I risked MACD Trading Strategy 100 TIMES Here’s What Happened... - Forex Day Trading

Summary

TLDRIn this video, the creator tests the MACD crossover trading strategy by backtesting it 100 times to reveal its true effectiveness. The MACD strategy, developed in the late 1970s, uses two lines—the MACD line and the signal line—to identify buy and sell signals. However, the creator warns that trading success depends on managing risk and knowing the strategy’s win rate. Through backtesting on various markets and timeframes, the creator demonstrates how this strategy performs, achieving a 62% win rate and a 50% profit after 100 trades. The video encourages new traders to backtest strategies and focus on money management to ensure long-term success.

Takeaways

- 😀 MACD is a technical analysis indicator used to identify trends in stock and forex markets.

- 😀 The MACD crossover strategy involves buying when the MACD line crosses above the signal line, and selling when the opposite occurs.

- 😀 The MACD strategy works better when combined with the 200-period Exponential Moving Average (EMA) to determine the market's trend direction.

- 😀 The strategy is designed to trade only in the direction of the overall trend, meaning buy when the market is above the 200 EMA, and sell when it's below.

- 😀 A solid money management system is key for success. The creator risks only 1% of the account balance per trade and uses specific profit-taking techniques.

- 😀 The backtest results showed a 62% win rate after 100 trades, with 62 wins and 38 losses.

- 😀 It is essential to manage losing streaks effectively. The backtest demonstrated losing streaks of up to 5 trades, but with proper risk management, the account grew by 50%.

- 😀 The strategy can generate a 100% profit in a year for intraday traders who take around 30 trades per month, based on the win rate and money management principles.

- 😀 Trading is a probability game. Even with a strategy that wins more than it loses, losing trades will occur, so traders should be prepared for them.

- 😀 Backtesting is a critical step to understand the real probability and potential outcomes of a strategy. Knowing the win rate allows better risk and trade management.

- 😀 The key takeaway from the video is that the MACD strategy can be profitable, but success hinges on money management, understanding the probability of the strategy, and managing psychology during losing streaks.

Q & A

What is the MACD trading strategy?

-The MACD (Moving Average Convergence Divergence) trading strategy involves using an indicator that helps traders identify potential buy or sell signals based on the crossing of two lines—the MACD line and the signal line. The MACD line crosses above the signal line to indicate a buy signal, while crossing below suggests a sell signal.

Why is the MACD crossover strategy not always reliable on its own?

-The MACD crossover strategy alone doesn't provide a clear direction of the trend. It cannot indicate if the market is trending up or down, which is crucial for successful trading. That's why it's essential to combine it with other indicators, like the 200-period Exponential Moving Average (EMA), to identify the trend.

How do you use the 200-period EMA with the MACD strategy?

-The 200-period EMA helps to determine the market trend. If the market price is above the 200 EMA, it's considered an uptrend, and traders should only take buy signals from MACD. Conversely, if the price is below the 200 EMA, it indicates a downtrend, and traders should look for sell signals from MACD.

How do you manage risk and set profit targets using the MACD strategy?

-To manage risk, a trader should take a position where the stop loss is placed below the pullback of the trend. The profit target should be set at least greater than the risk. A common approach is to take 25% of the trade profit when it hits 1x risk and move the stop loss to break even. The second profit target could be set at 2x the risk, allowing the trader to secure profits even if the second target isn't reached.

What is back-testing, and why is it important for traders?

-Back-testing involves testing a trading strategy on historical data to understand its potential performance. It's crucial for validating a strategy's effectiveness and estimating win rates, so traders can manage their expectations and adjust their risk accordingly before risking real money.

What does the back-testing process reveal about the MACD strategy?

-The back-testing results show that the MACD crossover strategy has a win rate of approximately 62%. This means out of 100 trades, 62 were profitable, and 38 were losses. The strategy also has streaks of winning and losing trades, with the longest winning streak being 9 trades in a row and the longest losing streak being 5 trades in a row.

Why is knowing the win rate of a trading strategy important?

-Knowing the win rate is vital because it helps traders set realistic expectations. It allows traders to predict the likelihood of consecutive losses and manage their risk more effectively, ensuring they don't overexpose their accounts to the market's inevitable ups and downs.

What is the risk-to-reward ratio in the back-testing example?

