حكم المكوس ، المحدث عبدالعزيز الطريفي فك الله أسره ، قناة فوائد الطريفي

Summary

TLDRThis video script discusses the Islamic perspective on unlawful taxes, known as *mukūs* or *'ushūr*, which are taken from people's wealth without a legitimate cause. The speaker highlights how such taxes, similar to those imposed on trade, salaries, or goods, are forbidden in Islam, drawing parallels to the actions of the people of Shu'ayb. The discussion contrasts unlawful taxes with legitimate ones, such as zakat, and addresses the role of the state in managing public funds. The speaker also touches on cases where certain taxes may be justified for infrastructure, like roads, if public funds are insufficient.

Takeaways

- 😀 The concept of 'mukus' refers to unlawful taxes or duties taken from people's property or earnings without legitimate cause, which are forbidden in Islam.

- 😀 'Zakat' is the lawful form of tax in Islam, which is obligatory for Muslims who meet certain conditions and is not considered exploitative.

- 😀 The unlawful taxes, such as customs duties on goods, are considered 'mukus' and are prohibited in Islamic teachings.

- 😀 Unfair taxation practices, such as taking a portion of people's earnings or purchases without clear justification, are condemned in Islam.

- 😀 The actions of the people of Shu'ayb, who exploited travelers through unfair taxation at checkpoints, serve as an example of what is forbidden in Islamic law.

- 😀 Taxation that involves deception, such as manipulating weights and measures, is considered fraudulent and falls under the category of 'mukus'.

- 😀 The Prophet Muhammad's teachings highlight the sanctity of people's wealth, emphasizing that taking money without consent is a grave injustice.

- 😀 Some modern tax practices, such as duties on goods entering a country, are considered unlawful unless they have a clear and legitimate purpose, such as infrastructure development.

- 😀 When public funds (such as zakat) are sufficient for maintaining public services like roads or bridges, taking additional taxes for these purposes is unjustified.

- 😀 There are different opinions among Islamic scholars regarding the use of zakat funds for public services, but it is generally considered acceptable if there are no other means of funding.

- 😀 The speaker emphasizes the importance of avoiding tax practices that exploit people for their wealth, and suggests that lawful taxes should be transparent and just.

Q & A

What is the concept of 'mukus' as mentioned in the script?

-The term 'mukus' refers to unjust taxes or duties that are imposed on individuals' wealth or transactions without a legitimate, religiously approved reason. It is considered impermissible in Islam.

What does the script say about taxes on individuals versus taxes on wealth?

-The script differentiates between taxes on individuals (such as zakat al-fitr, which is mandatory charity on every Muslim) and taxes on wealth, such as those imposed on property, money, crops, or livestock. The taxes on wealth, if legitimate, are considered acceptable, but taxes on individuals without proper justification are unlawful.

How does the script address the historical example of the people of Shu'ayb?

-The script refers to the people of Shu'ayb, who were condemned for taking unlawful taxes or dues from people in an unjust manner, particularly through deceit in trading and weights. This is used as an example of how such practices are forbidden in Islam.

What is the relationship between the Prophet Muhammad's (PBUH) teachings and the practice of taxes?

-The teachings of Prophet Muhammad (PBUH) emphasize that any unjust tax or fee is unlawful. The Prophet prohibited unfair enrichment from others' wealth and condemned such practices as theft, highlighting the sanctity of people's wealth.

What types of taxes does the script describe as being impermissible in Islam?

-The script identifies taxes such as customs duties, import/export taxes, road taxes, and other fees taken without legitimate justification as impermissible. These are considered 'mukus' or unlawful taxes.

Does the script suggest any exceptions where certain taxes may be acceptable?

-Yes, the script acknowledges that in cases where public infrastructure such as roads or bridges is needed, taxes may be justified if the state cannot cover the costs through other means. This is particularly valid when the funds are used for public welfare and the state is in need.

What is the view on taxing roads and infrastructure, according to the script?

-The script suggests that while road taxes may be permissible in certain cases to fund infrastructure, this should only occur if there is a genuine need, and if the state’s treasury cannot cover the costs. The funds should be used appropriately for public welfare, such as building and maintaining roads and bridges.

How does the script differentiate between legitimate and illegitimate taxes?

