財報中的「三率」是什麼?透過三大指標,教你看出公司是否賺錢!投資必知的基本面分析(二) |口袋小學堂EP41

Summary

TLDRIn this video, the importance of understanding three key profitability metrics—gross margin rate, operating profit margin, and after-tax net profit margin—is emphasized for investors. The video explains how each metric is calculated, what influences them, and how they can help assess a company's ability to generate sustainable profits. Investors are encouraged to use these indicators, found in financial reports, to evaluate company stability and profitability. The video also hints at future lessons on Return on Equity (ROE) and Return on Assets (ROA), offering a comprehensive approach to fundamental investment analysis.

Takeaways

- 😀 Gross margin, operating profit margin, and net profit margin are three key indicators to assess a company's profitability.

- 😀 Gross margin represents the percentage of revenue that exceeds the cost of goods sold, indicating a company's ability to create value through its products or services.

- 😀 A higher gross margin suggests a company has a stronger ability to add value and generate profit, while a lower margin may indicate vulnerability to risks and market fluctuations.

- 😀 Operating profit margin reflects a company's ability to generate profit after covering both direct and indirect costs. A higher margin indicates better operational efficiency.

- 😀 The operating profit margin can be impacted by factors such as operating expenses and sales efficiency.

- 😀 While gross margin focuses only on production costs, operating profit margin takes into account broader operational costs, providing a more comprehensive view of profitability.

- 😀 Net profit margin is the percentage of revenue that remains after all expenses, including taxes, are deducted, representing a company's true profit.

- 😀 A high net profit margin indicates strong overall profitability and management effectiveness, while a low margin may signal financial inefficiency.

- 😀 Companies may have additional income from non-operating activities (non-operating gains or losses), which can affect the net profit margin and overall profitability.

- 😀 Investors can assess a company's financial health by reviewing these three metrics in the provided financial reports, helping them understand the company's operational efficiency and potential for growth.

- 😀 The video will introduce other financial metrics, like ROE and ROA, in upcoming episodes, helping viewers deepen their investment knowledge.

Q & A

What is the purpose of evaluating profitability indicators in a company?

-Evaluating profitability indicators helps investors assess whether a company is consistently profitable, which is crucial for selecting stable and reliable investment targets.

What are the three key profitability indicators discussed in the script?

-The three key profitability indicators discussed are Gross Profit Margin, Operating Profit Margin, and Net Profit Margin.

