The Line That Explains The Coming Housing Depression

Summary

TLDRThe video discusses a concerning trend in the U.S. real estate market, particularly in southern regions, where rapid price increases, unsustainable price-to-income ratios, and rising speculation mirror conditions from the 2008 financial crash. Economist Robert Shiller, known for predicting the 2008 collapse, highlights these trends using his Case-Shiller Index. While the broader market appears stable, southern areas like Florida show signs of vulnerability, leading experts to speculate about a potential market crash. The video explores these trends and compares them to early 2000s housing bubble indicators.

Takeaways

- 📉 Real estate markets are inherently local, but a significant correction is happening in a specific U.S. region while the rest of the country remains competitive and optimistic.

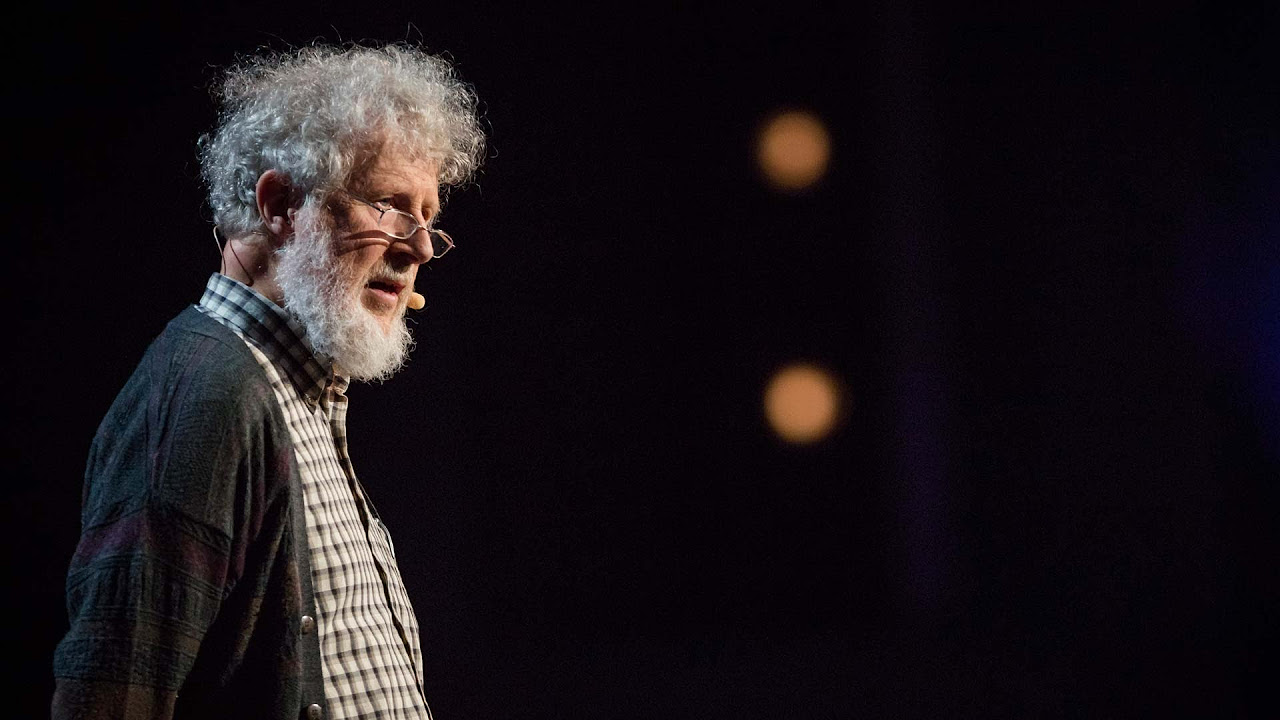

- 📚 Robert Shiller, a renowned economist and co-creator of the Case-Shiller Index, is cited as a leading expert on real estate trends, with insights that have predicted past market crashes.

