ITSA4 BONIFICAÇÃO R$ 13,55 (IRPF 2025) VOCÊ PODE PERDER DINHEIRO SE NÃO FIZER ISSO!

Summary

TLDRThis video explores the impact of stock bonuses on Itaú (ITSA4) shareholders from 2014 to 2024, with a focus on how these bonuses affect average prices and tax obligations. It explains the mechanics of stock bonuses, how they influence your investment, and the implications for your average price. The video further delves into the importance of correctly adjusting your average price for tax purposes, providing practical guidance on how to report stock bonuses, handle fractions of shares, and understand capital gains taxes. The aim is to help investors maximize their returns and minimize tax liabilities.

Takeaways

- 😀 Itaúsa has offered multiple stock bonuses (bonificações) from 2014 to 2024, significantly increasing shareholder equity over the years.

- 😀 The 2024 bonus introduces a higher cost for new shares (R$13.55), which will affect the price average (preço médio) of existing shares.

- 😀 Stock bonuses are a way for Itaúsa to increase shareholder holdings without requiring additional investment from the shareholders.

- 😀 The price adjustment after receiving stock bonuses can be seen as beneficial, despite the higher cost attributed to the bonus shares.

- 😀 Adjusting the price average (preço médio) correctly is essential for tax reporting, especially when calculating future capital gains or losses.

- 😀 When an investor receives bonus shares, the tax implications may not be immediately obvious, but accurate reporting is necessary for tax efficiency.

- 😀 For the 2024 bonus, the shares will be issued at a price of R$13.55 each, which is higher than the market price, leading to an increase in the price average of shares.

- 😀 Investors can choose to adjust their price average with the attributed cost or use a zero-cost adjustment, which impacts both tax reporting and potential future returns.

- 😀 If fractional shares are issued, they will be aggregated and sold in an auction, with the proceeds credited to the investor's account and subject to tax reporting in 2025.

- 😀 Properly handling the tax implications of stock bonuses and fractional shares can help reduce future taxable gains and improve overall tax outcomes for investors.

Q & A

What is the significance of the 2024 stock bonus mentioned in the script?

-The 2024 stock bonus is notable because it involves a 5% bonus where shareholders will receive one additional share for every 20 shares they own. However, it also comes with a cost of R$ 1.35 per new share, which might affect the average price of stocks for investors.

How did Itaú's stock bonuses work historically, from 2014 to 2024?

-From 2014 to 2024, Itaú implemented several stock bonuses, including a 10% bonus in 2014, 2015, and subsequent smaller bonuses in later years. By the end of 2024, a shareholder who started with 1,000 shares would have accumulated 1,864 shares, demonstrating a significant capital increase through bonuses alone.

What is meant by 'adjustment of average price' in the context of stock bonuses?

-The adjustment of the average price refers to the change in the average cost of the investor's stocks after receiving bonus shares. In the case of the 2024 bonus, investors will see their average price increase due to the cost of R$ 1.35 per bonus share, though it could be a beneficial long-term strategy.

How can an investor avoid seeing their average price increase after receiving bonus shares?

-Investors can avoid seeing their average price rise by adjusting their portfolio to account for the new shares received through the bonus. This involves calculating the cost of the bonus shares and ensuring it doesn't negatively impact the average cost of their holdings.

What are the two scenarios presented for adjusting the average price—one with cost and one without?

-The two scenarios involve: 1) Adjusting with cost, where the cost per bonus share (R$ 1.35) is incorporated into the average price. 2) Adjusting without cost, where no additional cost is added to the average price, but this might not reflect the true cost of acquiring the bonus shares.

What happens if an investor sells their shares after the bonus adjustment?

-If an investor sells their shares after the bonus adjustment, the taxable income is calculated based on the adjusted average price. The investor could potentially offset any losses from the adjustment by deducting them from future profits, which could help minimize taxes.

How does the bonus impact taxes, especially in relation to income tax for 2024 and 2025?

-The bonus shares themselves are not directly taxable when received, but any gains from their sale in the future would be subject to capital gains tax. Additionally, if any fractional shares are received, the income from those will need to be reported in the 2025 income tax return.

What is the process for handling fractional shares in the 2024 bonus?

-If an investor ends up with fractional shares, these fractions will be grouped and sold through an auction on the stock exchange. The proceeds from the sale will then be credited to the investor's brokerage account, and the amount received will be subject to tax as income.

How should investors report the bonus shares and fractions in their tax return?

-Investors should report the bonus shares under 'Other Income' (Campo 99) in their tax return, indicating the CNPJ of Itaú. For fractions, they should report the amount received from the sale of fractional shares under income from non-taxable earnings.

What is the impact of adjusting the average price correctly on future profits and taxes?

-Correctly adjusting the average price not only ensures more accurate tax reporting but also allows investors to potentially reduce future tax burdens by offsetting any capital losses. In the long term, this approach leads to a more favorable financial outcome.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

なぜ3月決算の会社は4月に賞与を払った方がいいのか?意外とみんなが知らない社会保険料の決まり方について解説します!

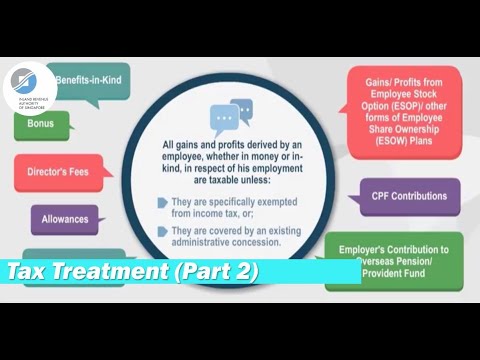

Tax Treatment of Remuneration Components (Part 2)

Training Session 13 04 02 2021 Payroll about taxation7

Payroll taxes: Here's a breakdown of what gets taken out of your pay and what you are taxed on

Proses Pengendalian Manajemen: Kompensasi Manajemen - Kelompok 11 - Kelas F

How To Make $$$ Churning Bank Account Bonuses

5.0 / 5 (0 votes)