Financial Literacy - 9 things a college student should know (Part 2)

Summary

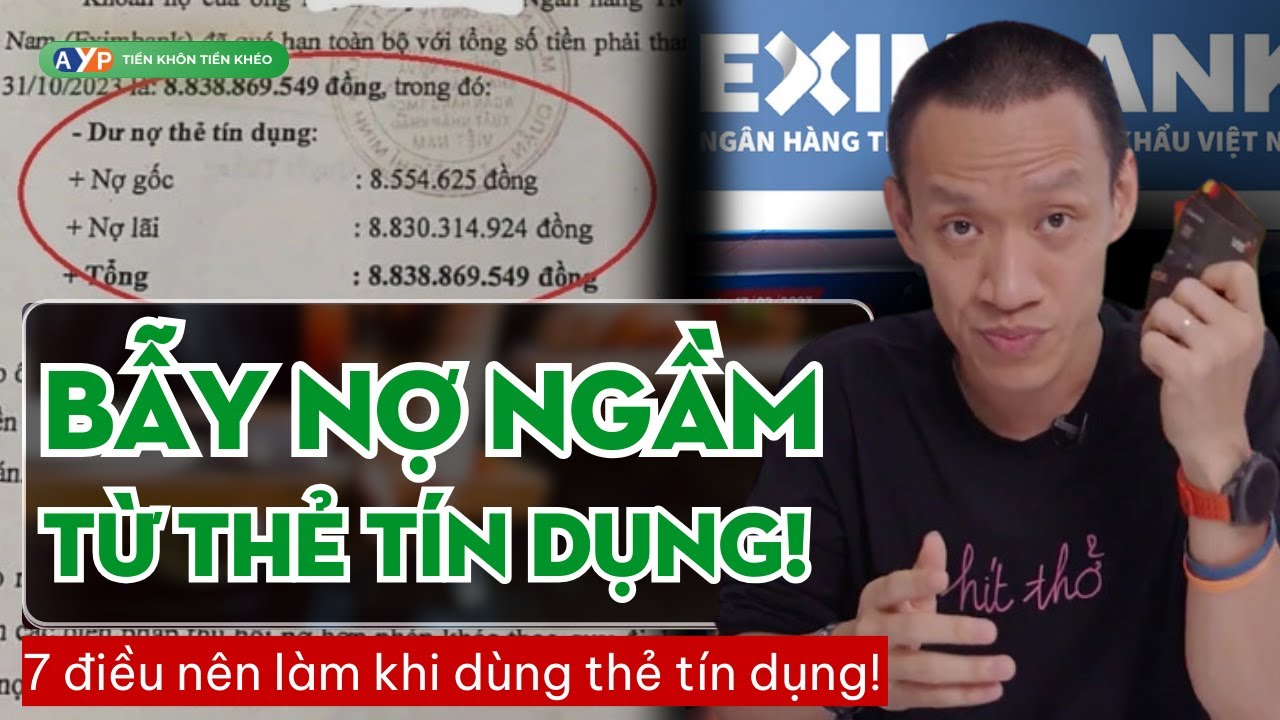

TLDRThis video offers essential financial advice for college students, covering topics like the dangers of credit card interest, the pitfalls of minimum payments, and the importance of protecting your credit score. It emphasizes the value of saving early and living within your means, highlighting the power of compound interest and the long-term benefits of smart financial planning. The script also warns about scams, gambling, and the deceptive nature of appearances when managing money. The key takeaway is to start saving and investing early, avoid debt traps, and make informed financial decisions to build wealth over time.

Takeaways

- 😀 Credit cards can be dangerous if you only make minimum payments. Interest charges can cause small debts to grow significantly over time.

- 😀 Always protect your credit score. A low score can affect your ability to get loans, like for a house, and it can stay on your record for 7 years.

- 😀 If something sounds too good to be true, it probably is. Be cautious of get-rich-quick schemes, especially ones targeting college students.

