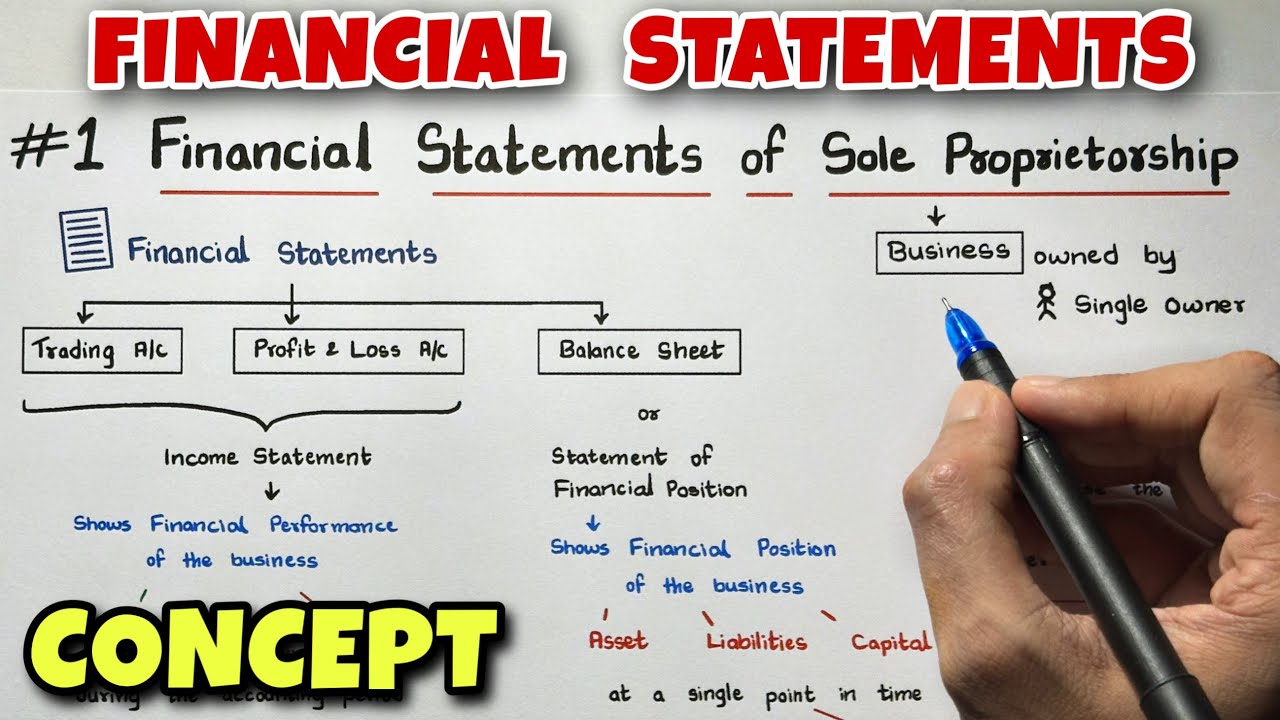

FINANCIAL ANALYSIS #1 Preparation of Income Statement and Balance Sheet @THINKTANKLIKEBEES

Summary

TLDRIn this financial analysis tutorial, the presenter discusses how to create an income statement and balance sheet for a sole proprietorship based on given figures. They explain that total expenses are $300,000, liabilities are $600,000, and current assets are $380,000, leading to a net income of $304,000. The income statement is structured by subtracting expenses from sales, while the balance sheet demonstrates the accounting equation of assets equaling liabilities plus capital. By detailing these calculations, the presenter aims to simplify the financial analysis process for viewers.

Takeaways

- 📊 Financial analysis involves creating an income statement and balance sheet based on given data.

- 💰 Total expenses are identified as $300,000 in the financial analysis.

- 📈 Total liabilities are stated to be $600,000.

- 🏦 Current assets are valued at $380,000.

- 🪙 The beginning capital is recorded at $480,000.

- 📉 Net income is computed as 80% of the current assets.

- 🔍 The income statement is calculated by subtracting expenses from sales to find net income.

- ⚖️ Assets must equal liabilities plus capital to ensure the balance sheet is accurate.

- ✏️ Net income is added to the beginning capital to determine the ending capital.

- 🔄 The balance sheet must balance, confirming that assets equal liabilities plus capital.

Q & A

What is the total amount of expenses mentioned in the analysis?

-The total amount of expenses is $300,000.

How is net income calculated in the script?

-Net income is calculated as 80% of the current assets, which amounts to $304,000 (calculated as $380,000 × 80%).

What are the total liabilities presented in the financial analysis?

-The total liabilities presented are $600,000.

What is the beginning capital value mentioned in the balance sheet?

-The beginning capital value mentioned is $480,000.

How do you derive the total sales from the provided figures?

-Total sales are derived by adding total expenses and net income: $300,000 + $304,000 = $604,000.

What formula is used to determine the ending capital?

-The formula used to determine ending capital is: Ending Capital = Beginning Capital + Net Income.

What is the calculated ending capital in the analysis?

-The calculated ending capital is $784,000 (calculated as $480,000 + $304,000).

How are total assets calculated in the balance sheet?

-Total assets are calculated using the formula: Assets = Liabilities + Capital, resulting in total assets of $1,384,000.

What balance is indicated between assets, liabilities, and capital?

-The balance indicated is that total assets ($1,384,000) equal the sum of total liabilities ($600,000) and ending capital ($784,000).

What is the importance of preparing both the income statement and balance sheet?

-Preparing both the income statement and balance sheet provides a comprehensive view of a company's financial health, showing profitability and overall financial position.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Basic Financial Statements

7. The connection between balance sheet, P&L statement and cash flow statement

#1 Financial Statements - Concept - Easiest Way - Class 11 - By Saheb Academy

Projected income statement Grade 11 PART 1

Financial Management: Financial Forecasting

How to Get Financial Statements Using Python

5.0 / 5 (0 votes)