When GST Credit availed in GSTR 3B is not Matching with GSTR 2A || CA (Adv) Bimal Jain

Summary

TLDRThis video explains the key aspects of Circular No. 193 (July 2023), which addresses the discrepancy in GST credit between GSTR 3B and GSTR 2A. It extends the provisions of Circular No. 183 to include the period up to 31st December 2021, providing taxpayers with a framework to reconcile credits. The video covers various issues like incorrect supplier filings, the impact of Rule 36(4), and the introduction of Section 16(2)(aa), which mandates credit matching in GSTR 2B. It also clarifies that the circular applies to ongoing audits and proceedings, offering guidance for managing discrepancies in GST filings.

Takeaways

- 😀 Circular No. 193 (17th July 2023) clarifies credit mismatches between GSTR 3B and GSTR 2A, offering guidance for taxpayers.

- 😀 Circular No. 183 (27th December 2022) was initially applicable for FY 2017-18 and 2018-19 but is now extended to 31st December 2021.

- 😀 Mismatched credit can arise when suppliers haven't filed GSTR 1, wrongly classified B2B as B2C, or made errors in place of supply.

- 😀 Rule 36(4) regulates the credit available based on GSTR 2A, allowing a percentage increase (20%, later reduced to 10% and 5%) on auto-populated credit.

- 😀 From 1st January 2022, credit eligibility shifted from GSTR 2A to GSTR 2B, and the fifth condition was introduced to match credit availed in GSTR 3B with GSTR 2B.

- 😀 Circular No. 193 explains the steps to reconcile discrepancies between the credit in GSTR 3B and GSTR 2A, including using a certificate from the supplier or a practicing CA if the discrepancy exceeds a certain amount.

- 😀 The circular emphasizes that taxes paid by the supplier are critical for determining the eligibility of the credit claimed in GSTR 3B.

- 😀 Circulars are clarificatory in nature and should be applied based on the facts and circumstances of each case, but not used for legal interpretation.

- 😀 Credit availed in GSTR 3B is not directly dependent on GSTR 2A; it is governed by Section 16(2) of the GST Act, confirmed by the Supreme Court's ruling in the Bhatia Tel case.

- 😀 The circular applies to ongoing proceedings (e.g., audits, scrutiny) for the period from 1st April 2019 to 31st December 2021 but not to completed cases.

- 😀 Taxpayers involved in ongoing adjudication or appeals can use Circular No. 193 to resolve discrepancies in credit claims and improve compliance.

Q & A

What is the main issue addressed in Circular No. 193 dated 17th July 2023?

-Circular No. 193 addresses the issue of discrepancies between the credit availed in GSTR-3B and the credit auto-populated in GSTR-2A. It provides clarifications on how to reconcile these differences, specifically in the context of GST input tax credit (ITC).

What are some common reasons for discrepancies between credit in GSTR-3B and GSTR-2A?

-Discrepancies can arise due to various factors such as the supplier not filing GSTR-1, errors in invoice classifications (B2B vs. B2C), incorrect GSTIN details, or misclassification of the place of supply (e.g., interstate vs. intrastate transactions).

What is the significance of Circular No. 183, issued in December 2022, in relation to Circular No. 193?

-Circular No. 183, issued in December 2022, provided guidelines for reconciling credit discrepancies for the financial years 2017-18 and 2018-19. Circular No. 193 extends the applicability of Circular No. 183 to cover discrepancies up until 31st December 2021.

How does Rule 36(4) of the CGST Act impact credit claims?

-Rule 36(4) of the CGST Act limits the credit a buyer can avail in GSTR-3B to a certain percentage of the eligible credit auto-populated in GSTR-2A. Initially, this limit was 20%, which was reduced to 10% in January 2020, and further reduced to 5% in January 2021.

How does Circular No. 193 clarify the process of credit reconciliation?

-Circular No. 193 clarifies that for periods up to 31st December 2021, taxpayers can reconcile discrepancies between the credit available in GSTR-3B and the auto-populated credit in GSTR-2A based on specific guidelines, such as obtaining certificates from suppliers or chartered accountants when necessary.

What is the relevance of GSTR-2B starting from 1st January 2022?

-Starting from 1st January 2022, the credit available in GSTR-3B must be matched with the credit auto-populated in GSTR-2B, which serves as the reference point for ITC claims. This replaces the previous reliance on GSTR-2A for credit reconciliation.

What are the new conditions introduced from 1st January 2022 under Section 16(2)(aa) of the CGST Act?

