【知らない人多すぎ、、】小規模共済とセーフティ共済で起こる凄まじい効果について税理士が解説します。個人事業主・経営者の方は絶対見てください!

Summary

TLDRIn this video, the host discusses effective tax-saving strategies using two powerful systems: the Small Business Mutual Aid and the Business Safety Mutual Aid schemes. These systems offer unique benefits, including tax deductions and loans with low-interest rates. The video explores how these systems can be used for business expansion, asset management, and even as a tool for efficient financial planning. Viewers are guided through how to maximize these benefits, including using loans for business growth or asset investments, as well as techniques to reduce tax burdens while building long-term savings.

Takeaways

- 😀 Small Business Mutual Aid and Safety Mutual Aid offer unexpected tax-saving benefits and flexible loan systems for entrepreneurs.

- 😀 Small Business Mutual Aid allows business owners to save for retirement with flexible contributions, ranging from ¥1,000 to ¥70,000 per month.

- 😀 Small Business Mutual Aid contributions are fully tax-deductible, reducing income and resident taxes, which can result in significant savings.

- 😀 For example, a ¥7,000 monthly contribution could result in up to ¥1.2 million in tax savings over 30 years for a high-income earner.

- 😀 Withdrawals from the Small Business Mutual Aid are taxed under retirement or annuity income categories, offering tax advantages.

- 😀 The Small Business Mutual Aid loan system allows for loans up to ¥2 million at low interest (1.5%) without collateral or guarantors, based on contributions.

- 😀 Loans from the Small Business Mutual Aid can be used flexibly for various business needs, offering a significant advantage over bank loans.

- 😀 Safety Mutual Aid is designed to protect against business risks, offering loans up to 10 times the amount saved if a business faces losses due to client defaults.

- 😀 Safety Mutual Aid contributions are tax-deductible as business expenses, providing a direct tax relief that reduces taxable income.

- 😀 Both systems allow borrowing for various purposes, including investments, asset management, and business expansion, offering diverse financial strategies for growth.

Q & A

What is the purpose of the 'Small Business Mutual Aid' (小規模企業共済)?

-The purpose of the 'Small Business Mutual Aid' is to allow small business owners and executives to accumulate retirement funds. It is a government-sponsored system for small businesses, offering flexible contributions ranging from ¥1,000 to ¥70,000 per month.

How does the tax benefit work with 'Small Business Mutual Aid' contributions?

-Contributions to the 'Small Business Mutual Aid' are fully deductible from taxable income. This means the amount paid as contributions reduces the taxable income, resulting in lower income and resident taxes.

What is the lending system available with 'Small Business Mutual Aid'?

-The 'Small Business Mutual Aid' allows members to borrow funds for business-related needs. The loans require no collateral or guarantor, and the maximum amount for a general loan is up to ¥2 million, with an interest rate of 1.5%.

What are the eligibility requirements for joining 'Small Business Mutual Aid'?

-To join 'Small Business Mutual Aid,' you must be an owner or executive of a small business with few employees. The company should meet specific criteria, such as having fewer than 20 employees or as few as 5, depending on the industry.

How does the lending system of 'Small Business Mutual Aid' compare to bank loans?

-The lending system in 'Small Business Mutual Aid' is more flexible than bank loans. It doesn't require collateral or a guarantor, and the funds can be used for various purposes without restrictions. The interest rate is also much lower than that of typical bank loans.

What is the 'K Safety Mutual Aid' (経営セーフティ共済) and its primary benefit?

-The 'K Safety Mutual Aid' is a system designed to protect small businesses from chain bankruptcies. It allows businesses to borrow up to 10 times their accumulated contributions, with the maximum borrowing amount reaching ¥80 million. This loan is provided without the need for collateral or a guarantor.

What is the difference between 'Small Business Mutual Aid' and 'K Safety Mutual Aid' in terms of contribution limits?

-The main difference is that 'Small Business Mutual Aid' has no upper limit on contributions, allowing for flexible retirement savings, while 'K Safety Mutual Aid' has a contribution limit of ¥800,000, as it is specifically designed to prevent chain bankruptcies and assist in such cases.

Can a business use 'K Safety Mutual Aid' to protect itself from losses caused by a partner's bankruptcy?

