Natura dan Kenikmatan Kena Pajak, Apa Saja Yang Kena dan Tidak kena Pajak?

Summary

TLDRIn this informative video, the speaker discusses taxation on non-cash benefits (natura and enjoyment) as regulated in Government Regulation No. 55 of 2022. It explains how employers provide compensation not just through salaries but also through goods and facilities. The video covers the changes in tax laws regarding natura and enjoyment, highlighting when such benefits are taxable and deductible. It also touches on international trends, the rationale for these tax reforms, and the specific exceptions where such benefits are not subject to tax. The episode aims to clarify these new taxation rules for employers and employees.

Takeaways

- 📜 The video discusses regulations on taxation for fringe benefits, known as 'natura' and 'kenikmatan', introduced by Government Regulation No. 55 of 2022.

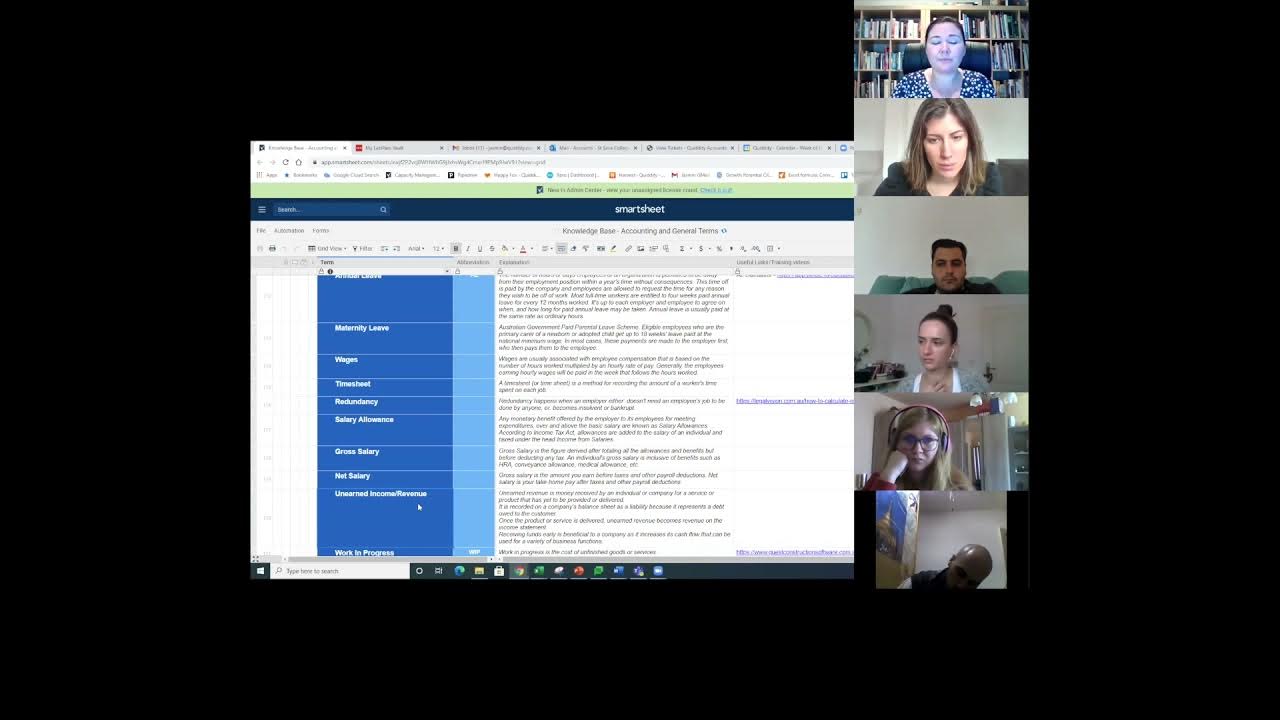

- 💼 'Natura' refers to non-cash compensation in the form of goods or services, while 'kenikmatan' refers to rights or utilization of facilities provided by employers.

- 📑 Before the 2022 tax law reforms, fringe benefits were not subject to tax, except for certain cases, such as employees of non-taxable entities.

- 🛑 Under the old law, companies could not deduct expenses for fringe benefits if the benefits were not taxable to employees.

- 📈 Starting in 2022, fringe benefits are taxable income for employees and deductible for employers, aligning with international tax practices.

