1d KURVA Money Supply dan Money Demand

Summary

TLDRIn this video, Prof. Andritra explains the fundamental concepts of money supply and money demand, crucial to understanding economic stability. The script discusses how money behaves like a commodity, with supply controlled by central banks and demand influenced by factors like interest rates and income. Key points include the vertical nature of the money supply curve, the inverse relationship between interest rates and money demand, and how shifts in these curves affect the economy. By exploring real-world examples, the video highlights the importance of balancing money supply and demand to maintain financial equilibrium and economic growth.

Takeaways

- 😀 Money supply and money demand are key concepts in understanding monetary economics.

- 😀 Money supply refers to the total amount of money circulating in the economy at a given time, including both currency and deposits.

- 😀 Money demand reflects the desire of individuals and firms to hold liquid cash, influenced by interest rates and income levels.

- 😀 The relationship between money supply and demand is crucial for determining economic stability and growth.

- 😀 A mismatch between money supply and demand can lead to financial instability and economic disruptions.

- 😀 Central banks control the money supply through monetary policies, influencing the economy's liquidity.

- 😀 The money supply curve is generally vertical, as it is determined by central bank policy and not directly influenced by interest rates.

- 😀 The money demand curve is typically downward sloping, indicating that as interest rates rise, people demand less money for transactions.

- 😀 Three key motives drive money demand: transactions, precautionary purposes, and speculation, each influenced by income and interest rates.

- 😀 As income rises, money demand increases because people have more to spend, which shifts the money demand curve to the right.

- 😀 Changes in interest rates influence money demand, with higher rates leading to less demand for liquidity as people prefer to invest in higher-yielding assets.

Q & A

What is the relationship between money supply and money demand in an economy?

-Money supply refers to the total amount of money available in the economy, which can be influenced by central banks. Money demand refers to the public’s desire to hold money in liquid form, which is affected by factors like interest rates and income levels. The interaction between the two determines the equilibrium level of money circulating in the economy.

How does the movement of interest rates affect money demand?

-As interest rates rise, the opportunity cost of holding money increases because people can earn higher returns from saving or investing. Consequently, money demand decreases. Conversely, lower interest rates encourage people to hold more money since the opportunity cost is lower.

What is the role of central banks in controlling money supply?

-Central banks regulate money supply through monetary policy, often by adjusting the amount of money circulating in the economy. This can be done through mechanisms like open market operations, setting interest rates, or adjusting reserve requirements for commercial banks.

What are the three main motives for money demand mentioned in the script?

-The three main motives for money demand are: (1) Transaction motive: holding money for day-to-day purchases, (2) Precautionary motive: holding money for unexpected needs, and (3) Speculative motive: holding money in anticipation of future investment opportunities, typically when interest rates are low.

How does income affect money demand according to the script?

-As income increases, the demand for money also increases, particularly for transaction and precautionary purposes. With higher income, individuals and businesses tend to require more money for everyday activities and unexpected expenses.

What does the money supply curve typically look like, and why?

-The money supply curve is typically vertical, indicating that the supply of money is not directly influenced by interest rates in the short term. Instead, it is determined by central bank policy, which sets a fixed amount of money in circulation.

What happens when the central bank increases the money supply?

-When the central bank increases the money supply, the money supply curve shifts to the right. This can be done through actions like buying assets or injecting liquidity into the banking system, which increases the overall money available in the economy.

What is the opportunity cost of holding money, and how does it relate to interest rates?

-The opportunity cost of holding money refers to the potential returns an individual forgoes by not investing or saving the money elsewhere. As interest rates rise, the opportunity cost of holding money increases, making people less inclined to hold money in liquid form.

How does the money demand curve behave with changing interest rates?

-The money demand curve generally slopes downward, meaning that as interest rates rise, the quantity of money demanded decreases. This reflects the inverse relationship between interest rates and money demand, where higher rates make holding money less attractive.

Can the central bank influence both the supply and demand for money in the economy?