- 🏡 Shiller's 2000 book 'Irrational Exuberance' identified three key factors that led to the 2008 housing crash: rapidly increasing home prices, high price-to-income ratios, and speculative buying.

- 📈 Home prices across the U.S. have surged, particularly in southern states, mimicking trends seen in the early 2000s before the last crash.

- 💰 The price-to-income ratio is at unsustainable levels, making homeownership unaffordable for many, and increasing financial strain in markets like Miami.

- 🔍 Shiller suggests that waiting to buy might be wise, as housing prices are still high and a potential downturn could occur.

- ⚠️ Speculation in the housing market is rising again, particularly in southern regions, with a growing number of home flips, mirroring pre-2008 conditions.

- 📊 Housing affordability is at historic lows according to the University of Michigan's consumer sentiment survey, indicating a very pessimistic outlook on buying conditions.

- 💸 Although subprime lending has been tightened since the 2008 crash, speculation and risky behaviors still persist, particularly in regions like Florida.

- 🌍 If a housing crash happens in 2024, it will likely start in the southern U.S. regions, which have shown more volatility compared to the rest of the country.

Q & A

What is the main theme of the video transcript?

-The main theme of the transcript is the potential real estate market crash in certain regions of the United States, particularly in the southern states, and how factors like rapidly increasing home prices, price-to-income ratios, and speculation are contributing to this instability.

Who is Robert Schiller, and why is he significant to this discussion?

-Robert Schiller is a renowned economist, academic, and author known for his work in real estate markets. He co-created the Case-Shiller Index, a widely respected tool for tracking housing prices, and his insights have proven valuable for understanding and predicting market dynamics, such as the 2008 financial crash.

What are the three main factors identified by Robert Schiller that indicate a housing bubble?

-The three main factors identified by Schiller that indicate a housing bubble are: 1) rapidly increasing home prices, 2) high price-to-income ratios, and 3) speculative buying in the market.

How do current home price increases compare to previous market conditions?

-Current home prices have risen significantly, with increases seen across almost every state, especially in the southern states. While these increases haven't matched the extremes of the 2008 buildup, the rise is still concerning, indicating similar speculative behavior.

Why is the price-to-income ratio considered a key indicator of market instability?

-The price-to-income ratio measures housing affordability by comparing home prices to typical incomes. A high ratio indicates that homes are becoming unaffordable, suggesting financial strain on buyers or increased speculation, which is unsustainable and can signal a bubble.

What does Schiller suggest about current market conditions?

-Schiller suggests that current home prices are very high by historical standards and that prices may cool off. He advises caution in buying decisions, though he acknowledges that purchasing a home is often more than just a financial decision.

How does speculation currently manifest in the housing market?

-Speculation is evident in the high rate of home flipping, particularly in southern markets like Atlanta and Memphis, where the proportion of flipped homes is nearing levels seen before the 2008 crash. This indicates increased speculative activity in the market.

What regions are most at risk of a market correction, according to the transcript?

-Southern regions, especially places like Florida, are most at risk of a market correction due to rapid price increases, high price-to-income ratios, and significant speculative buying.

Why does Schiller believe that predicting long-term housing market trends is challenging?

-Schiller believes that predicting long-term housing trends is challenging because market dynamics are influenced by various factors, including psychological elements, economic policies, and broader financial conditions, making it difficult to foresee long-term outcomes.

What does the University of Michigan's consumer sentiment survey indicate about current home buying conditions?

-The University of Michigan's consumer sentiment survey indicates that consumer sentiment regarding home buying conditions is at an all-time low, reflecting widespread pessimism about affordability and the current state of the housing market.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

The Negative Influence of Nitrous Oxide(whippets)

Weekly Meeting Example

Why An Alarming Number Of Men Are Leaving The Workforce

The REAL Economic Data Was Just Released, It's Not Good

Why our IQ levels are higher than our grandparents' | James Flynn

Elon Musk: "What Is Coming In The Next 20 Days Is UGLY And May DESTROY America..."

5.0 / 5 (0 votes)