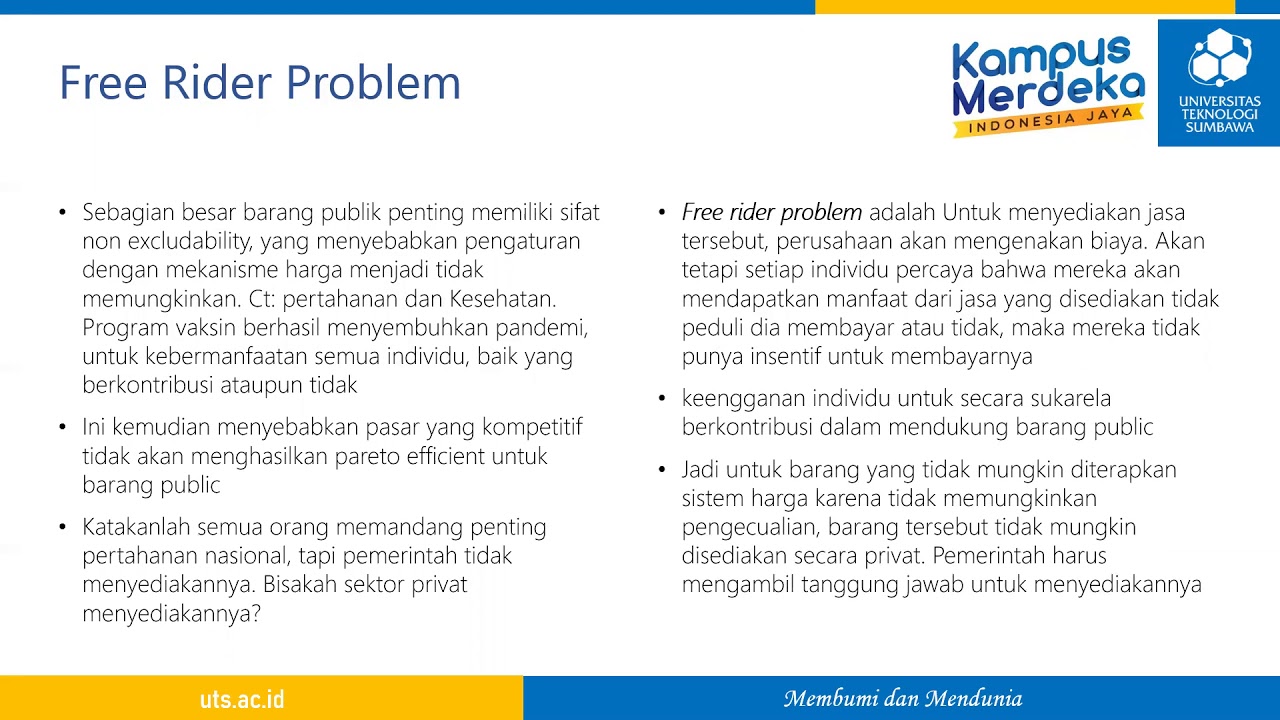

- ⚖️ The introduction of fringe benefit taxation aims to reduce tax planning and income inequality, particularly among high-income employees who previously received untaxed benefits.

- 🌍 This new policy follows international trends in countries like Australia, Singapore, and New Zealand, where similar fringe benefit taxes are implemented.

- 🛠️ Certain fringe benefits are exempt from tax, including meals, housing in specific areas, and benefits tied to mandatory work equipment or services.

- 💡 The video highlights that employers are required to withhold tax on fringe benefits starting from January 2023, but employees must report and pay tax for 2022 benefits independently.

- 📝 For the correct valuation, 'natura' is assessed based on market value, while 'kenikmatan' is evaluated based on the cost of providing the benefit.

Q & A

What is the main topic discussed in the video?

-The video discusses taxation on 'natura' (in-kind benefits) and 'kenikmatan' (fringe benefits) according to Government Regulation No. 55 of 2022 in Indonesia.

What is meant by 'natura' and 'kenikmatan' in the context of taxation?

-'Natura' refers to non-cash benefits provided to employees, such as goods or facilities, while 'kenikmatan' refers to benefits like the use of rights, facilities, or services.

What are the main changes introduced by Government Regulation No. 55 of 2022?

-The regulation details the taxation of 'natura' and 'kenikmatan', allowing these benefits to be taxed and, under certain conditions, to be deductible as company expenses.

Before the introduction of the new tax law, were 'natura' and 'kenikmatan' taxable?

-Before the law was changed, 'natura' and 'kenikmatan' were generally not taxable, except in cases where the employer was a non-taxpayer or had specific tax treatments.

How does the new law affect the deductibility of 'natura' and 'kenikmatan' for employers?

-Previously, 'natura' and 'kenikmatan' were not deductible as business expenses, but under the new law, they can be deducted if they relate to employee compensation and are taxable income.

What are the exceptions to the taxation of 'natura' and 'kenikmatan'?

-'Natura' and 'kenikmatan' such as meals for employees, benefits provided in certain regions, and benefits related to work safety or during pandemics are exempt from taxation.

What is the reasoning behind introducing fringe benefit taxes in Indonesia?

-The introduction of fringe benefit taxes aims to reduce income inequality, prevent tax avoidance, and align with international practices in countries like Australia and Singapore.

How does the fringe benefit tax help address income inequality?

-It ensures that high-income employees who receive substantial non-cash benefits are taxed more fairly, reducing the gap between the taxation of high-earning individuals and businesses.

How are 'natura' and 'kenikmatan' valued for tax purposes?

-'Natura' is valued based on market prices, while 'kenikmatan' is valued based on the cost incurred to provide the facility or service.

When does the obligation to withhold tax on 'natura' and 'kenikmatan' start?

-The obligation to withhold tax on 'natura' and 'kenikmatan' started in January 2023, although the regulation came into effect for the 2022 tax year.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführen5.0 / 5 (0 votes)