Why China Can't Quit the US Dollar

Summary

TLDRThe video discusses the perception of the US dollar losing its dominance as the world's reserve currency. It explores China's efforts to reduce reliance on the dollar through 'dollarization,' a strategy used to stabilize economies by pegging to the dollar. China aims to weaken the dollar's global role, but this is complicated by its economic reliance on imports and US dollar reserves. The video explains China's managed float system and the challenges it faces in balancing capital control, independent monetary policy, and exchange rate stability. The narrative touches on the broader geopolitical implications, including the risk of China invading Taiwan.

Takeaways

- 🌍 China's desire to move away from the US dollar aims to gain greater economic independence and reduce reliance on adversaries' currencies.

- 💵 Dollarization refers to countries adopting the US dollar to stabilize their economies, while de-dollarization is when countries move away from it to gain monetary sovereignty.

- 🇨🇳 China employs a managed float system for the Yuan, where it intervenes to maintain the currency's value against a basket of currencies, but the US dollar is still a primary reference.

- 📉 Even though China's trade with the US is below 20%, nearly 47% of its cross-border payments were denominated in US dollars in 2023, highlighting their dependence on the currency.

- 🔒 China faces challenges balancing its need for global trade with its desire for control, particularly in its approach to the free movement of capital, domestic monetary policy, and exchange rate management.

- 🔗 The international financial system relies heavily on SWIFT for transactions, where the US dollar dominates, accounting for 48% of transactions, compared to the Chinese yuan's 4%.

- 🚧 China’s capital controls complicate efforts to reduce reliance on the US dollar, as capital flows in and out of the country are tightly regulated.

- 🇺🇸 The US dollar still holds an overwhelming share of global foreign exchange reserves, at 54%, which dwarfs other currencies like the Euro and Yen.

- 💣 If China opens its capital account or gives up its fixed exchange rate, it risks economic instability, potentially leading to a severe asset bubble burst, similar to Japan's 1990s crisis.

- ⚔️ China’s precarious economic situation, compounded by its reliance on imports and capital controls, could heighten tensions, increasing the risk of military action such as an invasion of Taiwan to distract from domestic issues.

Q & A

Why is there concern about the US dollar losing its dominance as the world's reserve currency?

-The concern stems from factors like the rising debt in the US and global geopolitical shifts, such as China's efforts to weaken its reliance on the dollar. Some believe these factors indicate that the US is entering a late-cycle debt crisis, which could threaten the dollar’s dominant role.

What is dollarization, and why is it relevant to Argentina?

-Dollarization is when a country pairs its currency with the US dollar to stabilize its economy, often due to a lack of trust in its own currency. Argentina's new leader, Javier Milei, is considering this strategy to manage the country’s ongoing currency crises.

Why is China looking to reduce its dependence on the US dollar?

-China wants to reduce its reliance on the US dollar to exert more control over its economy and avoid the influence of American economic policies. This is part of its larger goal of becoming a more independent global economic power.

How does China manage its currency, the yuan?

-China employs a managed float system for the yuan, allowing it to fluctuate in foreign exchange markets but with intervention from the People’s Bank of China (PBOC) to manage its value. This system references a basket of currencies, with the US dollar as the primary benchmark.

What role does the US dollar play in China’s international trade?

-Despite China’s desire to reduce its reliance on the US dollar, 47% of its cross-border payments in 2023 were still denominated in dollars, even though less than 20% of its exports were sent to the United States.

How does the SWIFT system factor into China's dependence on the US dollar?

-The SWIFT system is crucial for global financial transactions, and 48% of all SWIFT transactions are denominated in US dollars, compared to less than 4% in yuan. This dependence on SWIFT highlights China’s continued reliance on the US dollar for international trade.

What are the three economic policy trade-offs that countries face, and how do they apply to China?

-Countries can choose only two of the following: a fixed exchange rate, independent monetary policy, or free movement of capital. China tries to balance all three by managing its currency exchange rate, conducting independent monetary policy, and restricting capital outflows. However, this balancing act is becoming increasingly difficult.

What risks would China face if it opened its capital account or abandoned its currency peg?

