The Most Efficient Company of All Time | Stellantis, Elf, CAVA Group Stock Review | Martin Shkreli

Summary

TLDRIn this engaging conversation, speakers humorously explore various topics, including the immense scale of rocket technology, the challenges facing the auto industry, and the dynamics of restaurant stocks. They analyze financial metrics and company management, expressing caution about investments amid fluctuating earnings and negative cash flow. The dialogue also touches on the evolution of financial software pricing, emphasizing the need for accessibility in trading tools. Ultimately, the discussion reveals a blend of insightful analysis and personal investment philosophy, underscoring the complexities of navigating today's fast-paced financial landscape.

Takeaways

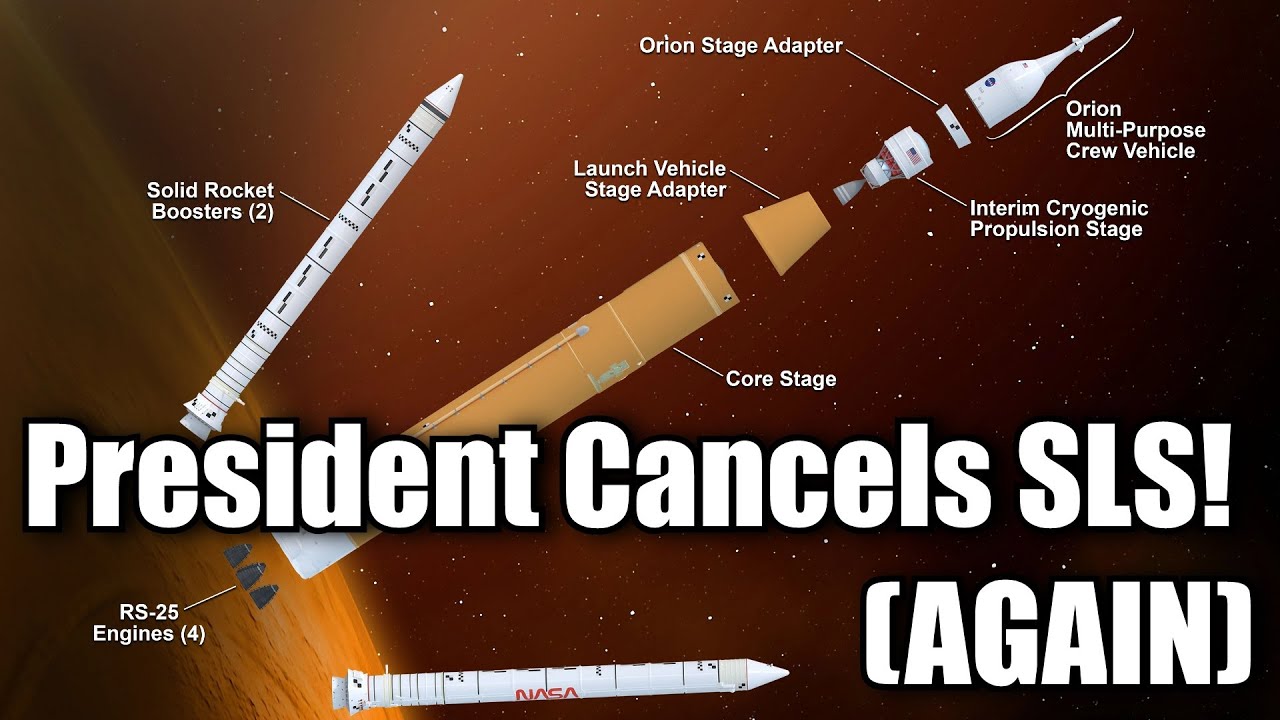

- 🚀 The discussion highlights the impressive scale of a rocket booster, comparing it to a 50-60 story building, emphasizing its massive size and engineering feat.

- 🤔 Concerns are raised about the financial viability of Stellantis, particularly regarding dropping earnings and negative cash flow, raising questions about its future profitability.