-While the central bank can directly influence the supply of money through policy tools like setting interest rates and controlling liquidity, it has less direct control over money demand. However, the central bank can indirectly affect money demand by adjusting interest rates, which impacts how much people are willing to hold money.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

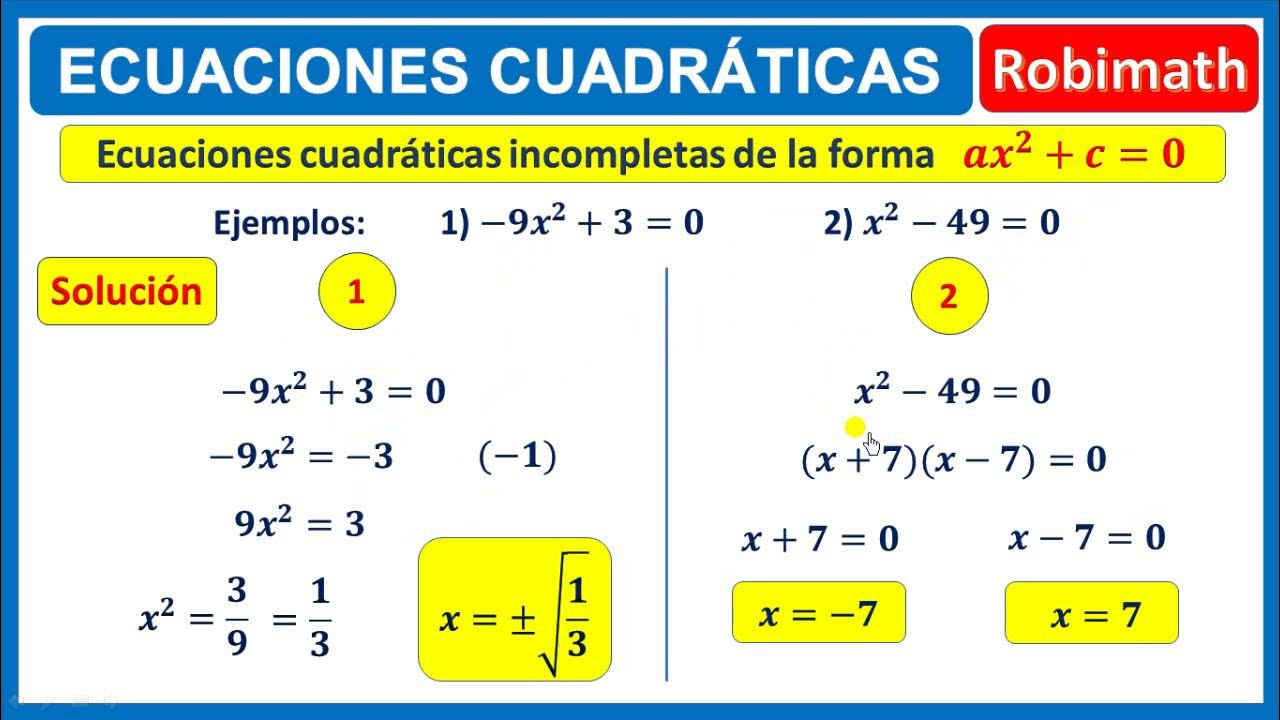

Ecuaciones cuadráticas de la forma ax2 + c=0

Memahami Conversion, Cara Menghitungnya dan 3 Cara Meningkatkan Conversion Rate Digital Marketing

Prof. Ali Saukah: Kemitraan Pembelajaran untuk English DL (PM)-Eps.1 @Suyantoid

FUNÇÃO DO 1 GRAU | FUNÇÃO AFIM | \Prof. Gis/- AULA 1

Kontribusi BINUS dalam Memperkaya Riset untuk RI | JURNAL BINUSIAN

PROF RACHMAT KRIYANTONO (PROF RK); ISU, KRISIS DAN PUBLIC RELATIONS, STUDI KASUS ARLA

Cara Membuat Literature Review Tiga Tips Mudah | Tirta Mursitama

5.0 / 5 (0 votes)