Bitcoin Poised for UP DOWN Volatility until the election.

Summary

TLDRIn this video, Jim, a crypto and forex trader, provides a detailed analysis of Bitcoin's current market structure using Elliott Wave theory. He presents both bullish and bearish scenarios, emphasizing the importance of Bitcoin's movement near key trend lines. Jim highlights the possibility of a significant upward move, potentially reaching $140K, or a hard dump leading to a multi-year bear market. He also discusses short-term price action, expecting consolidation before a decisive move post-election. His analysis encourages viewers to watch trend lines and anticipate either a continuation or a reversal.

Takeaways

- 📈 Bitcoin is at a critical juncture, with a major structure forming that could indicate a bullish scenario.

- 📊 A potential bull flag pattern is emerging, signaling a possible fifth wave to the upside in Bitcoin's price action.

- 🚀 If this wave pattern continues, Bitcoin could rapidly rise, with projected targets between $120K and $146K.

- 📉 A bearish scenario suggests that Bitcoin could drop hard, potentially reaching a support level between $4K and $10K in the next couple of years.

- 🔄 The market may either consolidate within current levels or see a significant pump or dump, depending on how trendlines are tested and held.

- 📐 Various Elliott Wave patterns are in play, with the bullish pattern relying on trendline support and a potential extended fifth wave.

- ⚖️ Both bullish and bearish scenarios are possible, with Bitcoin either breaking upwards or facing a multi-year bear market.

- 📅 The outcome could take years to fully play out, and short-term price movements may involve rejection and retracements at key levels.

- 💡 Short-term analysis suggests potential consolidation within the current range leading up to the election, after which a major move is expected.

- 📉 If Bitcoin breaks above key trendlines, it may initially spike before retracing, indicating a possible flat correction and further downward movement.

Q & A

What is the primary focus of the video?

-The primary focus of the video is on analyzing Bitcoin's price action using Elliot Wave theory, discussing both bullish and bearish scenarios.

What technical issue did Jim encounter during the live stream?

-Jim had a technical difficulty, which led him to cancel the stream and share his analysis through the video.

What is the bullish scenario Jim discusses for Bitcoin?

-In the bullish scenario, Jim sees Bitcoin in a third wave, projecting that the price could rise to 120-140k if the wave continues to the upside. He mentions a fifth wave extension and a potential peak at around 146k.

How does Jim use Fibonacci extensions in his analysis?

-Jim uses Fibonacci extensions to project potential price targets for Bitcoin. He highlights levels such as 2618, 3618, and 4618, which suggest significant upward movement if the bullish wave continues.

What does Jim predict could happen after a bullish rally?

-After a bullish rally, Jim predicts a potential multi-year bear market where Bitcoin could eventually fall back down to 20k, following a long upward wave and subsequent correction.

What is the bearish scenario Jim discusses for Bitcoin?

-In the bearish scenario, Jim considers that Bitcoin might be forming a leading diagonal (diag) followed by a significant dump, taking the price down to the 4-10k range over the next year or two.

What is Jim's 'Moment of Truth' for Bitcoin in this video?

-The 'Moment of Truth' refers to the current critical point in Bitcoin's price action where it must either break through key trendlines to confirm a bullish move or break down for a bearish outcome.

What does Jim recommend for traders if Bitcoin follows the bullish scenario?

-Jim recommends taking profits near the top of the bullish wave, as he does not believe Bitcoin will continue rising indefinitely without a significant correction.

What key trendlines does Jim monitor for Bitcoin?

-Jim monitors several trendlines in his analysis. He focuses on whether these lines hold or break, which will determine whether Bitcoin's price action remains bullish or turns bearish.

What impact does Jim foresee the U.S. election having on Bitcoin's price action?

-Jim predicts that Bitcoin may consolidate within a range leading up to the U.S. election, with more decisive movement (either pumping or dumping) occurring afterward based on market reactions to the election outcome.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

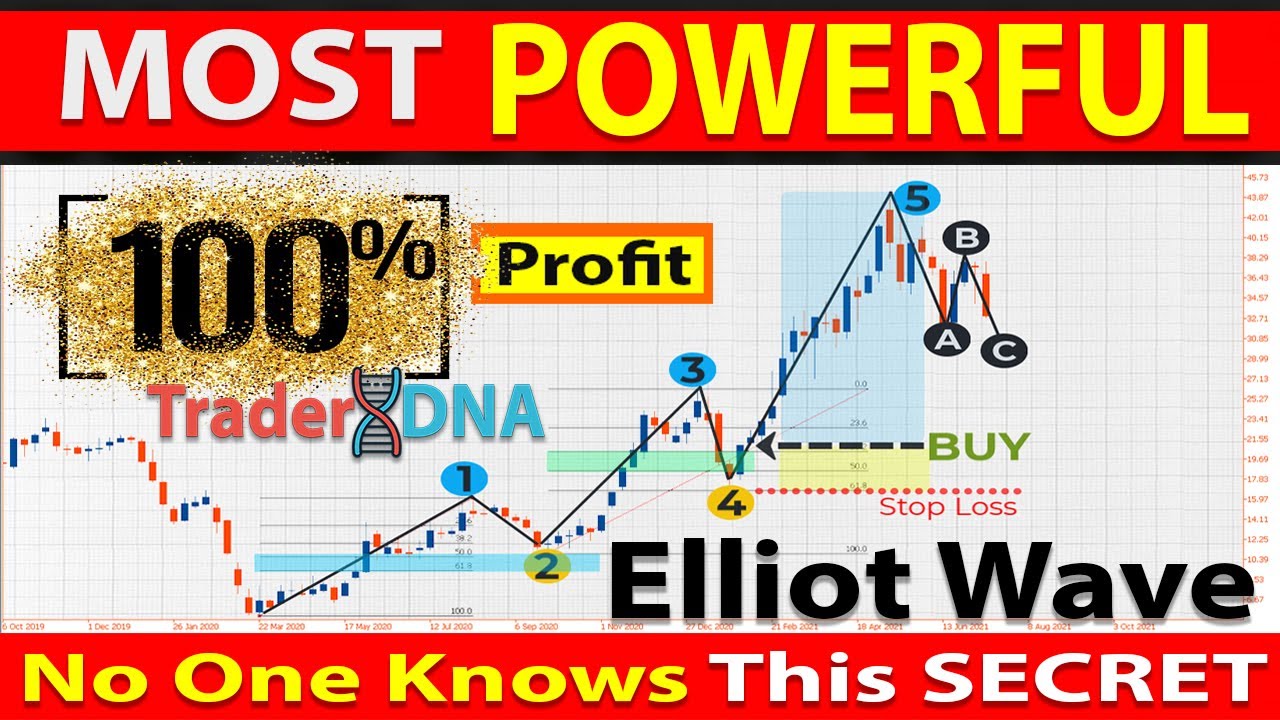

🔴 Most Effective "ELLIOT WAVE and FIBONACCI" Price Action Trading Strategy (Wave Trading Explained)

POPCAT (POPCATUSD) | Important Levels to be watched | Elliott Wave Technical Analysis & Price Action

Ethereum Support and Resistance Levels: Latest Elliott Wave Forecast for ETH and Microstructure

Bitcoin [BTC]: The final stage is here!

Uniswap (UNI) Price Prediction 2025 - How High Will It Go?

آموزش امواج الیوت مقدماتی

5.0 / 5 (0 votes)