ICT Forex & Futures Market Review October 4, 2025

Summary

TLDRIn this October 4th, 2025 Forex and futures market review, the speaker discusses key market inefficiencies and trading patterns, particularly in the US dollar, Euro, and Pound. Highlighting the lack of significant movement in Forex, the speaker emphasizes how low liquidity and high resistance make it challenging for traders. They contrast this with the more structured action in futures markets like the mini NASDAQ, demonstrating how market gaps and fair value levels can guide trading decisions. The video also stresses the importance of understanding past trading ranges and their impact on future movements, offering valuable insights for traders looking to enhance their strategies.

Takeaways

- 😀 Forex market is currently in a holding pattern, with limited movement and inefficiency in major currency pairs like USD, EUR/USD, and GBP/USD.

- 😀 Euro Dollar (EUR/USD) has been showing small ranges, making it less attractive for active trading, with only small price fluctuations (around 20 pips).

- 😀 GBP/USD (Cable) showed better structure, with clearer market moves and a range of about 45-50 pips, utilizing discount and premium wicks to define price action.

- 😀 Understanding inefficiencies in the US Dollar market is crucial, as price often gets trapped between zones marked by volume imbalances and consequent encroachment.

- 😀 The mini NASDAQ futures market provides more clear opportunities, with key price zones like regular trading hours opening range gaps, which were essential for market movement predictions.

- 😀 The concept of suspension blocks and fair value gaps plays a significant role in NASDAQ futures price prediction, where price action often reacts to these levels.

- 😀 Regular trading hours opening range gaps should be carried forward to the next day as they continue to influence price movements in both futures and CFD markets.

- 😀 For those trading CFDs or Forex pairs outside the U.S., the US 100 CFD can be tracked using the same principles applied to the mini NASDAQ futures.

- 😀 The speaker emphasizes marking specific price levels on TradingView, like the high and low of the previous day’s opening range gap, to track future price action effectively.

- 😀 Traders should focus on well-defined levels and avoid overcomplicating strategies, as markets often respect simple support/resistance levels and efficient price structures.

Q & A

What is the primary focus of this video?

-The video focuses on analyzing the Forex market, specifically looking at the US Dollar, Euro Dollar, and GBP/USD (Cable), as well as offering insights into futures trading like the mini NASDAQ futures. The speaker discusses market patterns, inefficiencies, and key levels that traders should pay attention to.

What is meant by the term 'inefficiency' in the context of the Forex market?

-In this context, 'inefficiency' refers to areas on the price chart where price movements are unbalanced or 'gaps' in price action, suggesting potential levels where the market may reverse or experience volatility.

Why does the speaker say Forex is currently in a 'holding pattern'?

-The speaker notes that the Forex market, particularly the US Dollar, is currently trapped between inefficiency levels, meaning there is a lack of clear direction or significant price movement, making it harder for traders to predict price action.

What does 'consequent encouragement' refer to in this analysis?

-'Consequent encouragement' refers to specific price levels where the market is expected to react based on previous price movements, often acting as support or resistance. It is a key concept when analyzing price inefficiencies and the market's potential reactions to them.

What is the speaker's stance on the current liquidity in the Forex market?

-The speaker expresses frustration with the current state of the Forex market, claiming that it is not highly liquid and is exhibiting high resistance. This makes it difficult for traders to navigate effectively, which is why the speaker prefers to focus on other markets like futures.

How does the speaker compare trading in the Forex market to the futures market?

-The speaker prefers the futures market over Forex because the former tends to be more liquid and less resistant. The speaker emphasizes that futures markets, like the mini NASDAQ, offer clearer trading opportunities compared to the low liquidity and high resistance seen in Forex markets.

What role do 'fair value gaps' play in the analysis of the NASDAQ futures market?

-'Fair value gaps' are key areas where the price has moved away from a particular level and then returns to fill that gap. The speaker uses these gaps to predict future price movements, with the market expected to react to these gaps and the levels around them.

What is the significance of 'quadrants' in the speaker's analysis?

-'Quadrants' are price ranges within a candlestick or wick that are analyzed for potential price action. The speaker uses quadrants to mark key levels such as support, resistance, or reversal zones. These are critical in forecasting future movements, especially when combined with other concepts like 'consequent encouragement.'

