Basic Concepts of Stocks and Bonds || Grade 11 General Mathematics

Summary

TLDRThis educational video for grade 11 mathematics covers the basics of stocks and bonds. It defines key terms, differentiates between common and preferred stocks, and explains bonds as debt instruments. The tutorial discusses stock valuation, market dynamics, and the concepts of equity and debt financing. It also explores the risks and returns associated with stocks versus bonds, and provides examples to calculate dividends, stock yield ratios, and bond-related values. The video concludes with insights into long-term investments and market indices for stocks and bonds.

Takeaways

- 📚 The class is focused on basic concepts of stocks and bonds for Grade 11 general mathematics.

- 🏢 Stocks represent a share of ownership in a company, making stockholders part-owners of the business.

- 💼 There are two types of stocks: common stocks, which entitle holders to dividends, and preferred stocks, which receive dividends before common stockholders.

- 📈 Stock valuation is crucial for comparing stock prices in the market, with stock prices fluctuating daily.

- 💵 Bonds are a form of debt financing where a company borrows money from investors, promising to pay a fixed interest rate and return the principal on a maturity date.

- 💻 The difference between stocks and bonds lies in the fact that stocks are equity financing with higher risk and potential for high returns, while bonds are debt financing with lower risk and yield.

- 📊 The stock yield ratio is a measure of dividends received relative to the amount invested, calculated as the annual dividend per share divided by the market value per share.

- 💹 Dividends are profits shared with shareholders, with dividend per share being the total dividend divided by the number of shares.

- 💼 The par value of a stock is the stated value on the company's certificate and remains stable over time, unlike market value which fluctuates.

- 📉 Bonds have terms like coupon rate, which is the interest rate paid periodically, and par value, which is the amount payable on maturity.

- 🌐 Market indices for stocks and bonds measure the value of a section of the market and are used to describe and compare market performance.

Q & A

What is the primary difference between stocks and bonds?

-Stocks represent a share of ownership in a company, making the stockholder part owner of the firm, while bonds are a form of debt financing where the bondholder is essentially lending money to the company.

What are common stocks and how do they differ from preferred stocks?

-Common stocks give stockholders the right to receive dividends. Preferred stocks also provide dividends, but they are paid out before common stock dividends in the event of liquidation.

How are dividends calculated for a company's common stock?

-Dividends per share are calculated by dividing the total declared dividend by the total number of shares outstanding.

What is the stock yield ratio and how is it calculated?

-The stock yield ratio is the ratio of the annual dividend per share to the market value per share, also known as the current stock yield.

What is the par value of a bond and how does it differ from the market price?

-The par value of a bond is the face value stated on the bond certificate, which remains stable over time. The market price is the current price at which the bond can be bought or sold, which can fluctuate.

How is the semi-annual coupon amount for a bond determined?

-The semi-annual coupon amount is determined by multiplying the bond's par value by the coupon rate and then by one-half, since it's paid semi-annually.

What is the difference between buying a bond at par, at a discount, or at a premium?

-A bond is bought at par when the purchase price equals the par value. It's bought at a discount if the purchase price is less than the par value, and at a premium if the purchase price is greater than the par value.

How can you determine the annual income from bonds?

-The annual income from bonds is calculated by multiplying the par value of the bonds by the number of bonds and the interest rate.

What is the yield of a bond and how is it calculated?

-The yield of a bond is the annual income from the bond divided by the amount invested in the bond. It is expressed as a percentage.

What is a stock index and how is it used by investors?

-A stock index is a measure of the value of a section of the stock market, computed from the prices of selected stocks. Investors and financial managers use it to describe the market and compare the returns on specific investments.

What information can be found in stock tables and how are they useful to investors?

