ICT Institutional Order Flow Simplified (Full Course)

Summary

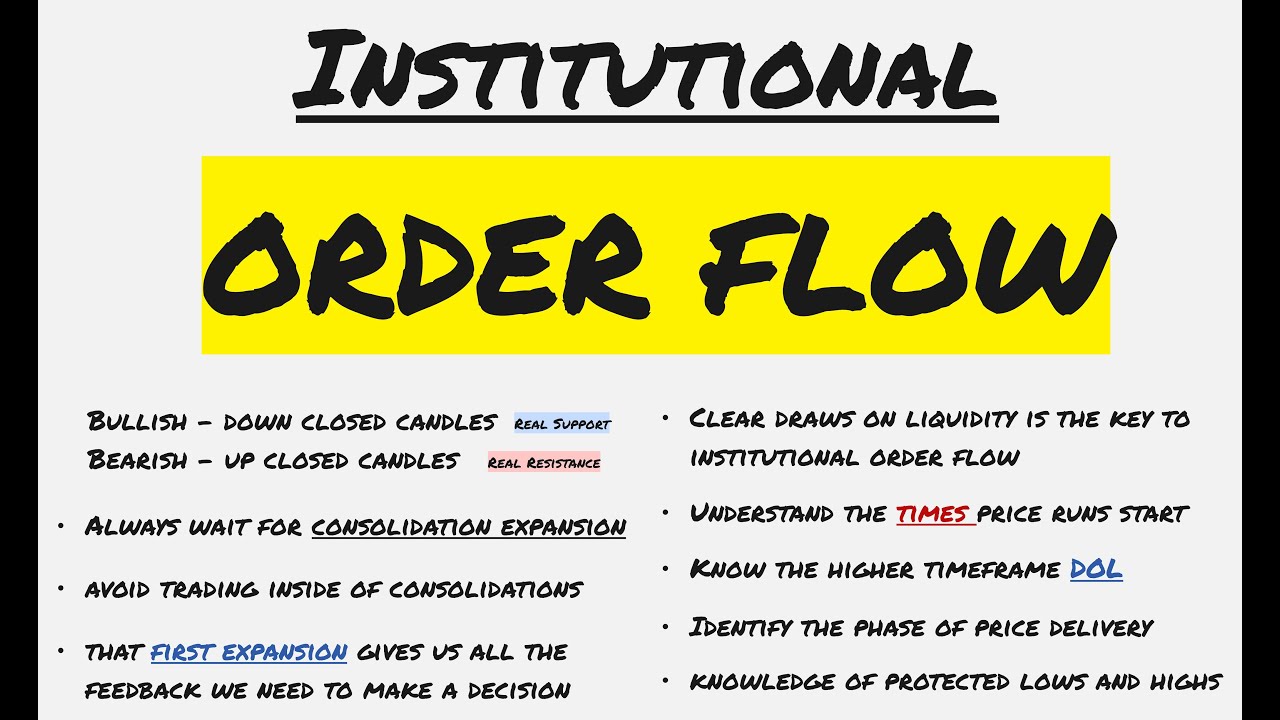

TLDRIn this video, the focus is on understanding bullish and bearish order flow, crucial for identifying market direction and improving win rates in trading strategies. The presenter outlines key concepts, such as price retracement into PD arrays, respecting bullish or bearish structures, and recognizing breaker structures and displacement as signs of trend changes. Examples from various timeframes, including the New York Kill Zone and NASDAQ, are used to illustrate these concepts in practice. Viewers are guided through the process of identifying high-probability setups and learning how to navigate liquidity sweeps and fair value gaps to enhance their market analysis.

Takeaways

- 😀 Bullish order flow is identified by price breaking highs, retracing to bullish PD arrays, and respecting them while creating liquidity sweeps of short-term lows.

- 😀 A bullish order flow also involves price violating bearish PD arrays and respecting bullish ones, which is a sign of a strong upward trend.

- 😀 Price sweeps short-term lows to engineer liquidity, and then pushes higher after respecting key levels such as fair value gaps or order blocks.