-Yes, 'K Safety Mutual Aid' is specifically designed for this purpose. If a business suffers losses due to a partner's bankruptcy, it can borrow up to ¥80 million, depending on the contributions made, without the need for collateral or a guarantor.

What is the unique feature of 'K Safety Mutual Aid' regarding tax benefits?

-One of the key benefits of 'K Safety Mutual Aid' is that the contributions are fully deductible as business expenses. This allows business owners to reduce their taxable income, which can significantly help lower corporate taxes.

How can the borrowing systems from 'Small Business Mutual Aid' and 'K Safety Mutual Aid' be used for business growth?

-These borrowing systems can be used for business expansion, such as investing in equipment or increasing business capacity. By combining these loans with grants and subsidies, businesses can grow more efficiently while benefiting from tax savings.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

CA Reveals 6 Insane Tax Saving Strategies (Just Copy These!)

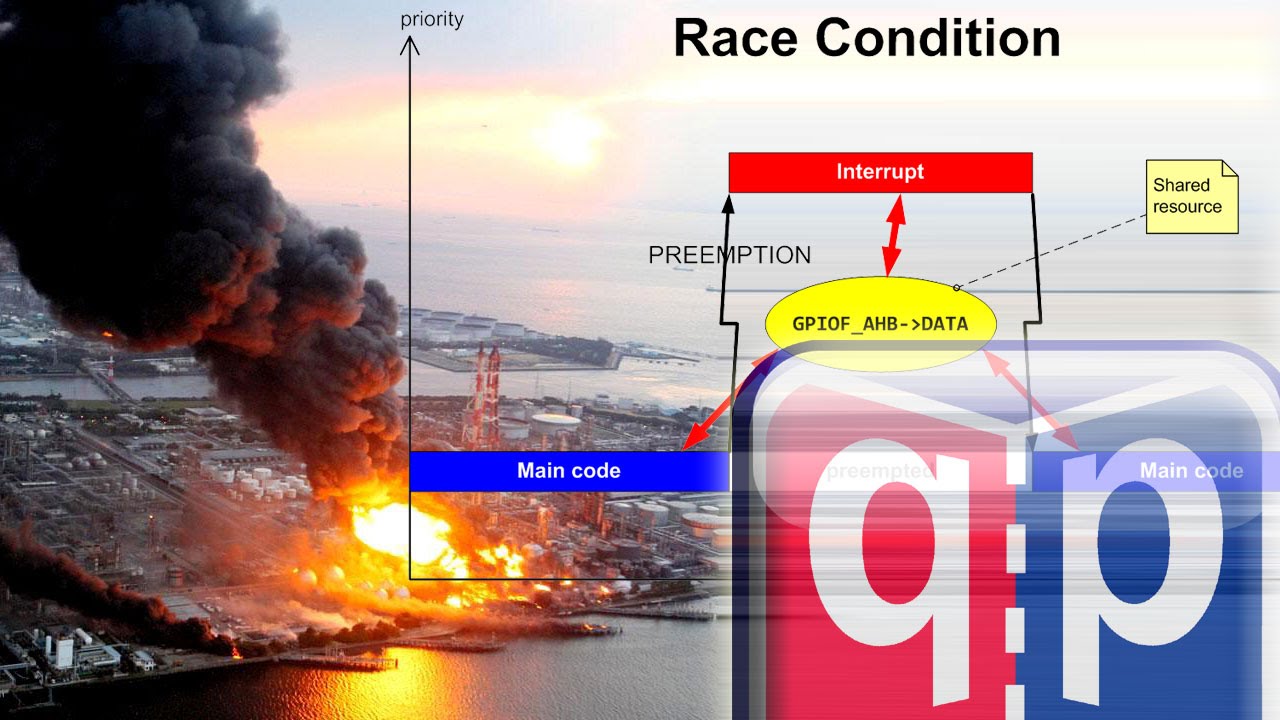

#20 Race Conditions: What are they and how to avoid them?

SAN NGA BA MAS MAKAKATIPID NG TAX? | Graduated Rates versus 8% Optional Rate

"Kerja Sama dan Gotong royong" - Pendidikan Pancasila dan Kewarganegaraan (PPKN)

Tax Planning Strategies For Canadian Small Business Owners

How to Invest in Mutual Funds? | Investing Strategy for Beginners in 2021 | Ankur Warikoo Hindi

5.0 / 5 (0 votes)