-Stock tables provide information such as the 52-week high/low prices, the highest and lowest selling prices of the stock in the last trading day, stock symbols, volume, closing prices, and net changes. This information is useful for investors to make informed trading decisions.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Macam Macam Produk Pasar Modal Part 60

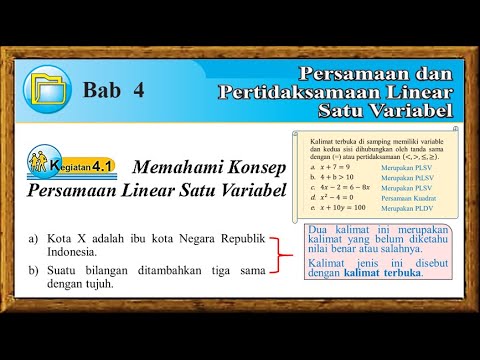

memahami konsep persamaan linear satu variabel

Uang Pendapatan Tabungan dan Investasi - Media Pembelajaran IPS kelas 7

1. Apa itu Obligasi? Apa manfaatnya? dan kenapa kita butuh obligasi syariah

Why Invest in Bonds? - S2 | E23

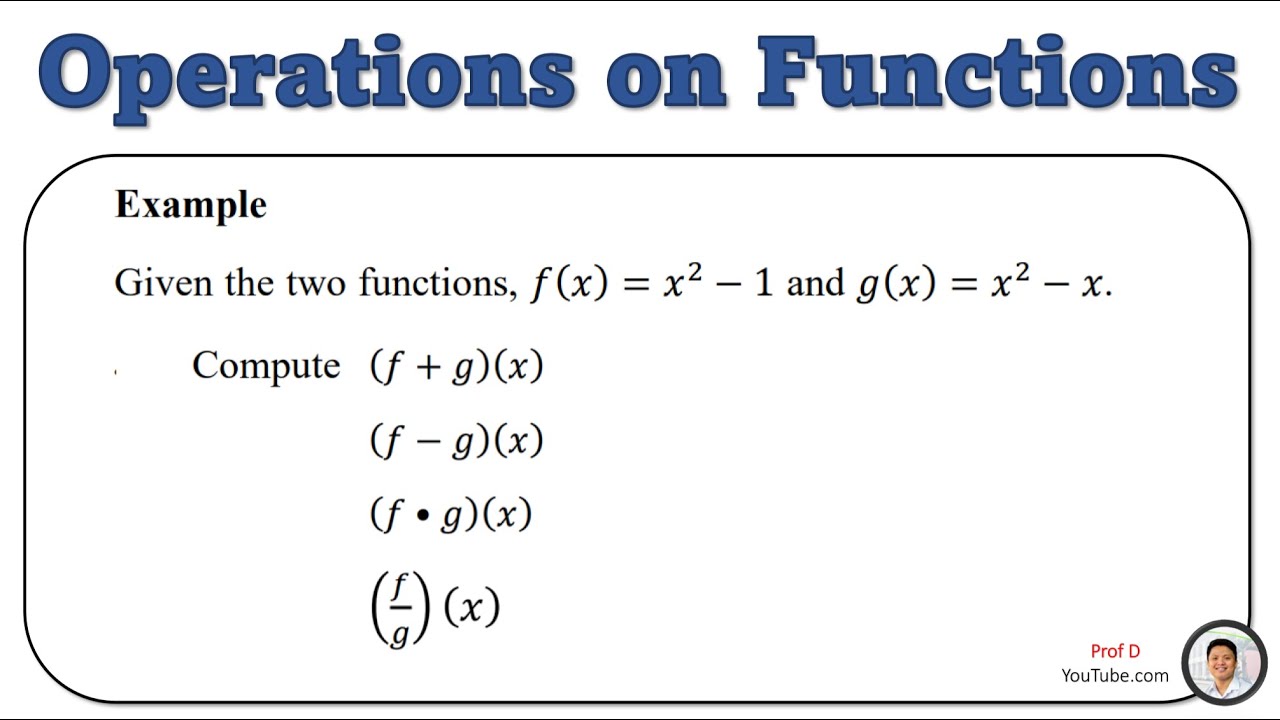

Grade 11 | Operations on Functions | General Mathematics

5.0 / 5 (0 votes)