S&P 500 to rise 10% before plunging to 26% in 2025: Stifel

Summary

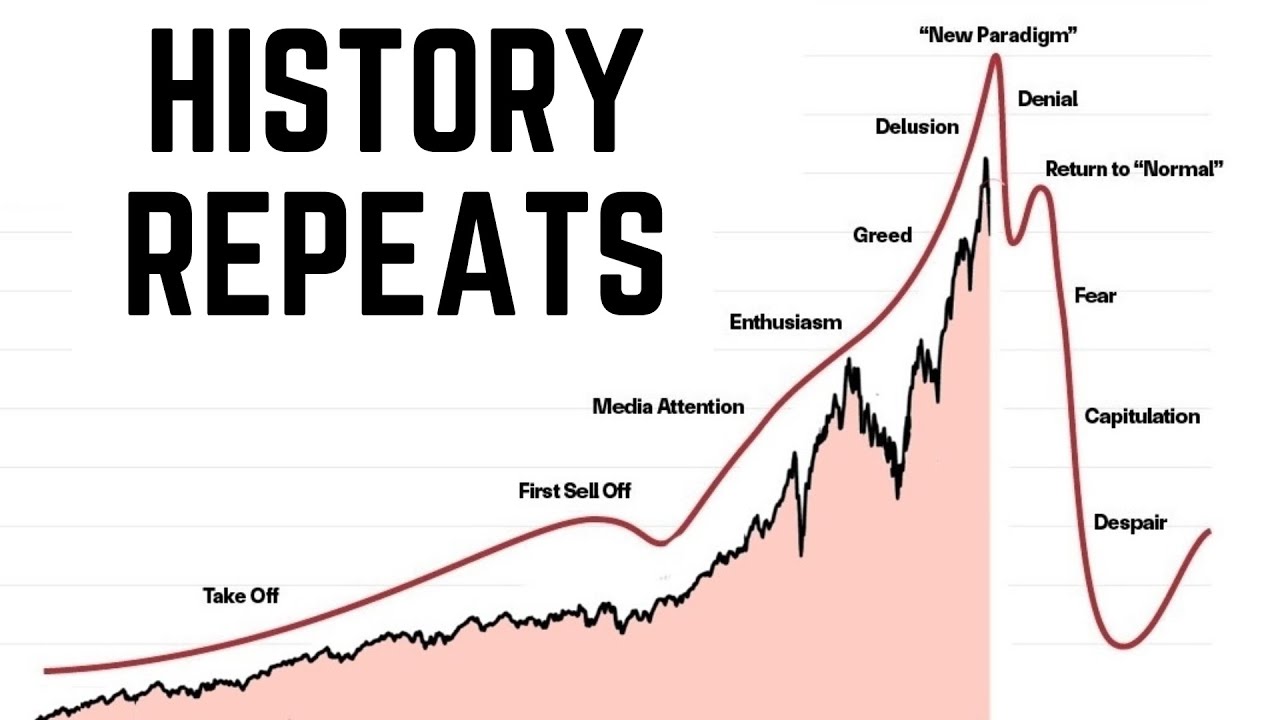

TLDRIn this interview, Barry Bannister, Chief Equity Strategist at Stifel, discusses his concerns about the current state of the S&P 500, which has experienced significant gains in 2024, marking the best year-to-date performance of the 21st century. Bannister explains that while earnings growth and technological advancements, such as AI, are driving the market, valuations are high, and inflation could rise again in 2025, leading to a potential market correction. He warns of a 20-25% downside and suggests that investors should be cautious and prepared for volatility, with a focus on managing risk rather than chasing short-term gains.

Takeaways

- 😀 The S&P 500 has had the best year-to-date performance of the 21st century, up 33% on a total return basis.

- 📉 Barry Bannister warns that the S&P 500 has overshot and may face significant downside risks in 2025.

