5 Dividend Increases You Need to Know About!

Summary

TLDRThis video explores five dividend stocks that recently announced increases, including a 4.1% hike by Altria, a high-yielding stock with a 50-year dividend growth history. Coca-Cola Consolidated's astonishing 400% dividend boost is scrutinized for sustainability, while Clorox's modest 1.7% increase raises concerns about inflation-adjusted payouts. McKesson's 15% dividend rise is highlighted as a potential long-term growth play, with the company's robust free cash flow and share buyback strategy underpinning its dividend potential.

Takeaways

- 📈 The S&P 500 is at an all-time high, with many quality dividend growth companies increasing their dividend payouts.

- 📊 The presenter owns Altria in their personal portfolio, which has just announced a 4.1% dividend increase, contributing to a high dividend yield of nearly 8%.

- 📊 Altria's performance has been impressive, with a 33% return on investment and a history of over 50 years of consecutive dividend increases.

- 💰 Concerns about Altria's high dividend payout ratio are addressed by the company's management's intentional strategy to reward shareholders with dividends.

- 📊 Altria's free cash flow has consistently covered its dividend payments, indicating the sustainability of its dividend policy.

- 🚀 Coca-Cola Consolidated has announced a massive 400% dividend increase, which is sustainable due to significant free cash flow growth.

- 📉 Clorox's 1.7% dividend increase is below the rate of inflation, effectively reducing the real value of dividends paid out.

- 📉 Clorox's performance has been lackluster, with a decline in earnings per share and slow revenue growth, impacting its ability to increase dividends significantly.

- 💡 McKesson's 15% dividend increase is a positive sign for investors, especially considering its low payout ratios and strong free cash flow.

- 💹 McKesson's consistent topline growth and aggressive share buyback program contribute to its potential for long-term dividend growth.

- 🔍 The video emphasizes the importance of analyzing a company's free cash flow, payout ratios, and historical dividend growth to assess the sustainability and attractiveness of its dividend policy.

Q & A

What is the significance of the S&P 500 trading at its all-time high in relation to dividend stocks?

-The S&P 500 trading at an all-time high indicates a strong market, which can positively influence dividend stocks as many quality dividend growth companies may increase their dividend payouts during such periods.

What is the role of the ticker dat.com and its add-on in analyzing dividend stocks?

-Ticker dat.com and its add-on are tools that allow users to automatically import stock financial data into spreadsheets, simplifying the analysis of dividend stocks and their financial performance.

Which company's dividend increase was discussed first in the video, and what was the percentage increase?

-The first company discussed was Altria, with a dividend increase of around 4.1%.

How has the presenter's personal portfolio performed with their Altria position?

-The presenter's Altria position has performed well, with a current return of around 33%.

What is the current annual dividend payment from the presenter's Altria position, and how much is it expected to increase by after the recent dividend hike?

-The current annual dividend payment is around $350, which is expected to increase by about 4.1% after the recent dividend increase.

What is the significance of a company being a 'Dividend King'?

-A 'Dividend King' is a company that has a history of over 50 consecutive years of dividend increases, indicating financial stability and a commitment to rewarding shareholders.

What is the concern regarding Altria's high dividend payout ratio, and how does the company justify it?

-The concern is the sustainability of high dividend payouts with a payout ratio of around 83.3%. The company justifies it by stating that they target a dividend payout ratio of about 80% of adjusted diluted earnings per share, which is part of their capital allocation strategy.

What was the dividend increase percentage for Coca-Cola Consolidated, and what does it imply about the company's financial health?

-Coca-Cola Consolidated announced a 400% increase in their dividend payment. This suggests the company is in a strong financial position as their free cash flow has been growing at a fast pace, making the dividend increase sustainable.

Why might a 1.7% dividend increase for Clorox be considered a negative sign?

-A 1.7% dividend increase is considered negative because it is below the rate of inflation, meaning the company is effectively paying out less in real terms, which could indicate financial strain or concerns about sustainability.