-The script differentiates legitimate taxes as those that have a clear and valid purpose, such as zakat or jizyah, and those that are used for public welfare (like roads or infrastructure). Illegitimate taxes are those taken without a justified reason or that are used for unjust enrichment.

What role does 'zakat' play in the discussion of taxes in the script?

-Zakat is highlighted in the script as a legitimate and obligatory form of taxation in Islam. It is a religious tax on wealth, taken from those who meet the necessary conditions (such as owning the minimum required wealth, known as the nisab). It is one of the few accepted forms of taxation in Islam.

What are the ethical considerations discussed in the script regarding taxation?

-The script stresses that taxes should only be taken for valid reasons, with clear justification, and in accordance with Islamic teachings. Unjust taxation, or 'mukus', is seen as unethical and unlawful, as it violates the sanctity of people's wealth and can lead to exploitation.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Literasi Ekonomi Islam

Is This The Best Argument For God's Existence?

Syarat Khulu / Wanita Mengajukan Cerai - Ustadz Firanda Andirja

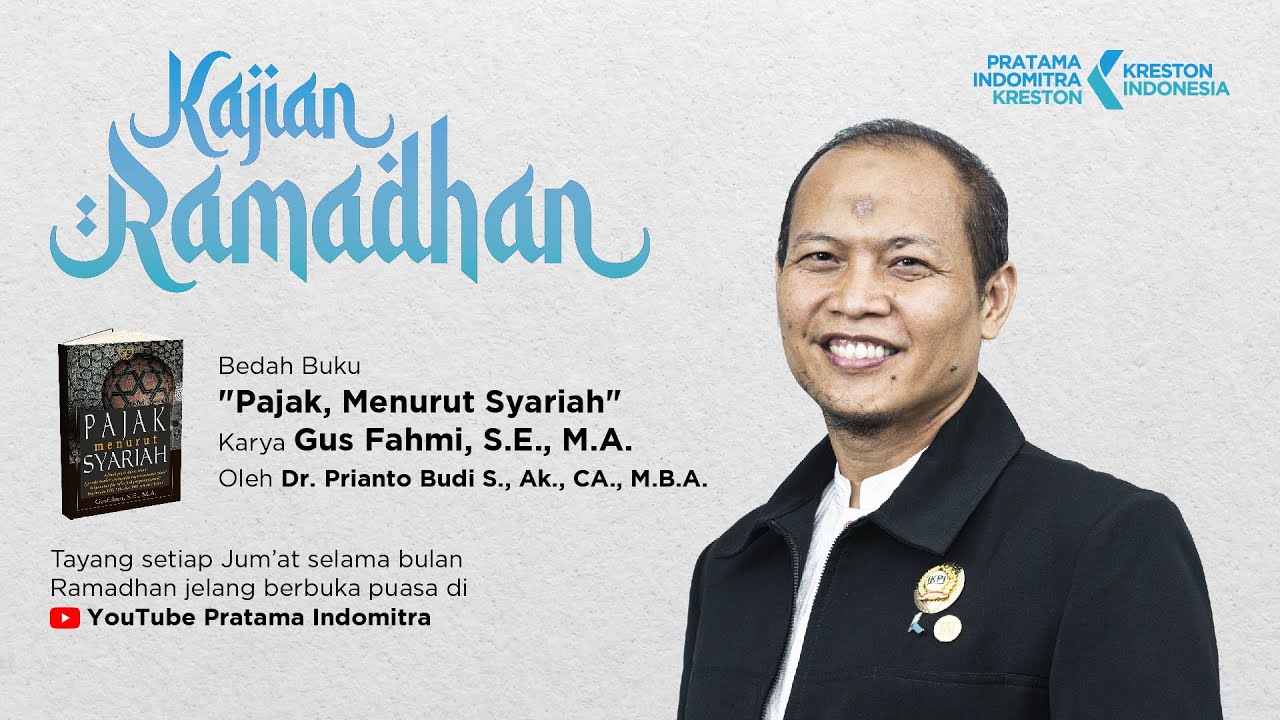

#KajianRamadhan | Bedah Buku "Pajak Menurut Syariah"

Apakah Selebgram, Youtuber & Tiktokers Wajib Berzakat? Ini Penjelasan Lengkapnya! - Literasi Zakat

Hukum Memasang Kalung Lonceng pada Hewan Peliharaan - Buya Yahya Menjawab

5.0 / 5 (0 votes)