Master MARKET STRUCTURE Strategy Now to MAKE MILLIONS

Summary

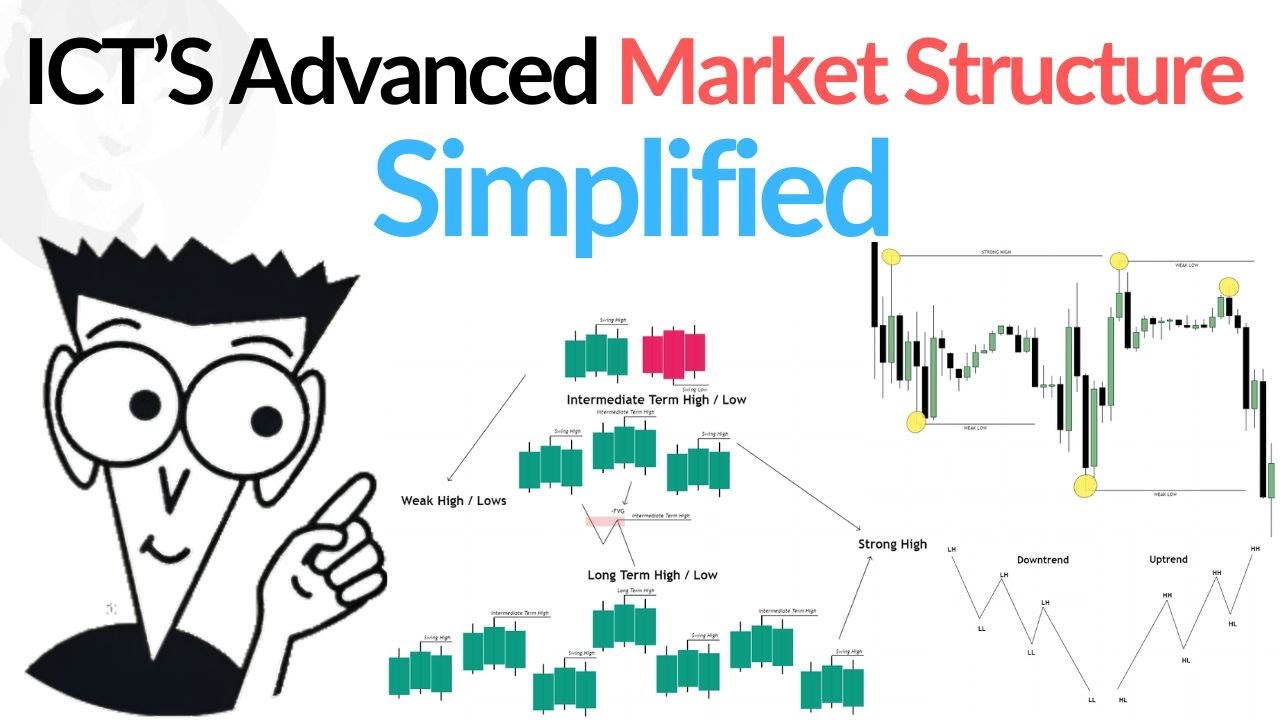

TLDRThe video script simplifies market structure for traders, explaining uptrends and downtrends with higher highs/lows and lower highs/lows. It emphasizes the importance of recognizing trend reversals and not assuming a change in market direction until confirmed by a new trend formation. The speaker shares personal trading goals and encourages setting ambitious targets, advocating for a mindset focused on trading psychology and risk management over complex strategies for sustainable success.

Takeaways

- 📈 Understanding Market Structure: The script simplifies the concept of market structure, emphasizing that prices move in waves, creating higher highs and higher lows in an uptrend, and lower highs and lower lows in a downtrend.

- 🔄 Recognizing Trend Reversal: It explains how to identify when a trend might be ending by looking for a break in the market structure, such as a price breaking through the previous higher low in an uptrend or lower high in a downtrend.

- 🕊️ Avoiding 'Fake Outs': The video warns about the possibility of a false trend reversal and advises waiting for confirmation, such as a new lower high in a downtrend or higher high in an uptrend, before making a trade.

