geldschepping en de reële economie

Summary

TLDRThis script delves into the medieval origins of paper money and its evolution into modern banking systems. It explains how banks create money through lending, which initially was backed by gold but now operates on a debt-based system. The video highlights the Netherlands' role as a global leader in mortgage debt, illustrating the connection between money creation and debt crises. It contrasts the real economy, including everyday businesses and services, with the financial sector, which includes banks and investment firms. The script also touches on the dangers of the asset market, exemplified by the Lehman Brothers' collapse, and how financial crises can impact the real economy, leading to a situation where the real economy serves the financial sector rather than the other way around.

Takeaways

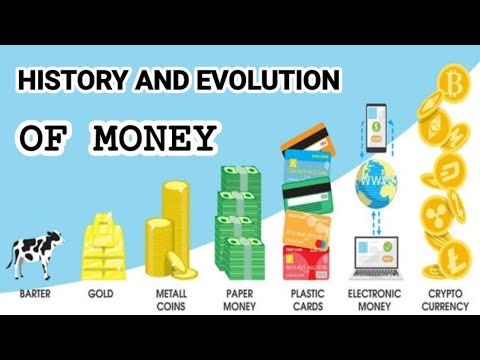

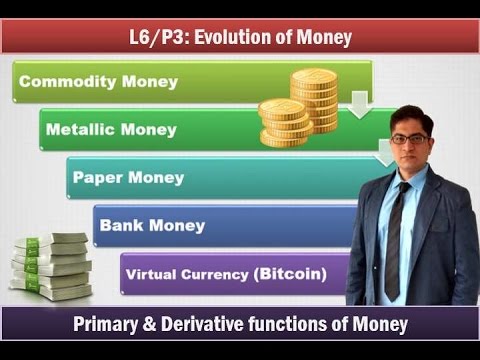

- 🏰 In medieval times, gold and silver coins were used for payment, and when people had too many coins, they could store them with a goldsmith who would issue a paper receipt for the amount of gold deposited.

- 📜 This paper receipt became a precursor to paper money, as it was more convenient than carrying around physical coins, and it started to be used as a medium of exchange.

- 💼 The goldsmith noticed that people rarely came to exchange their receipts for gold at the same time, which allowed him to issue more paper receipts than he had gold in reserve.

- 🏦 The role of the goldsmith evolved into what we now know as a bank, where loans are given, and value papers (loans) are issued with a promise to repay with interest within a certain time.

- 💵 Banks create money by lending. When a business requests a loan, the bank creates new money by registering a new asset, effectively creating money out of thin air.

- 🔄 The newly created money from loans enters the economy, is used for transactions, and circulates, becoming as real as any other form of currency.

- 🌐 The financial sector, which includes banks and other financial institutions, plays a crucial role in the economy by facilitating payments, savings, investments, and risk spreading.

- 🏢 The wealth market deals with shares, bonds, derivatives, real estate, and other investment and speculative instruments. It can be both beneficial and perilous, as seen with the case of Lehman Brothers during the financial crisis.

- 📉 The financial crisis can have a significant impact on the real economy, affecting the value of homes, the performance of pension funds, and the availability of loans.

- 🏛 The relationship between the financial sector and the real economy has become inverted, with the real economy now largely serving the financial sector and the wealth market, rather than the other way around.

Q & A

How did paper money originate in Europe during the Middle Ages?

-Paper money originated in Europe during the Middle Ages when goldsmiths offered to keep people's excess gold and silver coins safe. In return, they issued paper receipts that represented the amount of gold deposited. These receipts were more convenient than carrying coins and started to be used as a medium of exchange.

What was the role of the goldsmith in the early form of banking?

-The goldsmith played the role of an early banker by issuing paper receipts for the gold and silver coins kept in their safekeeping. They also began to lend money and issue loans, which led to the creation of more value papers than they had gold to back them up.

How does the process of banks creating money through loans work?

-Banks create money by lending out more than they have in deposits. When a loan is approved, the bank creates a new account with the loan amount, which did not exist before, by simply entering numbers into a computer system. This new money enters the economy and circulates as real currency.

What is the difference between the real sector and the financial sector of an economy?

-The real sector consists of tangible goods and services like housing, supermarkets, and schools. The financial sector includes banks and other financial institutions that facilitate payments, savings, investments, and risk management. The financial sector is meant to support the real sector.

Why do banks lend more money than they have in deposits?

-Banks lend more money than they have in deposits because they rely on the fractional reserve system. They only need to keep a fraction of their deposits as reserves to meet the demand for withdrawals, allowing them to lend out the rest and create new money in the process.

How does the creation of money through loans affect the total amount of money in circulation?

-The creation of money through loans increases the total amount of money in circulation. As banks lend money, the borrowed funds are used for transactions, which increases the money supply without changing the ownership of the existing money.

What is the significance of the statement 'money is actually debt'?

-The statement 'money is actually debt' signifies that the money in circulation is created as a result of loans, which are a form of debt. If all debts were repaid, the corresponding money would effectively disappear, highlighting the interconnectedness of money and debt.

How did the housing market crash in the United States affect the global financial system?

-The housing market crash in the United States led to a failure of banks like Lehman Brothers, which had speculated heavily on the market. This triggered a global financial crisis as the real economy was impacted, with houses losing value, pensions and savings yielding less, and reduced lending capabilities.

What is the role of the asset market in the economy, and how can it be dangerous?

-The asset market deals with trading shares, bonds, real estate, and other investable assets. It can be dangerous because it involves speculation and leverage, which can lead to bubbles and crashes. The 2008 financial crisis was partly due to the collapse of the asset market, affecting pensions, savings, and overall economic stability.

How has the relationship between the real economy and the financial sector changed over time?

-The relationship has shifted so that the real economy, which should be served by the financial sector, is now largely in service to the financial sector and the asset market. This is evident in the way government bailouts of banks were funded by cuts to the real sector, reflecting a prioritization of financial interests.

What are the implications of the financial sector's dominance over the real economy?

-The dominance of the financial sector can lead to an economy that prioritizes speculative activities over productive investments, potentially leading to economic instability and crises. It can also result in wealth concentration and reduced funding for public services and infrastructure.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführen5.0 / 5 (0 votes)