- 🔍 Bannister uses the cyclically adjusted price-to-earnings (CAPE) ratio and equity risk premiums to highlight overvaluation in the market.

- 💡 While AI is often seen as a revolutionary technology, Bannister argues it's more about leveraging existing data rather than creating entirely new technologies.

- ⚖️ The market's valuation is elevated, and Bannister emphasizes that high valuations often lead to corrections.

- 💥 Bannister expects inflation to rise again in the mid-2020s, driven by populist politics and increased government spending.

- 📊 The Federal Reserve's optimistic stance on rate cuts is fueling speculative behavior, which could lead to a market correction.

- 🔻 Bannister predicts a 25% drop in the S&P 500 in the coming years as inflation picks up and the Fed struggles to manage it.

- 💼 Bannister advises against chasing the market higher and suggests buying dips cautiously.

- 🥇 Gold could be a good hedge against market risks, but Bannister recommends waiting for specific triggers, like fiscal stimulus from China, before getting excited.

- 📅 Bannister anticipates a bear market around 2025-2026 due to inflationary pressures and a shift in Fed policy.

Q & A

What is Barry Bannister's primary concern regarding the S&P 500's current performance?

-Barry Bannister is concerned that the S&P 500 has overshot its potential gains in 2024, which could lead to a correction in 2025. He believes the market is currently overvalued and that a downside risk is looming due to factors like inflation, government spending, and speculative behavior.

How significant are the S&P 500’s gains this year compared to historical performance?

-The S&P 500 has experienced its best start to a year in the 21st century, with a year-to-date gain of approximately 33%. This makes 2024 one of the strongest years for the index in recent history.

What role does the Federal Reserve (Fed) play in Bannister’s concerns about market volatility?

-Bannister criticizes the Federal Reserve for encouraging speculative behavior by signaling rate cuts. He believes this has led to excess optimism in the market, especially in the technology sector, and could cause long-term instability when the Fed eventually has to address inflation more aggressively.

What historical examples does Bannister reference to explain current market conditions?

-Bannister compares the current market conditions to past periods of technological innovation, such as the 1950s nuclear boom, the 1970s computer revolution, and the 1990s internet expansion. He suggests that, while current innovations like generative AI are significant, they may not be as revolutionary as previous breakthroughs.

What are Bannister’s thoughts on the economic outlook for the next few years?

-Bannister believes inflation will likely persist and that the U.S. will experience a period of economic volatility. He expects inflation to rise again in mid-decade (2025–2026), potentially leading to a significant market correction once the Fed needs to play catch-up with interest rate hikes.

Why does Bannister mention 'buying the dips' in his analysis?

-Bannister suggests that investors could take advantage of market downturns by buying stocks at lower prices. While he acknowledges the market might experience a pullback, he believes there could still be short-term opportunities for gains before a potential long-term decline.

What does Bannister mean by saying the market feels 'effervescent like an Alka-Seltzer'?

-Bannister uses the metaphor of Alka-Seltzer to describe the market's current state as bubbly and overly optimistic. He implies that this exuberance could lead to an unhealthy market environment, which may cause issues when the speculative bubble eventually bursts.

What is Bannister's price target for the S&P 500, and how does it reflect his outlook?

-Bannister's price target for the S&P 500 suggests a potential 26% downside in 2025. He expects that, after a brief possible rise of up to 10% in the near term, the market will face a correction driven by rising inflation and central bank policies.

How does Bannister view the relationship between government spending and the market?

-Bannister believes that increased government spending, fueled by populist policies, will have a significant impact on the economy, particularly in terms of driving nominal GDP growth. However, he also sees this as contributing to inflationary pressures, which could harm the market in the long run.

What does Bannister suggest about gold as an investment option?

-Bannister suggests that gold can serve as a hedge against a weaker dollar and lower real interest rates. However, he advises caution, stating that gold's value will only rise significantly if additional fiscal stimulus, particularly from China, boosts global economic conditions.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

5.0 / 5 (0 votes)