-In the back-testing example, the trader risked 1% of their account on each trade, and the reward was 1.5 times the risk. This means for every $100 at risk, the potential reward was $150. Maintaining a good risk-to-reward ratio helps ensure profitability even if the win rate is not extraordinarily high.

What market conditions does the MACD strategy work in?

-The MACD strategy works well in all market conditions, as it can be applied to various time frames, including intraday trading and longer time frames. It is versatile for both stock and forex markets, making it adaptable to different trading environments.

How can traders avoid taking bad trades during back-testing?

-Traders should avoid taking trades with unclear entry signals. In back-testing, it's important to disregard trades where the entry signals are ambiguous, as this can result in poor performance. It's better to wait for clear, reliable setups rather than forcing trades that may lead to losses.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

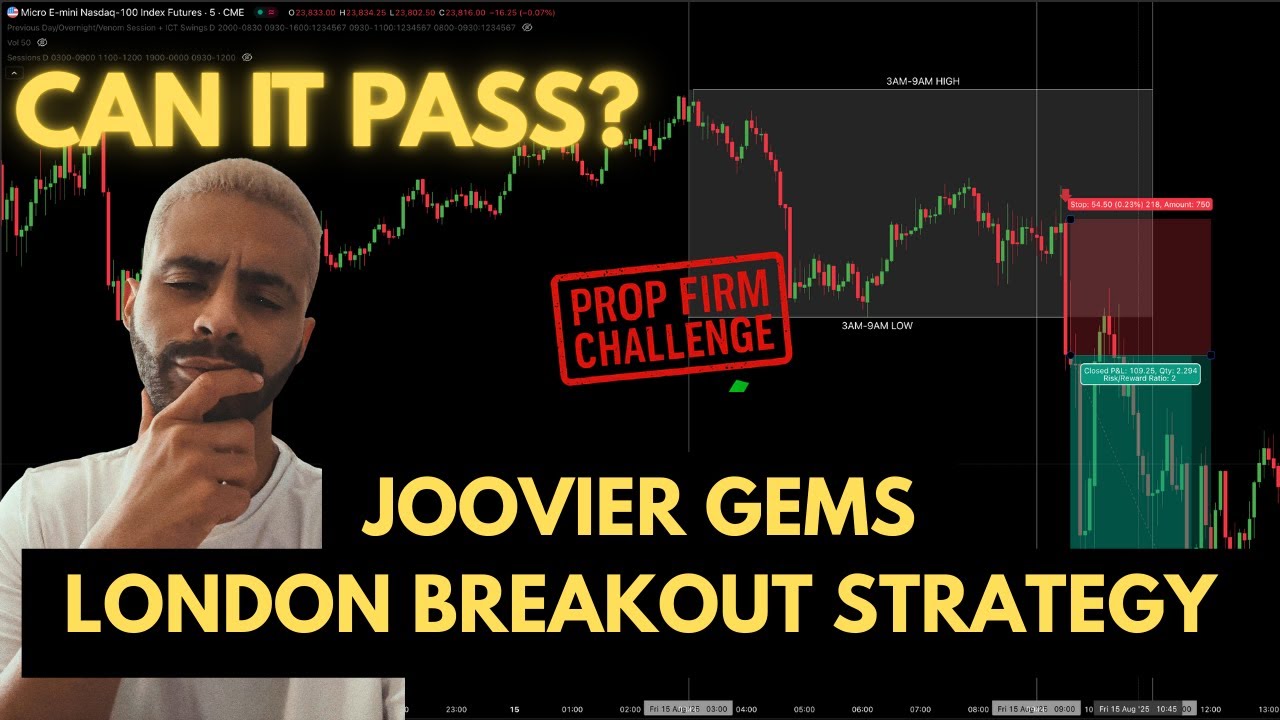

Prop Firm Strategy Backtest - Joovier Gems - CAN IT PASS?

Best Easy Trading Strategy – Stop Wasting Time NOW! *HIGH WIN RATE

$70 TO $195,000 💸 Secret NO-LOSS Pocket Option Trading Strategy | Binary Options Guide

La Estrategia De Trading Definitiva Con Medias Móviles

SECRET Trading Blueprint Makes Me My FIRST $10,000 Profit (2025)

1,000,000 backtest simulations in 20 seconds with vectorbt

5.0 / 5 (0 votes)