- 😀 Gambling has unfavorable odds, and if you gamble, do it with money you can afford to lose. Never rely on it for financial success.

- 😀 Avoid overspending when you start earning money. Stick to a budget, and resist the temptation to live beyond your means.

- 😀 The most important bill to pay is yourself. Save a portion of every dollar you earn to build wealth over time.

- 😀 Time is the greatest asset you have. Starting to save and invest early leads to long-term financial success through compound interest.

- 😀 Don't get discouraged if your financial plans don’t work perfectly at first. Adjust your budget and goals as needed to stay on track.

- 😀 Budgeting properly is crucial. Taxes and deductions will reduce your take-home income, so plan accordingly and live within your means.

- 😀 Building wealth is a long-term effort. Focus on saving, working hard, and making smart financial decisions instead of seeking shortcuts.

Q & A

What is the importance of paying your credit card bill in full?

-Paying your credit card bill in full helps avoid interest charges. If you only pay the minimum amount, you'll be charged interest on the remaining balance, and this can lead to significantly higher costs over time.

How does credit card interest work when you don't pay the full balance?

-When you don't pay the full balance, the credit card company charges interest on every purchase made during the billing period, not just on the remaining balance. This means you can end up paying interest on past purchases, including those made at the beginning of the billing period.

Why do credit card companies prefer minimum payments?

-Credit card companies make more money from you when you only make minimum payments because you're charged interest on the remaining balance. While paying the full balance would not generate interest, paying only the minimum results in more revenue for the company.

What happens if you only make the minimum payment on a $500 credit card balance?

-If you only make the minimum payment on a $500 balance, it could take years to pay off the debt, and the total cost will more than double due to interest. At 20% interest, a $500 purchase could end up costing you over $1,100 and take around nine years to pay off.

What is a credit score and why is it important?

-A credit score is a numerical representation of your creditworthiness based on your credit history. It ranges from 350 to 850, and the higher the score, the better the terms you're offered for loans and credit. A low credit score can lead to higher interest rates or loan denials.

How does a low credit score affect loan approval?

-A low credit score can prevent you from being approved for loans or result in higher interest rates. It reflects poor credit management, such as late payments or defaults, which can remain on your credit report for seven years.

What is the Rule of 72 and how does it help in wealth creation?

-The Rule of 72 is a formula used to estimate how long it takes for an investment to double based on a fixed annual rate of return. By dividing 72 by the interest rate (e.g., 72 ÷ 10% = 7.2 years), it shows how compounding interest works and the importance of starting to save early to build wealth.

What should you do if you're upside down financially?

-If you're upside down financially, meaning your expenses exceed your income, you have two options: either increase your income by taking on more work or cutting down on your expenses. For example, avoid buying unnecessary items or opting for cheaper alternatives.

Why is it important to pay yourself first?

-Paying yourself first means setting aside a portion of your income for savings or investments before paying other bills. This habit helps ensure that you consistently build wealth and can take advantage of the compounding effect over time.

What is the biggest factor in creating wealth at a young age?

-The biggest factor in creating wealth at a young age is time. Starting to save and invest early gives you the advantage of compounding interest, allowing your money to grow over the years and build significant wealth by the time you're older.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Credit Card Debt Explained With a Glass of Water

7 Signs You're Doing Well Financially (for your age)...Even If It Doesn't Feel Like It

How to RAISE Your Credit Score Quickly (Guaranteed!)

Best Time To Spend On Your Credit Card & How Much To Spend (INCREASE YOUR CREDIT SCORE)

Sau vụ nợ từ 8,5 triệu thành 8,8 tỷ: NÊN và KHÔNG NÊN làm gì khi xài THẺ TÍN DỤNG!| Nguyễn Hữu Trí

Como Ter Score Alto? 3 Dicas QUE FUNCIONAM Para Aumentar o Score - Acordo Certo

5.0 / 5 (0 votes)