stock rises after the investment is made. It also eliminates the risk of missing out on growth by delaying investments.

What are the risks of lump-sum investing?

-The risks include experiencing all the losses if the stock falls after the investment, which can lead to more psychological stress.

How did lump-sum investing compare to dollar-cost averaging in a hypothetical 20-year scenario?

-In a hypothetical scenario where two investors invested $2,000 annually from 2001 to 2020 in an S&P 500® index portfolio, the lump-sum investor came out ahead by $615, but the difference between the two strategies was relatively small.

What did Schwab’s analysis of 76 rolling 20-year periods reveal about lump-sum versus dollar-cost averaging?

-Schwab's analysis showed that in 66 of the 76 rolling 20-year periods, lump-sum investing outperformed dollar-cost averaging, but the differences were often small.

What is the key takeaway for long-term investors based on the analysis?

-The key takeaway is that long-term investors should prioritize investing as soon as possible, as delaying can result in missed opportunities, regardless of the market’s current level.

When might dollar-cost averaging still be a useful strategy?

-Dollar-cost averaging can be helpful for investors who prefer the discipline of investing regularly or who are concerned about making a large investment before a potential short-term drop in the market.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

5.0 / 5 (0 votes)