Things Every New Credit Manager Should Know, a Ten Minute Tips Program

Summary

TLDRThis video offers essential tips for new credit managers, emphasizing the importance of effective leadership, communication, and prioritization. It covers practical strategies for managing a credit department, setting clear performance goals, and using various metrics to measure success. Key advice includes fostering team engagement, handling difficult customer interactions, and ensuring efficient decision-making. The script highlights the significance of managing up, staying informed, and developing a proactive approach to problem-solving. Ultimately, it provides new managers with actionable insights for thriving in their roles while minimizing costly mistakes.

Takeaways

- 😀 People are your most valuable resource—align team priorities with your manager’s expectations and focus on exceeding them.

- 😀 Find a mentor early and own your mistakes—learning from trial and error is inevitable, but taking responsibility helps you grow.

- 😀 Listening is key—listen to your team, peers, customers, and other departments to improve communication and decision-making.

- 😀 Use a variety of performance metrics to measure your department’s success, not just standard ones like DSO and bad debt write-offs.

- 😀 Hire slowly, fire quickly—invest time in selecting the right people, but don’t hesitate to make tough decisions when necessary.

- 😀 Leadership is a skill that must be earned, not assumed—manage your team fairly and avoid favoritism.

- 😀 Don’t hesitate to say no when necessary—be comfortable with rejecting subordinates' requests if they’re not aligned with company goals.

- 😀 Engage proactively with customers, especially in difficult situations like overdue accounts, and always aim for solution-oriented communication.

- 😀 Stay adaptable to change—while technology evolves, the fundamental principles of good credit management remain the same.

- 😀 Provide transparency and share insights regularly with your team—meet with them both as a group and individually to foster growth and alignment.

Q & A

What is the primary challenge of learning the role of a credit manager on the job?

-The primary challenge is that learning on the job often involves trial and error, leading to mistakes that cost time, money, and potentially harm customer goodwill and the credit manager's reputation.

Why is it important to treat your team members as your most valuable resource?

-Because your team's performance directly impacts the success of the credit department. By prioritizing their well-being and development, you ensure better outcomes for the company and for customer relationships.

How can a credit manager align their priorities with those of their boss?

-By focusing on the tasks and goals that their boss considers most important, ensuring that their individual performance and the department's performance exceed expectations.

Why is finding a mentor crucial for a new credit manager?

-A mentor can provide guidance and help navigate the challenges of the role, offering advice on avoiding common pitfalls and improving decision-making.

What should a credit manager do if they don't know the answer to a question?

-They should avoid guessing the answer and instead acknowledge uncertainty, commit to finding the correct information, and get back to the person with the right answer.

What role does enthusiasm play in a credit manager's success?

-Enthusiasm helps build positive relationships with colleagues, customers, and subordinates. People are more likely to work with someone who is energetic and committed to the job.

What are the recommended performance metrics for evaluating a credit department?

-In addition to DSO and bad debt write-offs, other useful metrics include turnaround time, response rates to emails, number of calls made daily, and the percentage of overdue balances at various intervals (30, 60, 90 days).

What is the importance of setting clear, written goals with subordinates in the credit department?

-Clear, written goals help employees understand expectations and track their performance. It's important for these goals to be measurable, ideally with both individual and departmental targets.

How should a credit manager handle bad news or complaints from customers or subordinates?

-A good credit manager should never shoot the messenger. It's vital to receive bad news or complaints calmly, as they provide critical information to resolve issues efficiently and maintain goodwill.

What does it mean to 'hire slowly and fire quickly' in credit management?

-It means taking your time to carefully hire the right individuals, but being decisive and swift in addressing performance or behavioral issues that are not improving, thus maintaining team morale and departmental performance.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Organization and Management Lesson 3: Functions, Roles and Skills of a Manager

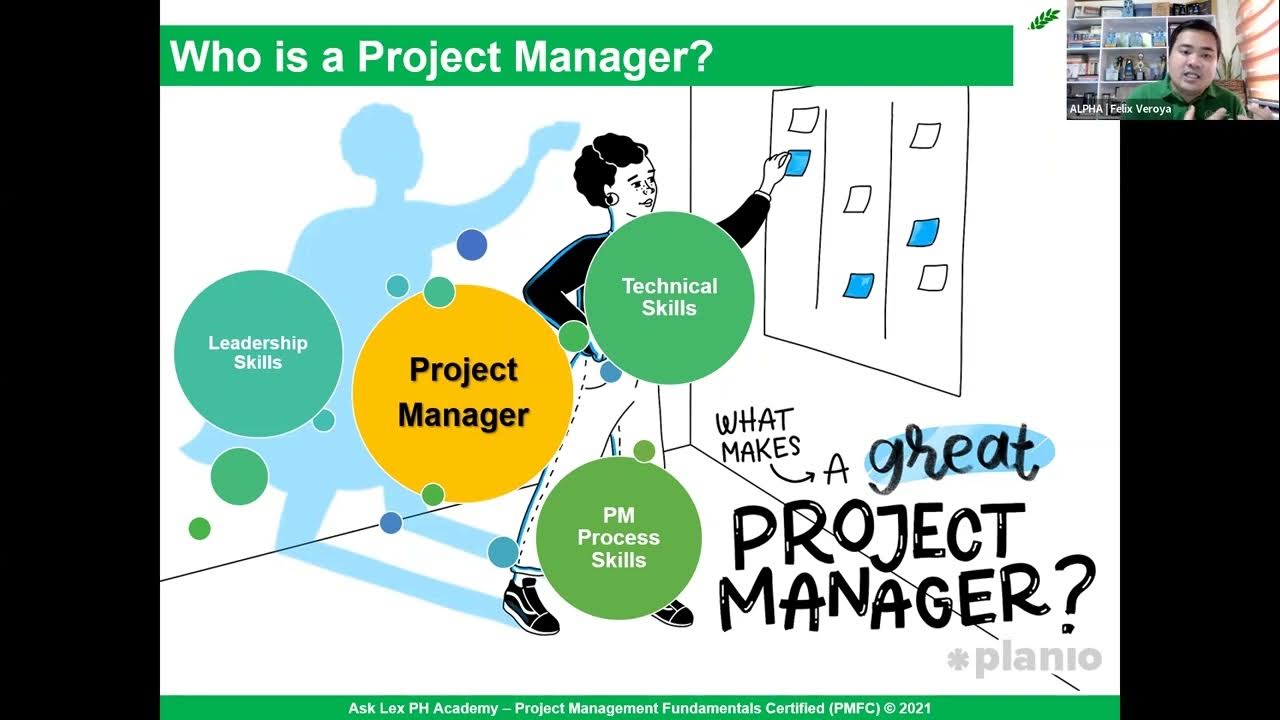

Who is a project manager_rev1

Professional Project Management Skills | Google Project Management Certificate

Most important skills for a Senior Product Manager job: Tips from Miro’s PM experts

Group Discussion Tips you should not Miss | Effective Group Discussion

First-Time Manager Tips [NEW MANAGER...NOW WHAT?]

5.0 / 5 (0 votes)