How the US will Inflate its Debt Away (and you can too)

Summary

TLDRThe script discusses the U.S. government's strategy to manage its $34 trillion debt through inflation, a tactic also used by the rich. It explains how understanding this playbook can empower individuals to protect and grow their wealth. The U.S. is expected to leverage inflation, high interest rates, and quantitative easing to deleverage its debt, similar to the 1940s. The speaker suggests increasing personal income, eliminating adjustable-rate debt, utilizing fixed-rate debt to acquire assets, and diversifying wealth outside the financial system to safeguard against the coming inflationary cycle.

Takeaways

- 💼 The U.S. government has a massive debt of over $34 trillion, which is serviced by paying around $1.2 trillion annually just in interest.

- 🔄 The U.S. is facing a debt service crisis where all tax revenue may soon be consumed by interest payments, necessitating further borrowing to fund other government spending.

- 📉 Historically, during the 1940s, the U.S. deleveraged its debt through inflation and rising interest rates, a strategy that may be revisited.

- 📈 From 1980 to 2020, the U.S. increased its leverage with falling inflation and interest rates, but this trend may be reversing.

- 💹 The Federal Reserve may engage in yield curve control and quantitative easing (QE) to keep borrowing costs low and prevent government default.

- 🌐 The U.S. government's actions can influence the global economy, and understanding these can help individuals make informed financial decisions.

- 💰 Individuals can mimic government strategies by increasing their personal income to improve their debt-to-income ratio, similar to how governments manage debt-to-GDP ratios.

- 🚫 Avoid adjustable-rate debt in an inflationary environment, as it can become unmanageable as interest rates rise.

- 🏦 Use fixed-rate debt to purchase assets that generate income, which can help pay off the debt and benefit from inflationary increases in asset value.

- 🏆 Diversify wealth outside the traditional financial system to protect against potential financial repression measures that governments may implement to control inflation.

- 📚 For comprehensive strategies on wealth creation and protection, consider educational resources like the Heresy Financial University.

Q & A

What is the current debt burden of the United States government?

-The United States government has over $34 trillion worth of debt.

What does it mean to 'service debt'?

-Servicing debt refers to the cost of paying only the interest portion on the debt, which currently stands at about $1.2 trillion per year for the U.S. government.

Why is the U.S. government's debt situation problematic?

-The problem arises because the government has to borrow new debt to service the existing debt, causing the national debt number to grow, which will eventually lead to insolvency if not addressed.

How does the U.S. government's total tax revenue compare to the cost of servicing its debt?

-The U.S. total tax revenue is around $4.5 trillion, which means that soon every dollar taken in taxes will be used just to service the debt, leaving no room for other spending without further borrowing.

What was the U.S. debt to GDP ratio during the 1940s?

-During the 1940s, the U.S. debt to GDP ratio was around 120%, similar to the current situation.

How did the U.S. government handle its debt during the 1940s?

-The government handled its debt through inflation, engaging in yield curve control and spending money into the economy, particularly on war efforts, which led to high inflation and a reduction in the real value of the debt.

What is the difference between the debt cycle phases from 1940 to 1980 and from 1980 to 2020?

-From 1940 to 1980, the U.S. government deleveraged its debt through inflation, while from 1980 to 2020, it increased its leverage during a period of disinflation and falling interest rates.

What are the potential strategies the U.S. government might employ to handle its current debt situation?

-The government might keep interest rates higher to fight inflation, and potentially return to quantitative easing (QE) to ensure it doesn't default on its debt.

What is the difference between QE and QT as it relates to the Federal Reserve's balance sheet?

-QE is when the Federal Reserve prints money to buy assets like treasuries, increasing the money supply, while QT is when the Fed allows assets to bleed off its balance sheet, effectively reducing the money supply and repaying debt without re-lending it back to the government.

How can an individual protect and grow their wealth in an inflationary environment?

-Individuals can protect and grow their wealth by increasing their personal money supply through higher income, eliminating adjustable-rate debt, using fixed-rate debt to buy inflation-protected assets, and getting wealth outside the system to avoid potential financial repression.

What is the potential outcome of the U.S. government's current debt management strategy?

-The strategy may lead to a massive deleveraging and an inflationary boom, similar to what was seen in the 1940s to 1980s cycle, potentially ending with the Federal Reserve monetizing a large portion of the government's debt.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