- 📊 Importance of Trend Lines: The use of trend lines is highlighted as a tool to visually connect higher lows in an uptrend or lower highs in a downtrend, providing a clear indication of the market direction.

- 📉 Entry and Exit Strategy: The script details a strategy for entering and exiting trades based on market structure, including waiting for a break of the trend line and subsequent confirmation of a new trend before entering.

- 🎯 Setting Trading Goals: The importance of having clear trading goals is emphasized, as they provide direction and motivation, helping traders to persevere through tough times.

- 🚀 Aiming for Big Goals: The script encourages setting ambitious goals, referencing the '10x Rule' by Grant Cardone, which suggests that aiming high can lead to greater achievements.

- 💡 Trading Psychology: It stresses the significance of trading psychology and risk management over specific strategies, asserting that these are the foundations for successful trading.

- 🌐 Impact Through Sharing: The speaker expresses a personal goal of reaching a large audience to share the message of trading psychology and risk management, aiming to make a significant impact on the trading community.

- 🔄 Persistence Over Time: The video script shares a personal story of persistence in trading despite initial failures, encouraging viewers to keep going even when facing setbacks.

- 👫 Community Support: The importance of community and support among traders is highlighted, with an invitation for viewers to share their trading goals and support each other in the comments section.

Q & A

What is the basic concept of market structure according to the video?

-The basic concept of market structure in the video is that prices do not move in a straight line, but rather in waves. In an uptrend, prices make higher highs and higher lows, while in a downtrend, they make lower highs and lower lows.

How does the video simplify the explanation of market structure for easier understanding?

-The video simplifies the explanation of market structure by using a visual analogy of waves and by drawing a chart to illustrate the concept of higher highs and higher lows in an uptrend, and lower highs and lower lows in a downtrend.

What is a 'break off structure' in the context of market structure?

-A 'break off structure' refers to a point in the market where the price breaks through the previous trend pattern, indicating a potential reversal. It helps determine when a trend might be ending.

How can a trader identify a potential trend reversal in an uptrend?

-A trader can identify a potential trend reversal in an uptrend by looking for a break below the last higher low. However, confirmation is needed, such as the formation of a lower high and lower low, to ensure the trend has indeed reversed.

What is the importance of not assuming a trend reversal immediately after a price breaks a lower high?

-It is important not to assume a trend reversal immediately after a price breaks a lower high because the market can often 'fake out' and continue in the original direction. Waiting for a clear downtrend structure, such as a lower high and lower low, provides more reliable confirmation.

What is the significance of drawing a trend line in identifying market structure?

-Drawing a trend line helps in visually connecting the higher lows in an uptrend or the lower highs in a downtrend. It provides a clear visual aid to identify when the price breaks the trend, which is a key signal in market structure analysis.

How does the video use the AUD/USD chart as an example to explain market structure?

-The video uses the AUD/USD chart as an example to demonstrate how market structure can be identified in real trading scenarios. It shows how prices respect market structure, forming clear uptrends and downtrends, and how traders can use this understanding to make informed decisions.

What is the role of 'confluence' in confirming a trade entry according to the video?

-Confluence refers to multiple indicators or signals aligning to support a trade decision. In the video, it is used to confirm a trade entry by looking for multiple signs such as a price retesting a previous higher low, forming a lower high, and other indicators like moving average crossovers.

Why is it important to have trading goals and what role do they play in a trader's journey?

-Having trading goals is important as they provide a clear direction and motivation for traders. They help traders stay focused and motivated, especially during challenging times, and can be a source of inspiration and determination to continue improving and achieving success in trading.

What advice does the video give about setting trading goals?

-The video advises traders to set big goals, using the '10x rule' as a guideline. It emphasizes the importance of aiming high and not limiting oneself to small or easily achievable goals. This approach is meant to inspire greater motivation and commitment to achieving success in trading.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

ICT Advanced Market Structure | The ONLY Video You Will ever Need

Market Structure Explained – Stop Trading Blind

Master SMC/ ICT Market Structure The Correct Way (very easy)

Trading Transformation Day 6: Highs, Lows, and Trends

1. Market Structure | Full Forex course you will ever need [Free]

Simplifying Advanced Market Structure in 20 Minutes | Forex Trading Tutorial

5.0 / 5 (0 votes)