Statement of Changes in Equity for Partnership | FULL EXAMPLE

Summary

TLDRThis video tutorial offers a comprehensive guide on preparing a statement of changes in equity for partnerships. It covers essential calculations, including net profit distribution, interest on capital and current accounts, and the sharing of profits among partners based on their capital ratios. The instructor walks through each step methodically, emphasizing the importance of accurate calculations to ensure all financial components are correctly reported. By the end, viewers will have a clear understanding of how to effectively manage and present partnership equity, making it a valuable resource for accounting students and professionals.

Takeaways

- 😀 Understanding the appropriation account is crucial for determining remaining profits after accounting for expenses.

- 💡 Profits and losses among partners are shared based on their capital contributions.

- 📊 To calculate a partner's share of profits, use the formula: (Partner's Capital / Total Capital) * Remaining Profit.

- 🔍 For example, Partner C with 80,000 capital receives a profit share of 44,920 from the remaining profits.

- 💰 Partner J, with 120,000 capital, receives a larger share of 67,380, reflecting their higher investment.

- 📉 It's essential to adjust current accounts to reflect positive or negative profit distributions correctly.

- 🔄 All movements in capital accounts should be accurately recorded to ensure zero balance at the end of the accounting period.

- 📅 Final balances should be double-checked to confirm that the totals align with expected values.

- ✨ Understanding the formula for profit sharing is vital for equitable distribution among partners.

- 📚 Accurate calculations and thorough checks prevent discrepancies in financial statements.

Q & A

What is the purpose of the appropriation account in a partnership?

-The appropriation account is used to determine how net profits are distributed among partners, taking into account various factors like interest on capital, payments to partners, and salaries.

How do you calculate remaining profit from net profit?

-Remaining profit is calculated by subtracting the total deductions (such as interest on capital and salaries) from the net profit.

What is the formula for calculating a partner's share of remaining profits?

-The formula is: (Capital of Partner / Total Capital of Partners) × Remaining Profit.

Why is it important to differentiate between positive and negative amounts in the appropriation account?

-Differentiating helps ensure that profits are recorded correctly as debits or credits, affecting the partners' current accounts accurately.

What factors can influence how profits are shared among partners?

-Profits can be shared based on capital ratios, equally, or according to other agreed-upon arrangements, which should be specified in the partnership agreement.

What should the balance at the end of the appropriation account indicate?

-The balance at the end of the appropriation account should always be zero, indicating that all profits have been distributed appropriately.

How do you treat the distribution of profits in the current accounts of partners?

-The distribution is recorded as a positive entry in the partners' current accounts if it represents profits allocated to them.

What are some common deductions made before calculating remaining profit?

-Common deductions include interest on capital, interest on current accounts, interest on drawings, and salaries to partners.

Why is it necessary to total the capital accounts at the end of the financial period?

-Totalling the capital accounts ensures accuracy in the financial statements and confirms that the equity reflects all transactions and distributions correctly.

What is the importance of understanding the ratios used in profit sharing?

-Understanding these ratios is crucial for fair distribution of profits based on each partner's investment, ensuring transparency and equity in partnership operations.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Cara cepat memahami laporan keuangan koperasi simpan pinjam dalam akun dan angka

Basic Financial Statements

[FABM2] Lesson 037 - Statement of Changes in Equity

Accounting for IGCSE - Video 36 - Limited companies (Part 2) - Financial statments

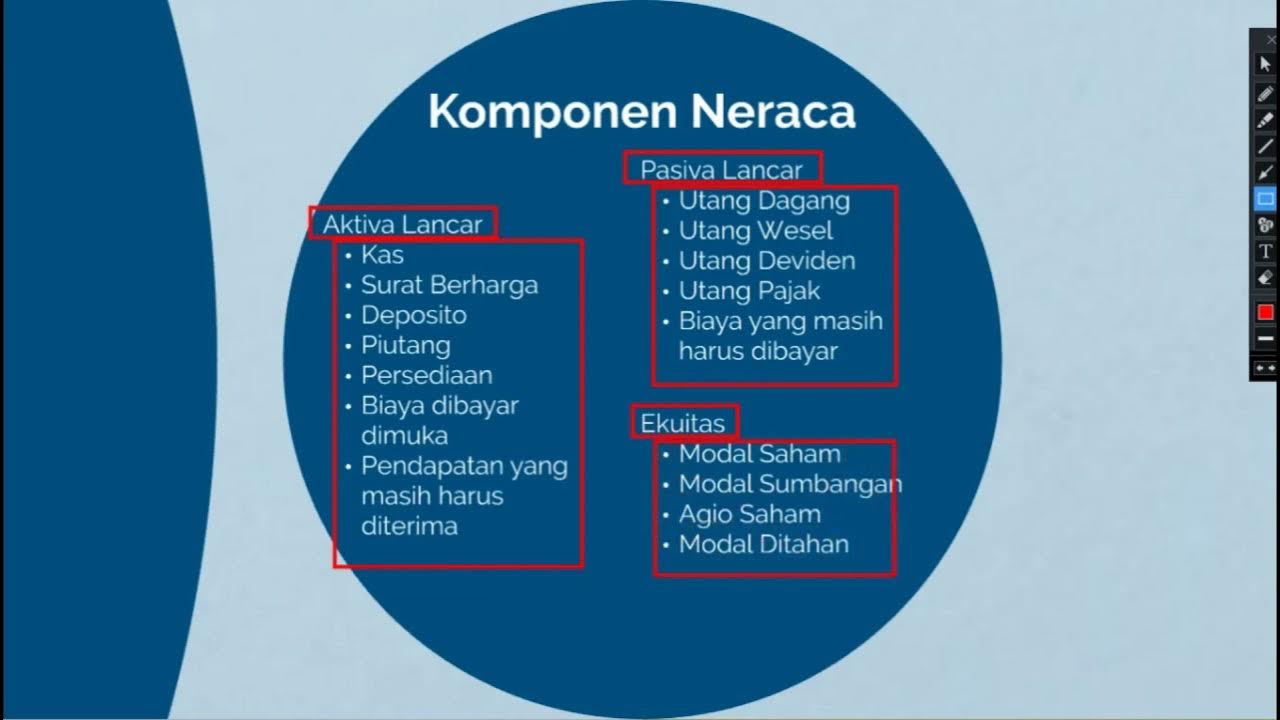

KD 3 10 MENGANALISIS LAPORAN KEUANGAN SEDERHANA || PRODUK KREATIF DAN KEWIRAUSAHAAN

Video Pembelajaran Jenis Laporan keuangan

5.0 / 5 (0 votes)