- 📉 The earnings of Stellantis are declining sharply, with a noted drop in gross margin from 22% to 18%, indicating potential financial instability.

- 💰 The panel expresses skepticism about the company's ability to sustain its dividend payments amidst negative cash flow.

- 🔍 There's a cautious approach towards investing in Stellantis due to unknown management effectiveness and the competitive nature of the auto industry.

- 📈 While discussing Tesla, the panel notes the significant long-term plans but also acknowledges that Wall Street's expectations might not align with the company's timeline.

- 📝 The importance of management quality is emphasized, with a clear statement that good management focuses on business growth rather than stock price fluctuations.

- 🔄 The conversation touches on the trend of financial software becoming more accessible, suggesting a shift towards usage-based pricing models for services.

- 🥡 Chipotle is mentioned as a high-growth restaurant stock, despite its high valuation, indicating investor confidence in its growth potential.

- 💄 The analysis of Elf Beauty reveals a strong growth trajectory but warns of the risks associated with potential future declines in growth.

Q & A

What concerns are raised about Stellantis in the discussion?

-The speakers express concerns about Stellantis due to rapidly declining earnings, negative cash flow, and compressing gross margins. They worry that the company may struggle to maintain profitability.

How does the discussion characterize Elon Musk's approach to engineering challenges?

-Elon Musk's approach is depicted humorously, with a suggestion that he would consider unconventional solutions, like using oversized chopsticks to address engineering problems, showcasing his creative thinking.

What is the sentiment surrounding AMC's future according to the speakers?

-The sentiment is largely skeptical, with speakers noting that AMC's share value has plummeted significantly, and there are concerns about potential manipulation with an increased share count. They reference previous warnings about its financial health.

What insights are shared regarding the restaurant stock being discussed?

-The restaurant stock is described as a 'Road Runner stock' due to its high growth rate, despite concerns over its valuation. The speakers emphasize that its sustainability is contingent on continued growth.

How do the speakers view the relationship between management quality and company success?

-The speakers stress that management quality is crucial for a company's success, particularly in challenging markets. They believe effective management can drive long-term growth, regardless of short-term stock fluctuations.

What do the speakers mention about democratizing financial information and software?

-The discussion highlights the shift towards making financial tools more accessible to average investors. They compare this democratization to historical changes in technology, indicating that financial software should become more affordable and user-friendly.

What risks do the speakers associate with growth stocks, particularly in the beauty industry?

-The speakers acknowledge that while growth stocks, such as those in the beauty industry, can offer impressive returns, they also carry significant risks. If growth stagnates, the stock value can drastically decline, highlighting the importance of understanding market dynamics.

What is the general sentiment about Tesla's stock performance and future prospects?

-The speakers generally maintain a positive outlook on Tesla's stock, acknowledging its volatility but expressing confidence in its long-term potential, especially due to ongoing innovations and partnerships in AI technology.

How do the speakers feel about the role of external factors in market valuation?

-The speakers recognize that external factors can heavily influence market sentiment and stock valuations, often leading to rapid changes in investor perceptions and behaviors, which may not align with the underlying business fundamentals.

What trading strategies do the speakers discuss regarding timeframes and stock management?

-The speakers advocate for flexibility in trading strategies, suggesting that if a stock does not yield profits within a set timeframe, such as a week, it's wise to exit the position to minimize losses. They emphasize not to become overly attached to any stock.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Competitiveness: How can European Key Industries Compete in the Global Markets? | EUROPE 2025

aik kel 5

US President Cancels Giant NASA Rocket (AGAIN!) - Deep Space Updates May 4th

#أروى_ولطيفة - زعتر

#65 Eric Sprott | Gold, Silver & Markets: Powerful Insights from The Man, The Myth, The Legend

De Dino Show 2011 FC Kip Aflevering 1

5.0 / 5 (0 votes)