Tax Credits vs Tax Deductions: What is the Difference and Which is Better?

Summary

TLDRThis video breaks down the key differences between tax credits and tax deductions, helping viewers understand how each can reduce their tax burden. Tax credits offer a dollar-for-dollar reduction on taxes owed, while tax deductions reduce taxable income. While tax credits can provide more savings, especially refundable ones like the earned income credit, deductions can still be valuable depending on your income and expenses. The video also highlights the importance of qualifying for both to maximize tax savings, with insights on when one might be more beneficial than the other.

Takeaways

- 😀 Tax credits directly reduce the amount of tax you owe, offering a dollar-for-dollar reduction.

- 😀 Tax deductions lower your taxable income, reducing the portion of your income subject to taxes.

- 😀 Tax credits generally offer more savings than tax deductions, but the type of credit and its limitations matter.

- 😀 Some tax credits are non-refundable, meaning they can only reduce your tax liability to zero but won't provide a refund.

- 😀 Refundable tax credits, such as the Earned Income Tax Credit and Child Tax Credit, can provide a refund even if your liability is zero.

- 😀 Tax deductions, like depreciation, can be carried forward to future tax years for additional savings.

- 😀 The standard deduction is a set amount that all taxpayers get, which often makes itemizing deductions unnecessary unless your deductions exceed this threshold.

- 😀 In comparing a $10,000 tax deduction versus a $10,000 tax credit, the tax credit typically results in more significant savings.

- 😀 High-income earners with substantial qualifying expenses benefit more from tax deductions, while low-income individuals benefit more from tax credits.

- 😀 It's best to pursue both tax credits and deductions, depending on eligibility, to maximize tax savings.

Q & A

What is the main difference between a tax credit and a tax deduction?

-A tax credit directly reduces the amount of tax you owe on a dollar-for-dollar basis, whereas a tax deduction reduces your taxable income, which indirectly lowers your tax liability based on your tax bracket.

How does a $2,000 tax credit affect your tax liability if you owe $2,000?

-A $2,000 tax credit would reduce your tax liability from $2,000 to zero, meaning you wouldn't owe any taxes.

If you're in a 24% tax bracket and have a $2,000 tax deduction, how much would you save in taxes?

-A $2,000 tax deduction in a 24% tax bracket would save you $480 in taxes (2,000 x 0.24 = 480).

Why are tax credits generally more valuable than tax deductions?

-Tax credits are more valuable because they directly reduce your tax liability dollar for dollar, while tax deductions only reduce your taxable income, which results in smaller savings depending on your tax bracket.

What is a non-refundable tax credit?

-A non-refundable tax credit can reduce your tax liability to zero but won’t result in a refund if the credit amount exceeds the taxes you owe. For example, if you owe $500 and have a $2,000 tax credit, your credit reduces to $500, and you won't receive the remaining $1,500.

Can you get a refund with a refundable tax credit?

-Yes, refundable tax credits can not only reduce your tax liability to zero but also allow you to receive a refund for the remaining amount. For example, the Earned Income Tax Credit and Child Tax Credit are refundable tax credits.

What is the standard deduction, and why is it important?

-The standard deduction is a fixed amount that everyone is entitled to subtract from their taxable income. It’s important because many people find that their itemized deductions don't exceed this amount, making the standard deduction more beneficial for them.

How much is the standard deduction for a single filer in the 2021 tax year?

-For a single filer in the 2021 tax year, the standard deduction is $12,400.

In the example given, which is more beneficial: a $10,000 tax deduction or a $10,000 tax credit?

-A $10,000 tax credit is more beneficial because it directly reduces your tax liability by $10,000, whereas a $10,000 tax deduction only reduces your taxable income, resulting in a smaller reduction in taxes owed.

Which group tends to benefit more from tax credits, and why?

-Low-income individuals tend to benefit more from tax credits because many tax credits are designed to assist them, and refundable credits can provide additional financial relief through refunds.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

How Taxes Work in Canada 🍁 - Learn to Lower Your Tax Bill

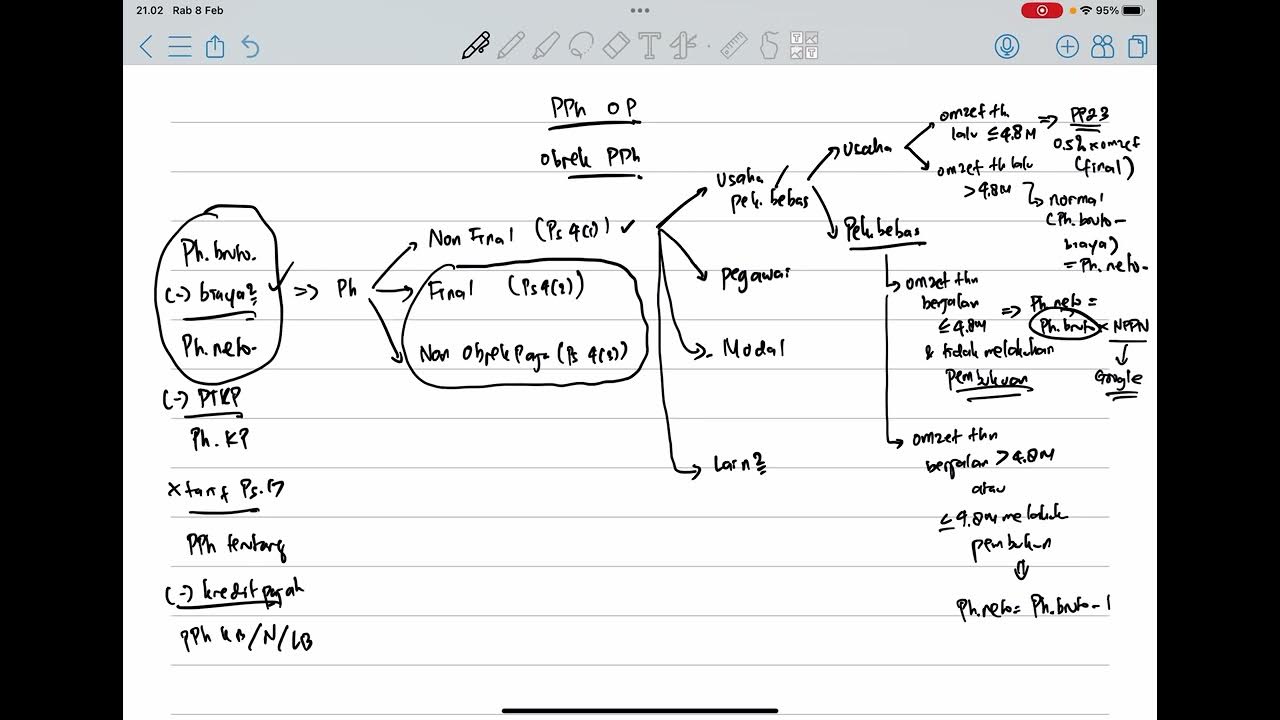

PPH Orang Pribadi (Update 2023) - 2. Objek Pajak

Strategi Perencanaan Pajak (Tax Planning) PPN

18 DEDUCTIONS to MAXIMISE REFUND & Pay Less Tax in 2025 (Australia)

RMF กองทุนรวมเพื่อการเลี้ยงชีพคืออะไร ? [ Money Q & A ]

Como Funciona o SIMPLES NACIONAL? Guia Prático do Empreendedor!

5.0 / 5 (0 votes)