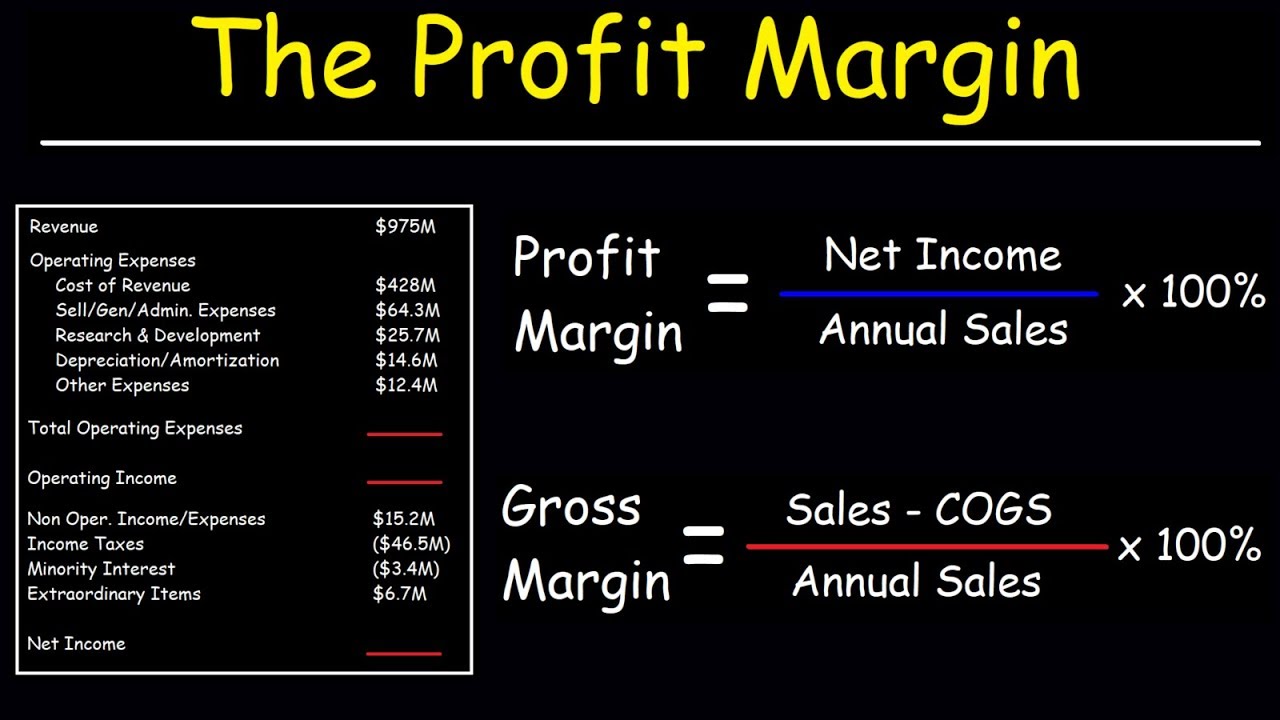

How is Gross Profit Margin calculated?

-Gross Profit Margin is calculated by dividing the gross profit by the total revenue and multiplying by 100%. The formula is: (Gross Profit ÷ Revenue) × 100%.

What does a higher Gross Profit Margin indicate about a company?

-A higher Gross Profit Margin indicates that the company is more efficient at generating profit from its sales, meaning it can create value with lower production costs.

What are the factors that can affect a company's Gross Profit Margin?

-The factors that affect Gross Profit Margin include sales prices, cost of goods sold, product/service quality, market competition, and fluctuations in raw material prices.

What does Operating Profit Margin tell us about a company?

-Operating Profit Margin reflects the company's ability to generate profit from its core operations after considering both direct and indirect costs. It shows how well a company manages its operating expenses.

How is Operating Profit Margin calculated?

-Operating Profit Margin is calculated by dividing operating profit by revenue and multiplying by 100%. The formula is: (Operating Profit ÷ Revenue) × 100%.

How is Operating Profit Margin different from Gross Profit Margin?

-Operating Profit Margin differs from Gross Profit Margin because it takes into account both direct costs (like COGS) and indirect costs (like operating expenses), providing a more comprehensive view of a company's profitability.

What does it indicate if the Gross Profit Margin decreases but the Operating Profit Margin increases?

-If the Gross Profit Margin decreases but the Operating Profit Margin increases, it suggests that the company may be reducing operational costs to maintain profitability, possibly at the expense of product competitiveness.

What does Net Profit Margin represent and how is it calculated?

-Net Profit Margin represents the percentage of revenue remaining after all expenses, including taxes, are deducted. It is calculated by dividing net profit by revenue and multiplying by 100%. The formula is: (Net Profit ÷ Revenue) × 100%.

Why is it important to consider non-operating income/loss when analyzing Net Profit Margin?

-Non-operating income/loss, such as gains or losses from side ventures, can impact the company's overall profitability. Investors should consider these factors to get a full picture of a company's financial health.

What can an investor infer from comparing Gross Profit Margin, Operating Profit Margin, and Net Profit Margin together?

-By comparing these margins, an investor can understand a company’s profitability structure. For example, a rising Operating Profit Margin with a falling Gross Profit Margin could indicate reduced product competitiveness but improved cost control. Similarly, a strong Gross Profit Margin with a declining Operating Profit Margin could point to strong products but inefficient management of operating costs.

What should investors look for in the long-term Net Profit Margin of a company?

-Investors should look for a consistently high Net Profit Margin, as it indicates stable business operations and effective cost and tax management, which suggests good long-term profitability.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآن5.0 / 5 (0 votes)