-If China opened its capital account, it could face an asset bubble similar to Japan's in the 1990s. Abandoning its currency peg could lead to significant currency devaluation, making imports more expensive and destabilizing its economy.

Why is the idea of China overtaking the US dollar as the global reserve currency considered unlikely?

-The US dollar still accounts for about 54% of global foreign exchange reserves, far outpacing other currencies like the euro (19%) and yen (5%). Despite China’s ambitions, its currency plays a much smaller role in global finance, and it faces significant challenges in loosening its dependence on the dollar.

How could China’s economic struggles lead to a military conflict over Taiwan?

-If China’s economic situation worsens, its leadership might use military action, such as invading Taiwan, as a distraction from domestic problems. This could rally public support and shift the blame for economic issues onto foreign adversaries like the US.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Saudi Arabia Just Ditched The US Dollar (How This Affects You)

China's real plan for the dollar - Yanis Varoufakis & Wolfgang Munchau | The Econoclasts

Kenapa Dolar AS Dijadikan Uang Internasional?

BRICS are Plotting to Overthrow the U.S. Dollar (Why You Should be Worried)

Why the dollar is the dominant global currency

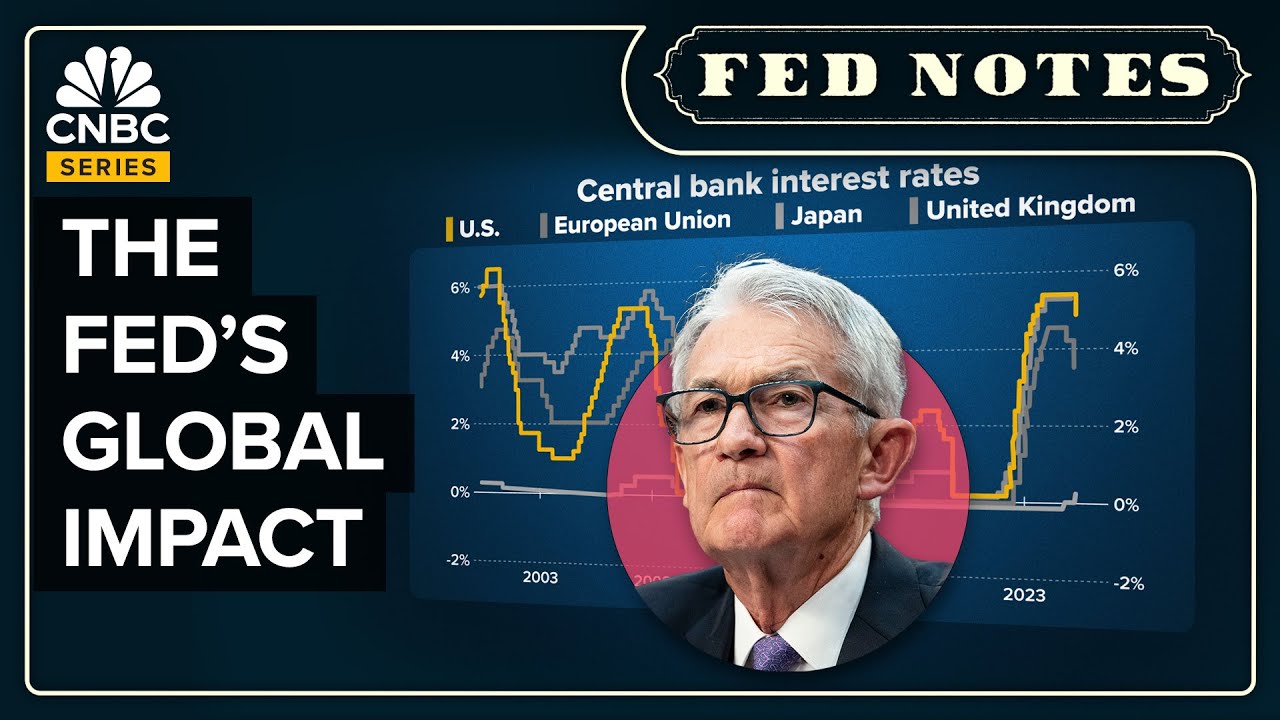

How Fed Rate Cuts Affect The Global Economy

5.0 / 5 (0 votes)