What was the significant event in early August for McKesson that affected its stock price?

-In early August, McKesson experienced a significant selloff after missing their quarterly revenue estimates in their earnings report, which led to a drop in the stock price.

What does McKesson's 15% dividend increase suggest about the company's future dividend growth potential?

-McKesson's 15% dividend increase, along with their low payout ratios and strong free cash flow growth, suggests a high potential for future dividend growth as the company continues to perform well financially.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

THREE Undervalued Dividend Stocks WE'RE BUYING! | Adding Passive Income to Reach Financial Freedom!

MINA UTDELNINGSAKTIER 2024 - Passiv inkomst från aktier?

ヤバい高配当を発表した株w

SAPR4: Saiba porque a Sanepar está Caindo e a Projeção de Dividendos para 2025

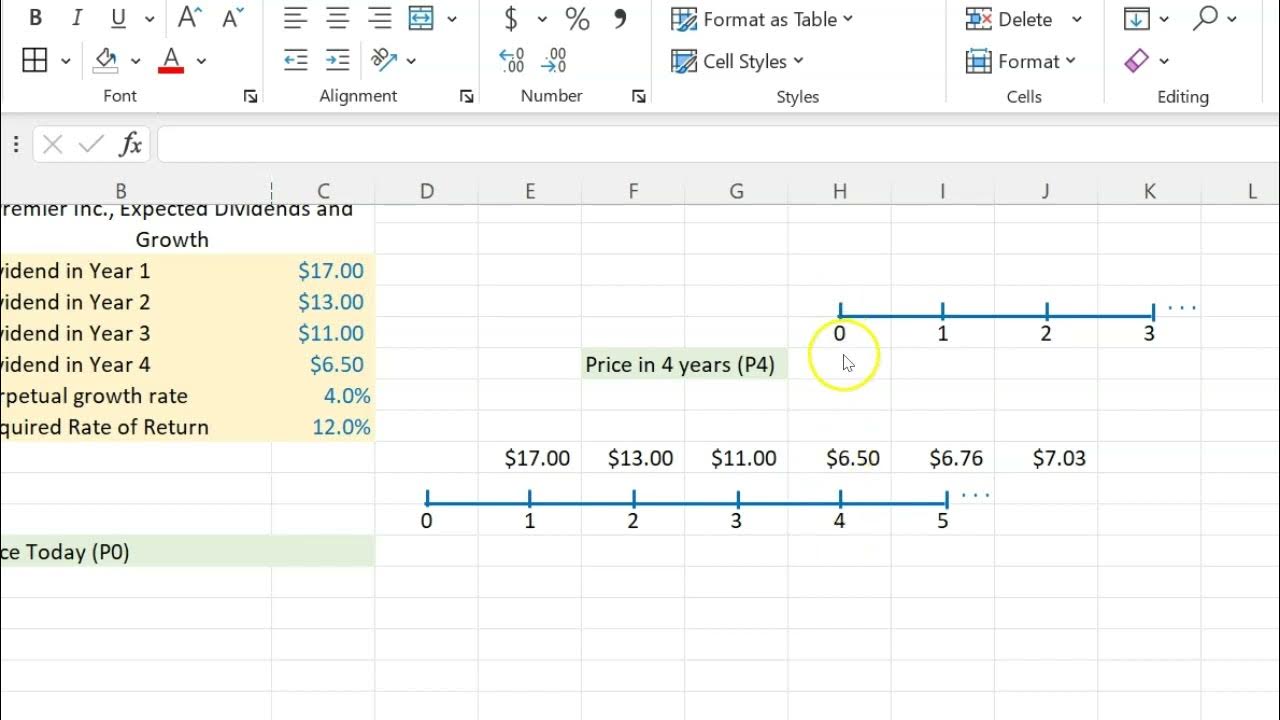

Stock Valuation With Non-Constant Dividends (Using Excel)

Warren Buffett: The FASTEST Way To Living Off Dividends! ($4400/month)

5.0 / 5 (0 votes)