SoftBank's involvement in the ARM IPO is a red flag, says NYU's Aswath Damodaran

Summary

TLDRIn a discussion about the valuation of companies like ARM and Instacart, NYU Professor Aswath Damodaran shares his insights. He suggests that ARM's $54.5 billion valuation could be reasonable if it achieves a 40% annual growth rate. However, he expresses skepticism about SoftBank's involvement, citing their track record in building businesses. Regarding Instacart, he believes its $9 billion valuation reflects a more realistic view of the online grocery market's potential. Damodaran also touches on the challenges facing media companies in the streaming era, drawing parallels to the music industry's transformation, and shares his cautious approach to investing in mega-cap tech stocks at current prices.

Takeaways

- 📈 Arm's valuation at $54.5 billion is reasonable if they achieve a 40% annual compounded growth rate.

- 🚀 Aswath Damodaran, a professor at NYU, suggests that Arm could potentially be valued at $100 billion in 2021 due to its AI potential.

- 💡 There is skepticism about investing in companies that SoftBank has touched, given their recent track record.

- 🤔 Damodaran expresses concern about SoftBank's control over Arm and prefers the company to be run by its original builders.

- 📉 Instacart's valuation has dropped from $39 billion to $9 billion, reflecting a more realistic view of the online grocery market's potential.

- 🛒 The online grocery retail market is capped, with a realistic expectation of only around 20% online market share.

- 📊 The $9 billion valuation for Instacart assumes a loss of market share, which is seen as a realistic assessment.

- 🔍 The current IPO environment is considered healthier as investors are focusing more on business fundamentals rather than just pricing.

- 🎥 The media industry, particularly movie and broadcasting companies, face existential threats similar to what the music industry experienced with streaming.

- 📉 Disney's market cap meltdown reflects concerns about how the movie and broadcasting businesses will evolve with streaming becoming dominant.

- 💸 Damodaran is cautious about buying big tech companies like NVIDIA at current prices, having bought them at much lower prices.

Q & A

What is the valuation of ARM and what growth rate is considered reasonable for it?

-ARM has a valuation of $54.5 billion, and a 40% annual compounded growth rate is considered reasonable if they can achieve it.

What is Aswath Damodaran's stance on the ARM IPO?

-Aswath Damodaran is not participating in the ARM IPO, but he believes that in 2021, he wouldn't be surprised if ARM went for $100 billion due to the hype and its potential as a true AI play.

Why is Damodaran hesitant about investing in companies that SoftBank has touched?

-Damodaran is cautious because he feels that SoftBank doesn't have a soft touch when it comes to building businesses, and he would prefer to avoid investments that SoftBank promotes.

What is the current valuation of Instacart and how does it compare to its past valuation?

-Instacart's current valuation is $9 billion, which is down from its previous valuation of $39 billion.

What is Damodaran's view on the online grocery retail market?

-Damodaran believes that online grocery retail can never achieve the same market penetration as other online retail spaces, with a ceiling of around 20%, and that the grocery business is not very profitable.

How does Damodaran assess the current IPO environment?

-Damodaran thinks the current IPO environment is healthier because people are asking the right business questions rather than just pricing questions.

What is Damodaran's analogy for the future of the movie and broadcasting industries?

-Damodaran compares the future of movie and broadcasting industries to the music industry, which was devastated by streaming and had to adapt to a new business model.

What is Damodaran's opinion on mega cap tech stocks like Netflix and NVIDIA?

-Damodaran is cautious about buying these stocks at today's prices, as he believes they are being sold at premium prices. He owns some of these companies in his portfolio but would not buy them at current valuations.

What is the significance of Taylor Swift's success in the context of the music industry?

-Damodaran uses Taylor Swift's success to illustrate that in the new iteration of the music industry, only a small percentage of artists (like her) dominate the majority of streams.

How does Damodaran approach stocks that are already in his portfolio compared to those he hasn't bought yet?

-Damodaran treats stocks in his portfolio differently than those he hasn't bought, acknowledging that he got lucky by buying them at much lower prices and that this is not how he should ideally approach stock investments.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Aswath Damodoran Leaves Entire CNBC Panel SPEECHLESS

Growth Hacks for Startups from Elliot Shmukler of InstaCart, LinkedIn and now Anomalo | E1926

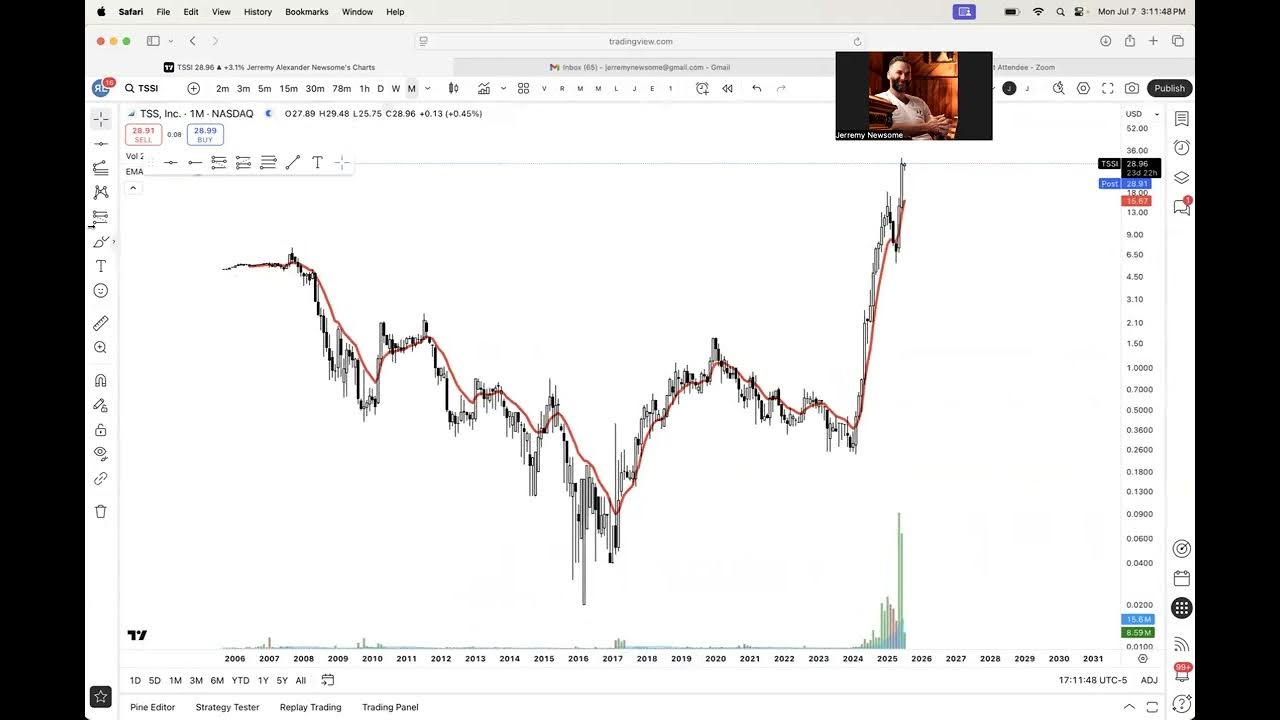

Top Tuesday Trade Ideas for July 8th, 2025

Change Your Brain Forever, Starting Today! Feat. Dr. Wendy Suzuki | Mel Robbins Clips

Vídeo de revisão - Gestão contábil

Startup Experts Discuss Doing Things That Don't Scale

5.0 / 5 (0 votes)