Case Study: Is India in Deep Trouble? | If Income tax reduces, how it saves our BHARAT?

Summary

TLDRThe speaker, Siddhant Agnihotri from Study Gloss P, addresses the Indian middle class, discussing the impact of the tax system on sleepless nights and the need for reform. He compares global tax structures, criticizes the Indian system for its lack of benefits despite high tax contributions, and suggests progressive tax could stimulate the economy. The lecture also touches on the importance of investing in education and technology to avoid a potential brain drain, urging the audience to hold their leaders accountable for the country's development.

Takeaways

- 📚 The speaker, Siddhant Agnihotri, introduces himself and welcomes the audience to a discussion on the tax system and its impact on the middle class in India.

- 💤 The script mentions that sleepless nights are not just due to love but also due to the stress caused by the taxation system in India.

- 🌍 It discusses the tax structures around the world, comparing progressive tax systems like in Russia and China to the flat tax system in the United States.

- 🇮🇳 The speaker criticizes the Indian taxation system, suggesting it is not as respectful of taxpayers as other countries and implies a need for reform.

- 📉 The script highlights the 'brain drain' issue in India, where the talented and wealthy are leaving for other countries due to unsatisfactory conditions, including the tax system.

- 📈 The speaker emphasizes the importance of investing in science and technology for the growth of the country, and expresses concern over the current state of investment in these areas.

- 🤔 There is a call for introspection and change from the political class, with the speaker urging leaders to implement changes they advocate for others.

- 📊 The script provides statistics and data about the agricultural sector in India, pointing out the disparity between small and large farmers and the tax benefits they receive.

- 🏫 Criticism is directed towards the education system, particularly private institutions, for exploiting students and parents through high fees without adequate returns.

- 💼 The middle class is portrayed as bearing the brunt of the tax burden, while the wealthy and politically connected seem to evade their responsibilities.

- 🚀 The speaker concludes with a call to action for the audience to take responsibility for the country's future, implying that change must come from within.

Q & A

What is the main theme of the video script?

-The main theme of the video script is a critique of the tax system in India, the middle class's burden, and the need for tax reforms.

What does the speaker suggest about the tax structure in India?

-The speaker suggests that the tax structure in India is regressive, with the middle class bearing a disproportionate burden, and that it lacks the benefits and progressive nature seen in other countries.

What are the speaker's views on the benefits provided in return for taxes paid in India?

-The speaker believes that the benefits provided in return for taxes paid in India are insufficient, with the government failing to offer adequate public services and infrastructure.

What comparison does the speaker make between the tax systems of India and other countries?

-The speaker compares the tax systems by pointing out that while India has a high tax burden on the middle class, other countries offer more benefits and have a more progressive tax structure.

What is the speaker's opinion on the tax benefits for the elderly in the United States?

-The speaker mentions that in the United States, the elderly receive tax benefits such as free education up to the 12th grade and other social security benefits.

What does the speaker suggest about the tax evasion and black money in India?

-The speaker implies that high taxes and a complex tax system in India contribute to tax evasion and the generation of black money.

What is the speaker's view on the potential impact of zero income tax on India's economy?

-The speaker speculates that zero income tax could lead to increased investment, job creation, and economic growth, as well as a reduction in black money.

What is the speaker's stance on the tax rate for the agricultural sector in India?

-The speaker argues that the agricultural sector, particularly small and marginal farmers, should not be taxed and should instead receive government support.

What does the speaker suggest about the tax rates for the wealthy in India?

-The speaker suggests that the wealthy in India should be taxed more, as they currently enjoy numerous exemptions and do not contribute proportionally to the revenue.

What is the speaker's opinion on the role of the middle class in India's tax system?

-The speaker believes that the middle class in India is overtaxed and is not receiving adequate benefits or services in return for their tax contributions.

What suggestions does the speaker make for tax reforms in India?

-The speaker suggests simplifying the tax system, reducing or eliminating income tax for certain brackets, and focusing on increasing tax revenue from other sources such as corporate taxes and reducing black money.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Real Estate Options For Middle Class Living In Metropolitan Cities

बजट 2024: फ़्लैट, सोना और शेयर पर बढ़ा टैक्स

Tax Terrorism | How Middle Class is Getting Chocked between Rich & Poor?

Why aren't we all getting rich from compound interest?

Parliament Budget Session: बजट को लेकर Rajya Sabha में AAP सांसद Raghav Chadha का जवाब | Budget 2025

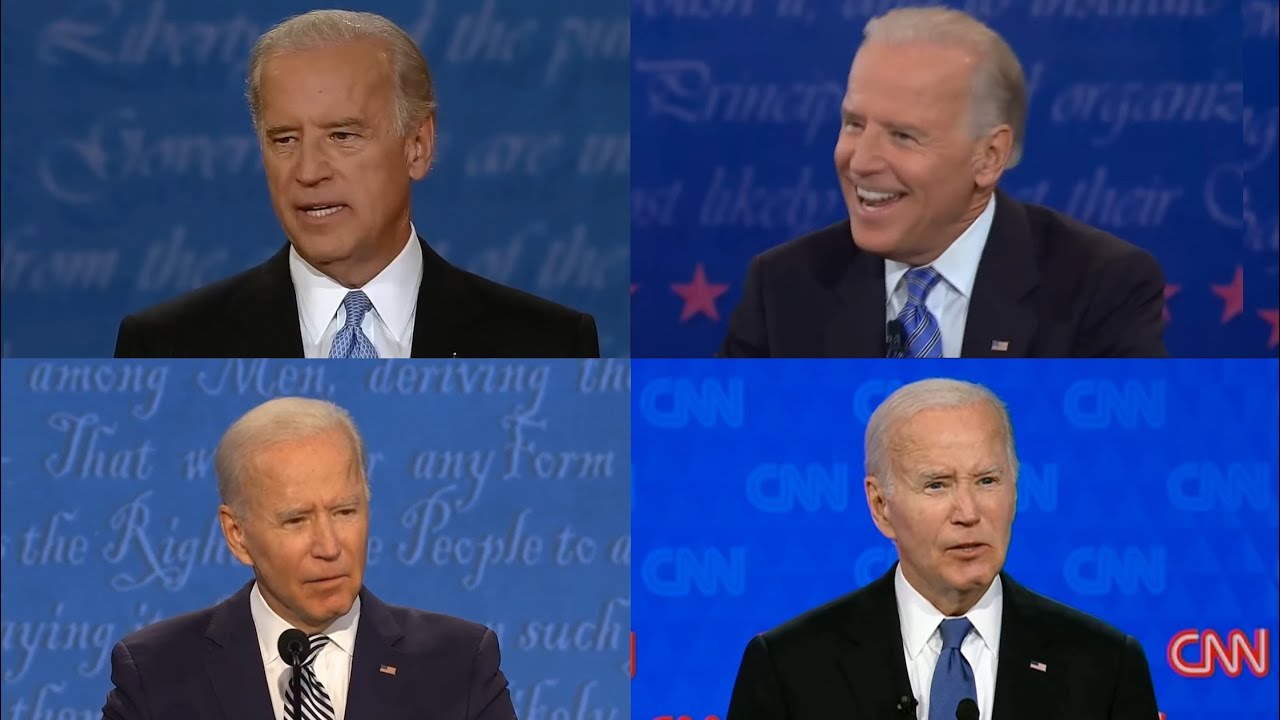

Joe Biden debating tax policy 2008–2024

5.0 / 5 (0 votes)