Money & Risk Management & Position Sizing Strategies To Protect Your Trading Account

Summary

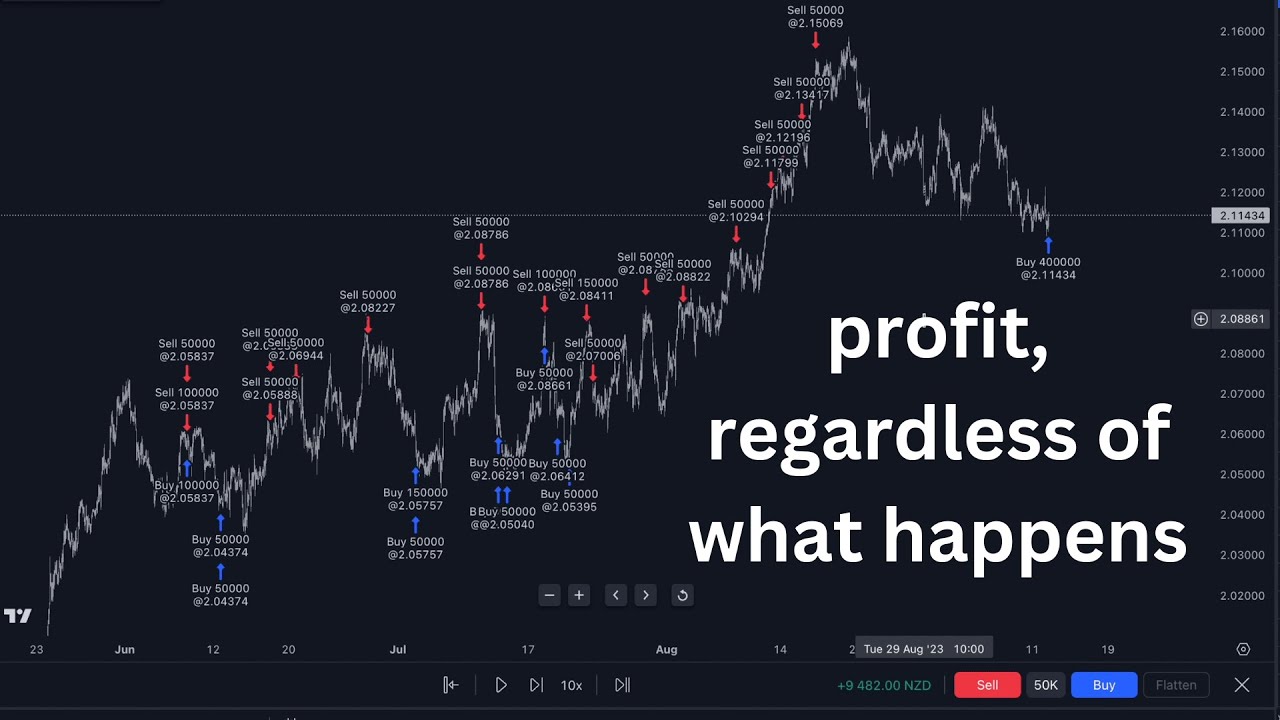

TLDRThis video script emphasizes the importance of risk management and position sizing in trading. It highlights that many traders, both new and experienced, often overlook these crucial aspects, leading to significant account losses. The script introduces various position sizing strategies, including fixed percentage, fixed-dollar amount, and volatility-based approaches, to help traders manage risk effectively. It also touches on the concept of averaging down in long-term trading and the importance of having a consistent, well-thought-out trading plan to balance risk and reward.

Takeaways

- 📈 Traders should spend time on both technical/fundamental analysis and risk management, particularly focusing on position sizing.

- 💡 Position sizing is crucial for determining the number of shares to trade with, to avoid risking too much capital and blowing up the account.

- 🚫 Without proper position sizing, traders are vulnerable to market movements and may take on trades that are too large for their account size.

- 🔑 Position size is more important than entry and exit points in trading, as it directly impacts risk management.

- 💰 Position sizing can be determined by a fixed percentage of the portfolio, such as 1% or 5%, to ensure not risking too much on a single trade.

- 🤔 Fixed-dollar amount per trade is another approach, limiting the dollar amount at risk, which can be suitable for small account sizes but may limit stock selection.

- 📊 Volatility-based position sizing adjusts the position size based on the security's volatility, allowing for more control and flexibility in the portfolio.

- 📉 Averaging down is a strategy for long-term traders to add to a position when the price drops, using position-sizing approaches to manage risk.

- 🛡 Risk parameters should include being able to accept losses on any trade and surviving ten consecutive losses without exceeding a 25% portfolio drawdown.

- 📌 Stop loss levels should be determined and placed based on analysis, not adjusted to fit a desired position size.

- 🔄 Consistent position sizing is vital, and traders should adapt their approach to match their trading style and risk tolerance.

Q & A

What are the two main types of analysis traders often focus on?

-Traders often focus on technical analysis and fundamental analysis, or a combination of both.

Why is risk management and position sizing important for traders?

-Risk management and position sizing are crucial because they help prevent traders from risking too much on a single trade, which could lead to blowing up their accounts.

What is meant by 'position size' in trading?

-Position size refers to the number of shares or contracts a trader takes on a trade, which is a key element in managing the risk of the trade.

What are the potential consequences of not knowing how to size positions properly?

-Without proper position sizing, traders may take on trades that are too large for their account, making them highly vulnerable to market movements and increasing the risk of significant losses.

Why is position size considered more important than entry and exit points in trading?

-Position size is more important because even with the best strategy, if the trade size is too large or too small, it can lead to taking on too much or too little risk, which can be detrimental to the trader's account.

What is the fixed percentage per trade approach to position sizing?

-The fixed percentage per trade approach involves setting a predetermined percentage of the overall capital to be risked on each trade, such as 1% or 5%, to ensure consistent risk management.

How does the fixed-dollar amount per trade approach differ from the fixed percentage approach?

-The fixed-dollar amount per trade approach uses a set dollar amount for each trade, rather than a percentage of the portfolio, which can be attractive for traders with small account sizes but also limits the types of stocks they can buy based on price.

What is volatility-based position sizing and how does it work?

-Volatility-based position sizing is a dynamic approach that adjusts the amount of shares bought based on the security's volatility. It allows for finer control over the portfolio by buying less of higher volatility stocks and more of lower volatility ones, measured using standard deviation over a given period.

What is 'averaging down' and how can it be used in position sizing?

-Averaging down is the practice of adding to a position when the price of a security goes down, which is seen as more value. It can be done using fixed-dollar or percentage amounts, with caution, to avoid increasing the position to a point where it's no longer worth holding.

What are some common sense risk parameters that should be incorporated into a trade plan?

-Some common sense risk parameters include being able to accept losses on any given trade and surviving ten consecutive losses without exceeding a 25% total drawdown, which implies risking no more than 2% of the portfolio on any single trade.

Why is it important to have a consistent approach to position sizing that matches your trading style?

-A consistent approach to position sizing helps in managing risk effectively and aligns with the trader's risk tolerance and trading strategy. It ensures that the trader can stick to their plan and avoid making impulsive decisions that could jeopardize their account.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Forex Trading: Risk Management And Position Sizing (Video 6 of 13)

5 Steps to Fix Your Trading in 2024 (with Live Trading Examples)

📈 Swing Trading Strategy for Monthly Income || Stocks Trader

BEST 5 Minute Crypto Scalping Strategy (Simple)

how i make money trading, even when i’m wrong

2022 ICT Mentorship Episode 10

5.0 / 5 (0 votes)