Mastering Order Flow To Make Money Trading (2023)

Summary

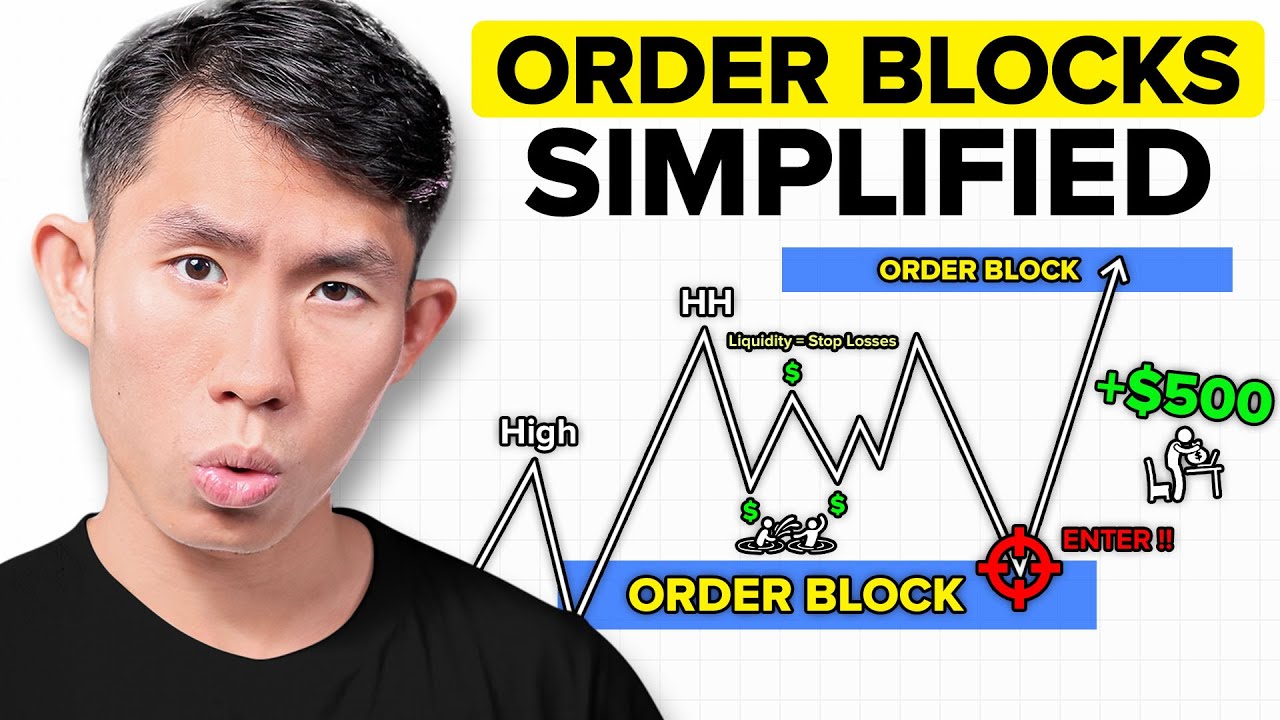

TLDRThis video script delves into the intricacies of order flow trading, explaining its foundations in auction market theory. It addresses how professional traders leverage order flow to time market entries and exits more effectively than retail traders. The script aims to demystify market movements by illustrating the balance and imbalance phases of asset pricing, using relatable examples like a bakery and Apple's iPhone pricing strategy. It emphasizes the importance of understanding market structure and the role of limit and market orders in creating price movements, ultimately guiding viewers on integrating order flow analysis into their trading strategies for improved decision-making.

Takeaways

- 😀 Order Flow Trading is based on Auction Market Theory, which posits that financial markets operate similarly to other businesses, with buyers and sellers trying to find the fair value of an asset.

- 🎯 The primary goal of traders in the market is to identify and capitalize on imbalances, which occur when there is a shift from balance to imbalance due to new information or catalysts.

- 📈 Prices move based on the interaction between limit orders and market orders, which reflect the aggressiveness or passiveness of market participants.

- 📊 A footprint chart is a tool used to track the aggressive market orders and their impact on price, providing insights into where large volumes of trades have occurred.

- 📉 Imbalances are created by the market's reaction to new information, which can cause prices to move away from previously established fair values until a new equilibrium is found.

- 🔍 Order flow analysis provides a deeper understanding of market structure, revealing the levels at which smart money is positioned and the areas of significant trading activity.

- 📝 The video emphasizes the importance of not just trading at support or resistance levels, but understanding the 'why' behind price movements and the underlying market dynamics.

- 📚 Traders are encouraged to start with larger time frames to understand market structure and then narrow down to smaller time frames for more precise trading decisions.

- 🛠️ Order flow can be integrated into a trading strategy to enhance decision-making by providing insights into market imbalances and identifying key support and resistance levels.

- 📈📉 The concept of a 'failed auction' is introduced, where the market tests a previous fair value and finds it too expensive, leading to a continued price movement in the direction of the imbalance.

- 🔑 The video concludes by highlighting the three main points discussed: the basis of order flow in auction market theory, understanding price movement and imbalances, and integrating order flow into a trading system.

Q & A

What is the main concept behind order flow trading?

-Order flow trading is based on the auction market theory, which posits that financial markets operate similarly to any other business, with buyers and sellers trying to find the fair value of an asset. Traders look for imbalances in the market to capitalize on price movements as the market discovers the next fair value.

Why do traders time their exits and entries better using order flow?

-Traders can time their exits and entries better using order flow because it provides insights into where the big money is positioned, where most transactions have occurred, and what the reference points in terms of volume and price are. This information is not typically available from standard price charts.

What is the auction market theory and how does it relate to order flow?

-Auction market theory suggests that financial markets are fast-moving auctions where the primary goal of buyers and sellers is to find the fair value of an asset. This theory is the foundation of order flow, as it explains how prices move based on the balance and imbalance of supply and demand.

How does the concept of fair value influence price movements in the market?

-Fair value is the perceived worth of an asset by market participants. Price movements are influenced by changes in this perception as new information or catalysts affect the market, causing prices to adjust until a new fair value is established.

What is the difference between a balance and an imbalance phase in the market?

-A balance phase is when the market is in equilibrium, with no significant price movement as buyers and sellers agree on the fair value. An imbalance phase occurs when a catalyst disrupts this balance, causing aggressive buying or selling that moves the price until a new fair value is found.

Why is it important to understand the interaction between limit orders and market orders in order flow trading?

-The interaction between limit orders and market orders is crucial because it reveals the aggressiveness and passiveness of market participants. Limit orders show patience, waiting for a price to be reached, while market orders indicate immediate action, often moving the market significantly.

How can a footprint chart help in identifying market imbalances?

-A footprint chart provides a detailed view of transactions within a price range, showing where most of the volume has been traded and identifying areas of significant buying or selling pressure. This helps traders spot imbalances and potential turning points in the market.

What is a 'failed auction' in the context of order flow trading?

-A failed auction occurs when the market tests a previous fair value or support level but is unable to sustain the price there, indicating that the price is still considered too expensive and leading to further selling pressure.

How can understanding order flow help in integrating it into a trading strategy?

-Understanding order flow helps traders identify key support and resistance levels, the intensity of trading activity, and the behavior of smart money. This information can be used to make more informed trading decisions and to develop strategies that capitalize on market imbalances.

What are some key takeaways from the video on order flow trading?

-Key takeaways include the importance of understanding auction market theory, recognizing balance and imbalance phases, identifying fair value zones, and using tools like footprint charts to spot market imbalances and make better trading decisions.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

5.0 / 5 (0 votes)