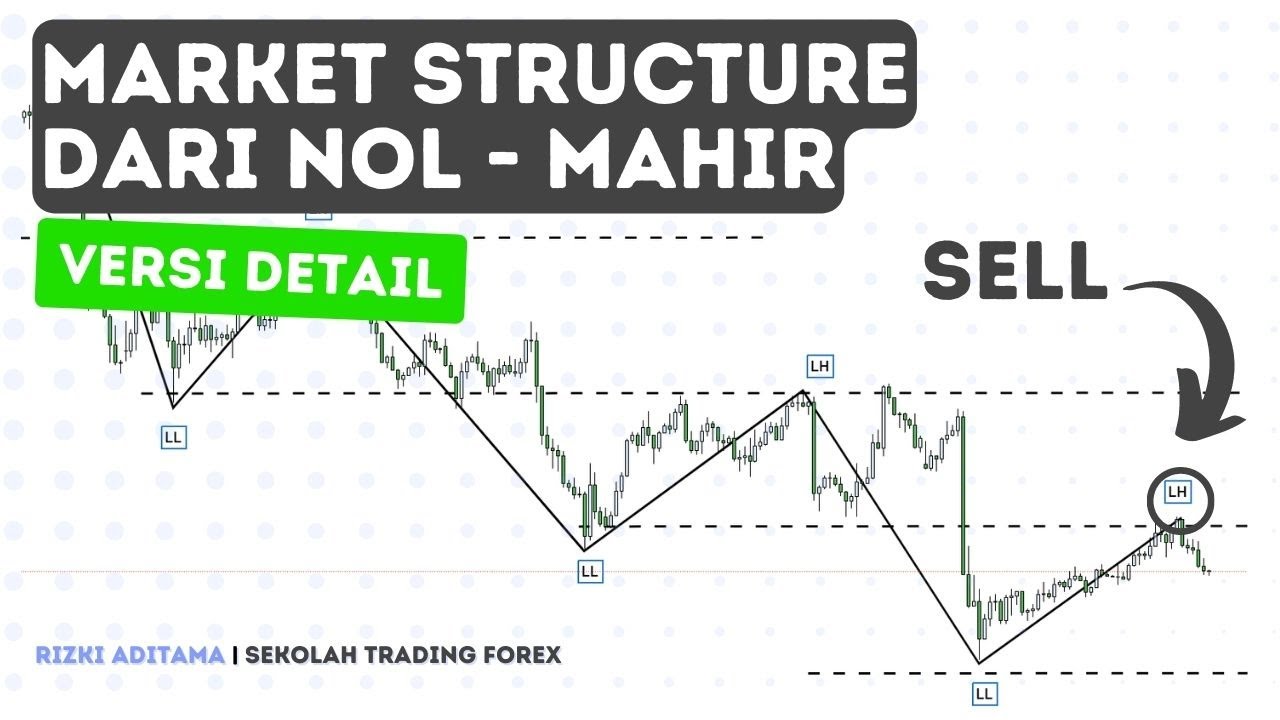

- 😀 In a bearish order flow, price retraces into bearish PD arrays and respects them while violating bullish PD arrays, creating a downward market trend.

- 😀 Liquidity sweeps in bearish order flow involve taking out short-term highs, followed by displacement downward and breaking structures.

- 😀 Break of structure and displacement are key signs to confirm a shift in order flow direction, whether bullish or bearish.

- 😀 Extreme fair value gaps and order blocks are critical in identifying valid entry points, with the most significant gaps being those at the extremes.

- 😀 Using time fractals, the principles of order flow apply across different time frames, from minutes to hours, as long as extreme fair value gaps and order blocks are considered.

- 😀 The concept of liquidity is central to both bullish and bearish order flows, with price movements engineered to take out short-term highs and lows to fuel the market.

- 😀 The key to successful order flow analysis is identifying when price respects or disrespects fair value gaps and order blocks, which signals the market's next movement.

Q & A

What is the focus of this video?

-The video focuses on understanding market direction and identifying bullish and bearish order flow. It provides a guide to recognizing order flow and applying it to trading strategies for a higher win rate.

What is a bullish order flow, and how can it be identified?

-A bullish order flow is characterized by price moving upward, typically supported by multiple breaker structures, bullish PD arrays (price delivery arrays), and displacement. Key indicators include price retracing into bullish PD arrays and respecting them, while bearish PD arrays are disrespected.

What role do breaker structures play in identifying bullish order flow?

-Breaker structures indicate a change in market direction. In a bullish order flow, a breaker structure is formed when price displaces upwards, taking out previous highs. This shows that the market is shifting from a bearish to a bullish sentiment.

How are PD arrays (Price Delivery Arrays) important in the context of order flow?

-PD arrays are critical levels in the market where price is expected to either reverse or continue its trend. In a bullish order flow, bullish PD arrays are respected, and bearish PD arrays are disrespected, signaling the market's prevailing direction.

What is the significance of fair value gaps in identifying order flow?

-Fair value gaps (FVG) are areas where price leaves an imbalance in the market, and they act as key levels to watch. In a bullish order flow, price will often retrace to fill these gaps before continuing higher. In bearish order flow, these gaps are respected and often lead to further price movement in the downward direction.

How does liquidity manipulation (sweeping) relate to order flow?

-Liquidity manipulation, or 'sweeping,' involves price moving to clear out short-term highs or lows. In a bullish order flow, short-term lows are swept to provide liquidity before price moves higher. In a bearish order flow, short-term highs are swept to fuel a downward move.

What are the key differences between bullish and bearish order flow?

-In a bullish order flow, price moves upwards, respecting bullish PD arrays, violating bearish PD arrays, and creating higher highs with displacement. In a bearish order flow, price moves downwards, respecting bearish PD arrays, violating bullish PD arrays, and creating lower lows with displacement.

How can order flow be applied in real-time trading scenarios?

-Order flow can be applied to any time frame by identifying key levels and patterns in price action. The script demonstrates how to observe these patterns on charts, such as the Euro Dollar 3-minute chart during the New York Kill Zone, and how to identify changes in order flow through breaker structures, fair value gaps, and price retracements.

What is the role of breakouts in confirming order flow?

-Breakouts confirm the market's direction after a period of consolidation. In a bullish order flow, a breakout occurs when price pushes above previous highs with displacement, signaling the start of an upward trend. In a bearish order flow, breakouts occur below previous lows, signaling a downtrend.

Why is the 50% level significant in analyzing order flow?

-The 50% level is often used as a reference for retracement and discount/premium zones. Price retracing to the 50% of a fair value gap or order block can signal a higher probability of price moving in the expected direction. This level serves as an area where price is likely to either reject or continue its trend.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

This ONE ICT Concept Will Change Your Trading - SMT Divergence

Real ICT Institutional Order Flow Explained

Why Valid Order Blocks Fail in Forex Trading, Exploring the Order Flow Trading Strategy

Trading Cepat dan Mudah dengan Market Structure (Detail)

ICT Mentorship Core Content - Month 04 - Interest Rate Effects On Currency Trades

Most Traders Don’t Understand This About FVGs

5.0 / 5 (0 votes)