What are derivatives? - MoneyWeek Investment Tutorials

Summary

TLDRThis video introduces the concept of derivatives, explaining their crucial role in financial markets. A derivative is a contract whose value is derived from an underlying asset, such as shares, commodities, or property. The video breaks down three primary types of derivatives—futures, options, and swaps—while using relatable examples, like a friend's deposit for a sports car. It highlights how derivatives can be used for speculation, hedging, arbitrage, and creating structured financial products. The presenter also directs viewers to additional resources for a deeper understanding of these financial instruments.

Takeaways

- 📈 Derivatives are financial products that derive their value from an underlying asset, which could be anything from shares to commodities like gold.

- 🚗 An example of a derivative in daily life is when someone pays a deposit for a sports car and later sells their place in the queue for a profit, similar to a call option.

- 💼 There are only three main types of derivatives: futures (or forwards), options, and swaps.

- 🛠 A future or forward contract allows someone to track the price of an asset without actually owning it, while an option provides the flexibility to buy or sell the asset later.

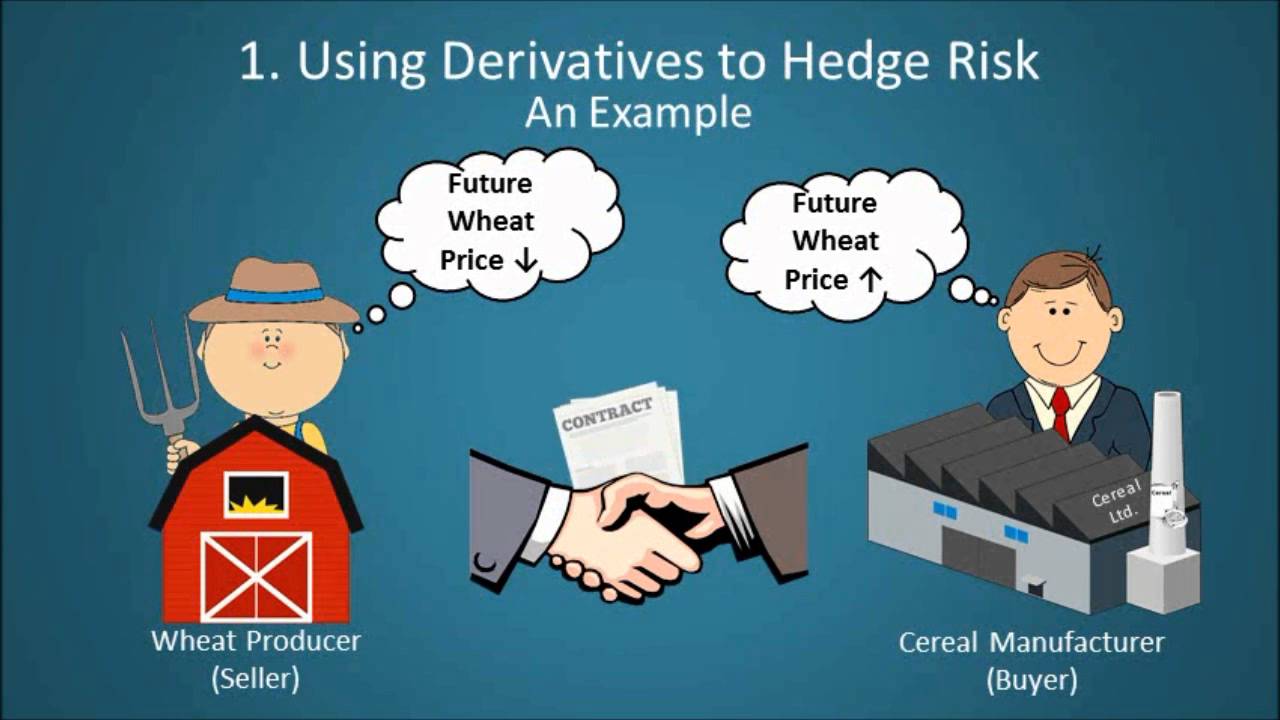

- 💡 Derivatives are used in multiple ways: for speculation (gambling), hedging (reducing risk), arbitrage (taking advantage of price anomalies), or creating structured financial products.

- ⚠️ Derivatives can be dangerous if misused, but they are also powerful tools when handled responsibly, much like a lawn mower.

- 🔄 Spread bets and CFDs (contracts for difference) are accessible forms of futures for retail investors in the UK, offering a way to speculate on price movements.

- 🛡 Derivatives can be used for hedging, allowing investors to protect themselves from falling prices without selling their underlying assets.

- 🔍 Arbitrage with derivatives involves exploiting short-term price differences across markets, such as buying in one place and selling in another for a profit.

- ❗ Structured products, often made using combinations of derivatives, promise certain financial outcomes but are viewed skeptically by some due to their complexity and potential risks.

Q & A

What is a derivative in financial markets?

-A derivative is a financial contract whose value is derived from an underlying asset, such as stocks, commodities, or currencies. It allows investors to trade on the price movements of these assets without actually owning them.

Can you provide an example of a derivative in everyday life?

-Yes, the speaker gives an example where a person paid a deposit to be on a waiting list for a limited-edition sports car. When they decided not to buy the car, they sold their place in line for a profit. This is similar to a call option, a type of derivative, as it involved selling the right to buy something in the future.

What are the three main types of derivatives?

-The three main types of derivatives are futures (or forwards), options, and swaps. All other complex derivatives are combinations or variations of these three basic forms.

What is a future or forward contract?

-A future or forward contract is an agreement to buy or sell an underlying asset at a specified future date for a set price. Futures are typically exchange-traded, while forwards are privately negotiated.

How does an option differ from a future contract?

-An option gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before or on a specified date. This flexibility differs from a future contract, which obliges both parties to complete the transaction at the specified date.

What is a swap in the context of derivatives?

-A swap is a contract in which two parties exchange financial obligations or cash flows. Common examples include interest rate swaps, where one party pays a fixed interest rate and the other pays a variable rate, and currency swaps, which involve exchanging payments in different currencies.

How can derivatives be used in financial markets?

-Derivatives can be used in several ways: for speculation (taking on risk to potentially profit), hedging (reducing exposure to risk), arbitrage (profiting from price discrepancies between markets), and creating structured products to meet specific investment needs.

What is the difference between speculation and hedging with derivatives?

-Speculation involves using derivatives to take a position on the direction of an asset’s price, seeking to profit from price movements. Hedging, on the other hand, involves using derivatives to reduce or manage risk, protecting against adverse price movements.

What is arbitrage, and how does it relate to derivatives?

-Arbitrage is the practice of taking advantage of price differences between markets or financial instruments. In derivatives trading, arbitrageurs buy an asset in one market and sell it in another where the price is higher, profiting from the price discrepancy.

Are derivatives accessible to retail investors?

-Retail investors have limited access to derivatives compared to institutional investors. However, similar products like spread bets and contracts for difference (CFDs) provide retail investors with ways to participate in derivatives markets.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

5.0 / 5 (0 votes)