Why does the speaker stress the importance of understanding the opening range in futures trading?

-The speaker emphasizes the opening range because it serves as a benchmark for the trading day. By identifying the high and low of the opening range, traders can better predict price movements throughout the day. This method applies to both the futures market and the CFD market for US 100, a proxy for NASDAQ.

What is the speaker’s advice regarding CFD traders and the NASDAQ market?

-The speaker advises CFD traders to pay attention to the same principles that are applied in futures trading, especially when trading CFDs like US 100. They should mark the high and low of the regular trading hours and use that information to track price movements, as the CFD market mimics the futures market.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

ICT Forex - Market Maker Series Vol. 2 of 5

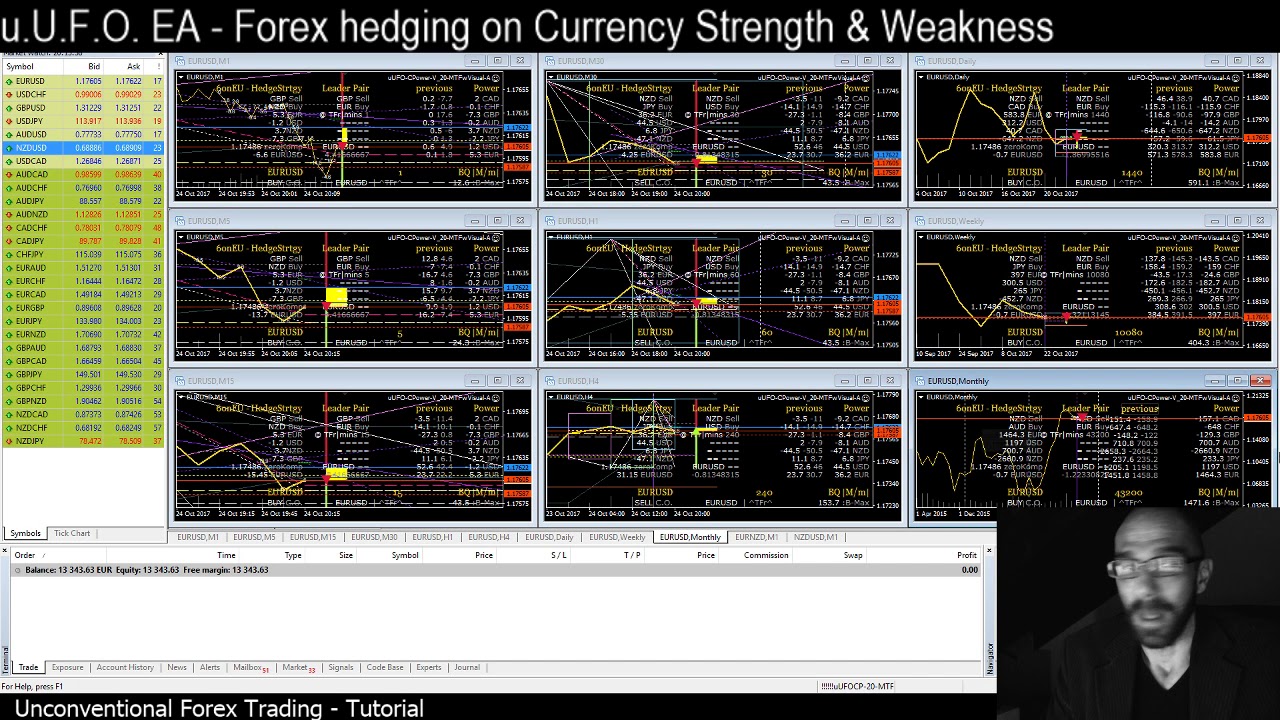

Forex math based formula application - MT4 - uUFO-EA: foreign currency hedging strategy explained.

MY BIG SHORT Will Happen NOW. Full Trade Analysis!

ICT Forex - Market Maker Series Vol. 5 of 5

What is Forex trading basic lecture no#1 and how can we generate money in Forex Bright TrustAcademy

ICT Supplemental Session 01 - Mastering High Probability Scalping

5.0 / 5 (0 votes)