-From 1st January 2022, a new condition was introduced under Section 16(2)(aa), requiring that the credit availed in GSTR-3B must match with the credit auto-populated in GSTR-2B for the taxpayer to be eligible to claim ITC.

How should taxpayers handle discrepancies between GSTR-3B and GSTR-2A for periods prior to 31st December 2021?

-For periods prior to 31st December 2021, taxpayers can follow the guidelines provided in Circular No. 193 and Circular No. 183 to reconcile discrepancies. This may include obtaining certificates from suppliers or chartered accountants based on the size of the credit difference.

What is the scope of Circular No. 193 in terms of applicability to ongoing proceedings?

-Circular No. 193 applies only to ongoing scrutiny, audits, or investigations for the period from 1st April 2019 to 31st December 2021. It is not applicable to completed proceedings but can be applied if the case is still pending adjudication or appeal.

What is the legal standing of GSTR-2A and GSTR-2B in determining ITC eligibility?

-Although GSTR-2A is a facilitation tool for reconciling ITC, the eligibility for claiming ITC is not legally dependent on GSTR-2A. However, from 1st January 2022, GSTR-2B has become the relevant document for determining the eligible credit, provided all other conditions under Section 16 of the CGST Act are met.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Movimientos circulares, MCU y MCUA - rápido y fácil

deadlock prevention in os | deadlock prevention in operating system

Beautiful Trigonometry - Numberphile

Gerak Melingkar • Part 1: Sudut Radian & Gerak Melingkar Beraturan (GMB)

Me Salva! CIN11 - MCU

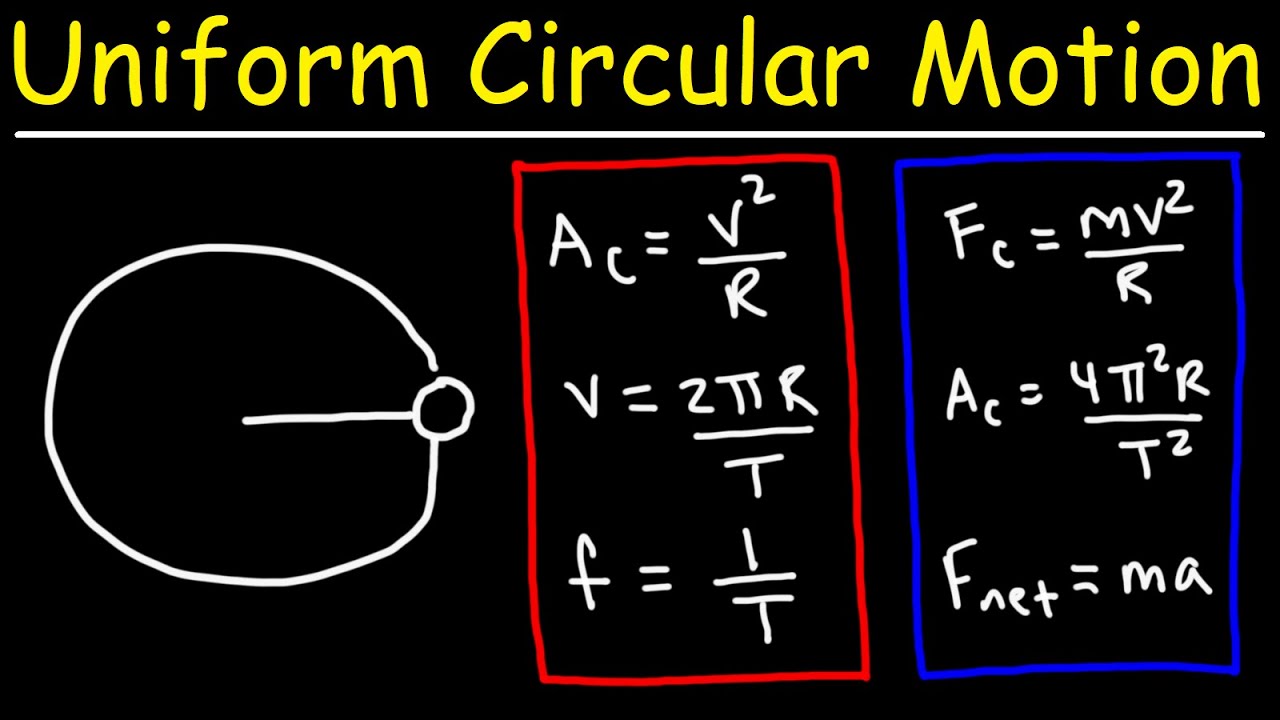

Uniform Circular Motion Formulas and Equations - College Physics

5.0 / 5 (0 votes)