Fundamentals - Partnership | Chapter 1 | Accountancy Class 12 | Easiest way | Part 3

Summary

TLDRIn this video, the speaker continues discussing the fundamentals of partnership accounting, focusing on the Profit & Loss Appropriation Account and the differences between 'Charge Against Profits' and 'Appropriation Out of Profits.' Key concepts include how profits are distributed among partners, handling situations where appropriations exceed profits, and the importance of understanding interest on capital, partner salaries, and manager's commissions. The speaker emphasizes the practical application of these concepts, encouraging viewers to follow along and prepare for upcoming classes on more detailed topics.

Takeaways

- 📚 The session focuses on the concept of Capital Account in partnership accounting, building upon previously discussed topics like P&L appropriation.

- 💼 The video explains the process of profit distribution among partners, including the calculation of interest on capital and other partner-related distributions.

- 📈 The instructor clarifies the difference between 'Charge Against Profits' and 'Appropriation Out of Profits', emphasizing their significance in financial accounting.

- 🔍 'Charge Against Profits' includes mandatory expenses like interest on loans and rent, which must be paid regardless of the firm's profit status.

- 💼 'Appropriation Out of Profits' refers to distributions that are made from the firm's profits, such as interest on capital and partner's salary, which are only paid if profits are available.

- 📝 The script highlights the importance of understanding the sequence of recording transactions in the P&L account, where charge items are recorded before calculating the net profit or loss.

- 💡 The video provides a scenario where the total appropriations requested by partners exceed the available profits, explaining how to distribute the profits proportionally according to the ratio of appropriations.

- 📋 The instructor emphasizes the need for students to take notes and screenshots for important concepts, suggesting a structured approach to learning.

- ⏰ The session concludes with a预告 of the next class, which will delve into the detailed topic of 'Interest on Drawings', indicating the depth of the upcoming discussion.

- 📢 The video ends with a reminder for viewers to watch all the classes in order, not to miss any, and to utilize the playlist for easy navigation through the course material.

Q & A

What is a Capital Account in the context of partnership accounting?

-A Capital Account in partnership accounting is an account that records the initial capital contributions of each partner, as well as any additional capital injections, drawings, and the partner's share of profits or losses.

How is P&L appropriation account different from a regular P&L account?

-A P&L appropriation account is a specific type of account that is used to distribute the firm's profits among the partners according to the partnership agreement, including interest on capital, salary, bonus, commission, and any reserves. It differs from a regular P&L account in that it focuses on the distribution of profits rather than just calculating them.

What is meant by 'Interest on Drawings' in the script?

-'Interest on Drawings' refers to the interest charged to partners for money they withdraw from the firm during the accounting period. It is a way of adjusting the profit distribution to reflect the use of the firm's funds by the partners.

What is the significance of 'Charge Against Profits' in partnership accounting?

-In partnership accounting, 'Charge Against Profits' refers to expenses that must be paid by the firm regardless of whether it is profitable or not. These charges are deducted from the profits before the remaining amount is available for distribution among partners.

Can you explain the term 'Appropriation Out of Profits' as mentioned in the script?

-'Appropriation Out of Profits' refers to the distribution of the firm's profits to the partners after all necessary expenses and charges have been accounted for. This appropriation includes interest on capital, partner's salary, bonus, commission, and any reserves, and it only occurs if there is a profit.

What happens if the total appropriations exceed the available profits in a partnership?

-If the total appropriations exceed the available profits, the available profit is distributed among the partners in the ratio of their appropriations. This means that each partner receives a share of the profit proportional to their share of the total appropriations.

What is the difference between 'Charge items' and 'Appropriation items' in the context of the script?

-In the context of the script, 'Charge items' are expenses that must be paid by the firm regardless of profit status, such as interest on loans and rent. 'Appropriation items', on the other hand, are distributions from profits, such as interest on capital and partner's salary, which only occur if there is a profit.

How are partner's salary, bonus, and commission (SBC) treated in a P&L appropriation account?

-Partner's salary, bonus, and commission (SBC) are treated as appropriation items in a P&L appropriation account. They are distributed from the profits, and only if there are profits available after accounting for all charge items.