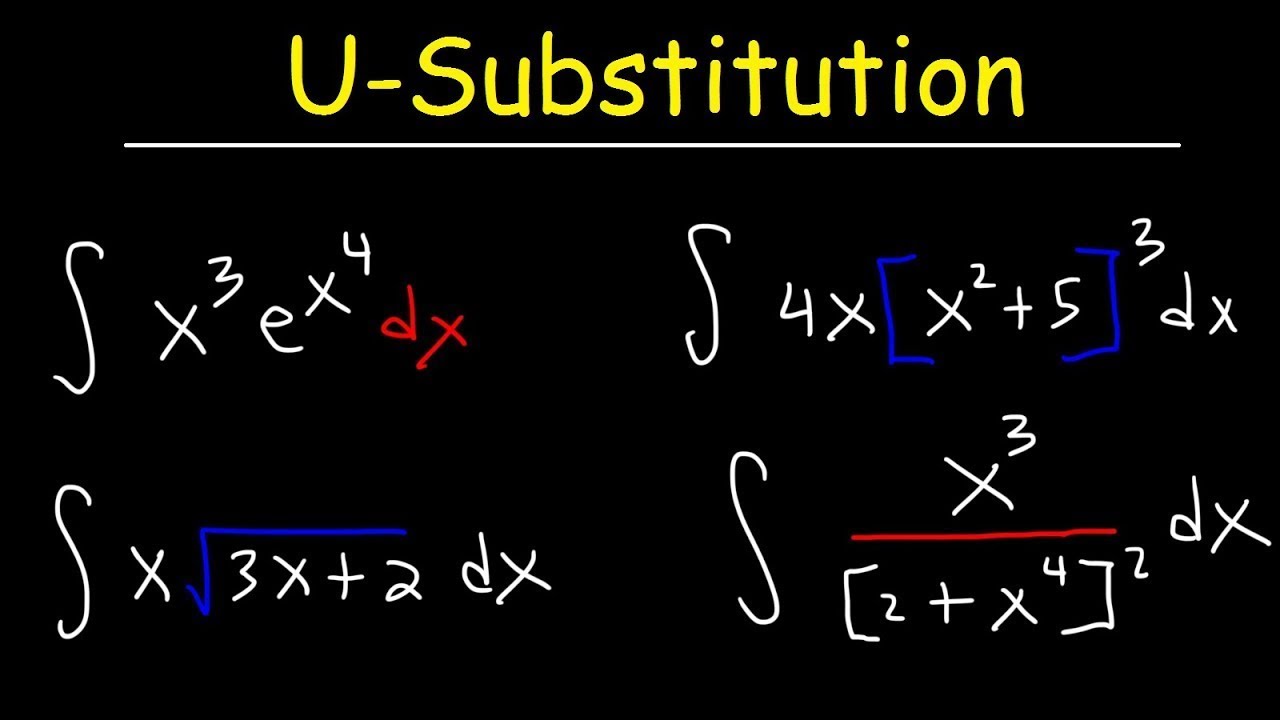

How To Integrate Using U-Substitution

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

Suma y resta de vectores

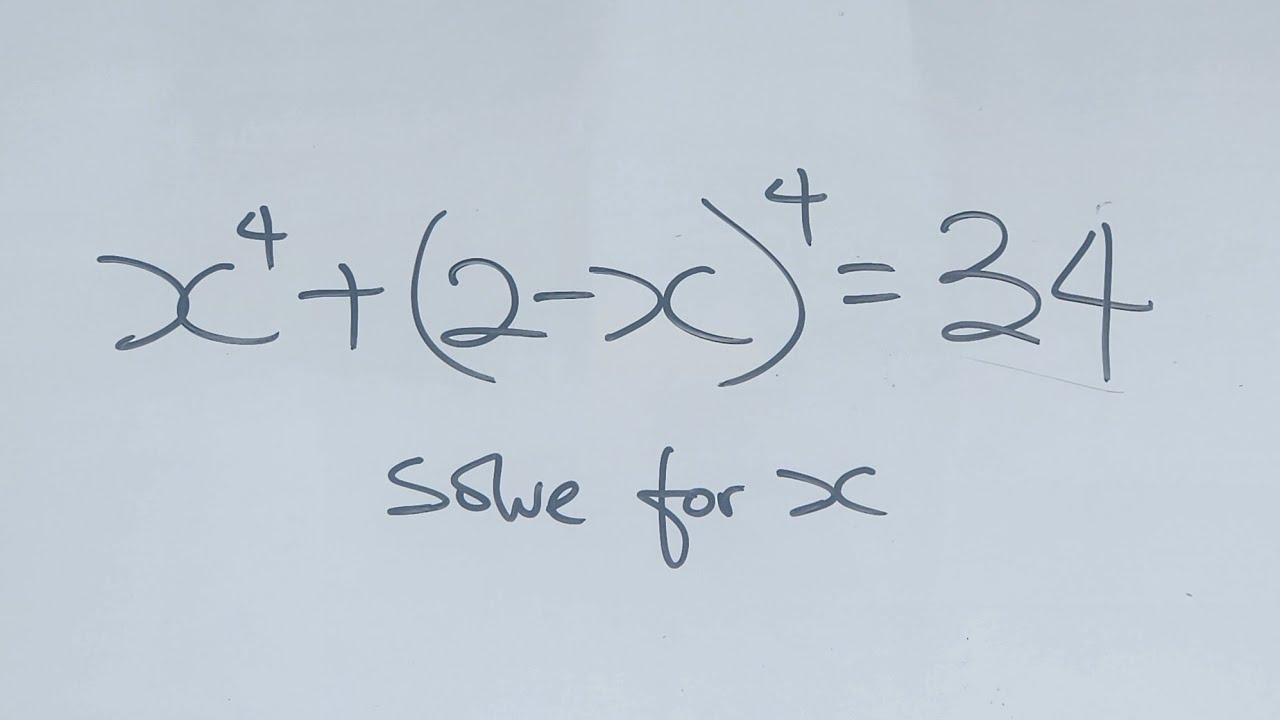

Maths Olympiad Question | A nice algebraic equation | You should know this trick!

Unit Step Signal: Basics, Function, Graph, Properties, and Examples in Signals & Systems

Embedded Linux | Introduction To U-Boot | Beginners

5.0 / 5 (0 votes)