What is the role of reserves in the P&L appropriation account?

-Reserves in the P&L appropriation account are amounts set aside from the profits for specific purposes, such as future business needs or contingencies. They are part of the appropriation process and are only funded if there are sufficient profits after accounting for other appropriation items.

Why is it important to understand the difference between charge and appropriation items in partnership accounting?

-Understanding the difference between charge and appropriation items is crucial in partnership accounting because it affects how profits are distributed among partners and how the financial health of the firm is assessed. Charge items are mandatory expenses, while appropriation items are dependent on the availability of profits.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Accounting for IGCSE - Video 31 - Financial statements of Partnerships

fundamentals of Partnership | Class 12 | Accountancy | Chapter 1

final accounts introduction in telugu part 1 #RSACADEMY|#degree #accountancy #finalaccounts #inter

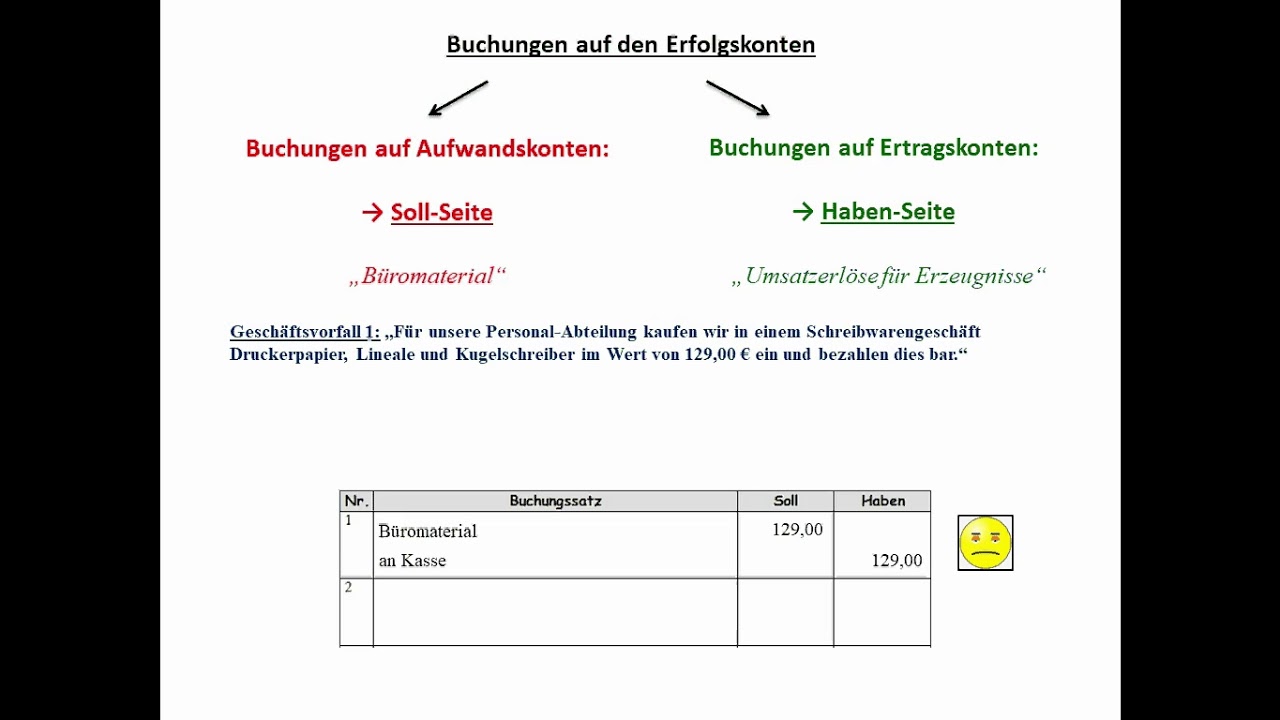

Buchführung 8: Die Erfolgskonten und das GuV-Konto

Jay Barney: Why Resource-based Theory Must Incorporate a Stakeholder Perspective

The 3 P's of Cultural Appropriation | Kayne Kawasaki | TEDxHultLondon

5.0 / 5 (0 votes)