How to Navigate Your First Credit Card: Teen's Edition

Summary

TLDRThe speaker shares their journey of mastering credit card usage, starting from acquiring multiple cards at 20 to optimizing them for lifestyle benefits. They recount overcoming their family's financial struggles post-2008 recession and turning credit card knowledge into a tool for a better life. The video offers a step-by-step guide for using credit cards wisely, from beginner to elite tiers, emphasizing the importance of paying off balances monthly, not exceeding 30% of credit limits, and utilizing welcome bonuses. It concludes with tips on maximizing point redemption and using transfer partners for better value.

Takeaways

- 💳 The speaker mastered the credit card game and acquired multiple cards, emphasizing their usefulness for different lifestyles.

- 🚫 The speaker's mother advised against credit cards due to her own struggles with debt post-2008 recession.

- 🎓 The speaker, despite initial advice, paid off his mother's debt and used credit cards to improve his financial situation.

- 💰 Credit cards can be a tool for financial growth, helping to achieve financial goals like owning a home or traveling.

- 💡 The importance of using credit cards properly is stressed, including paying off balances in full each month.

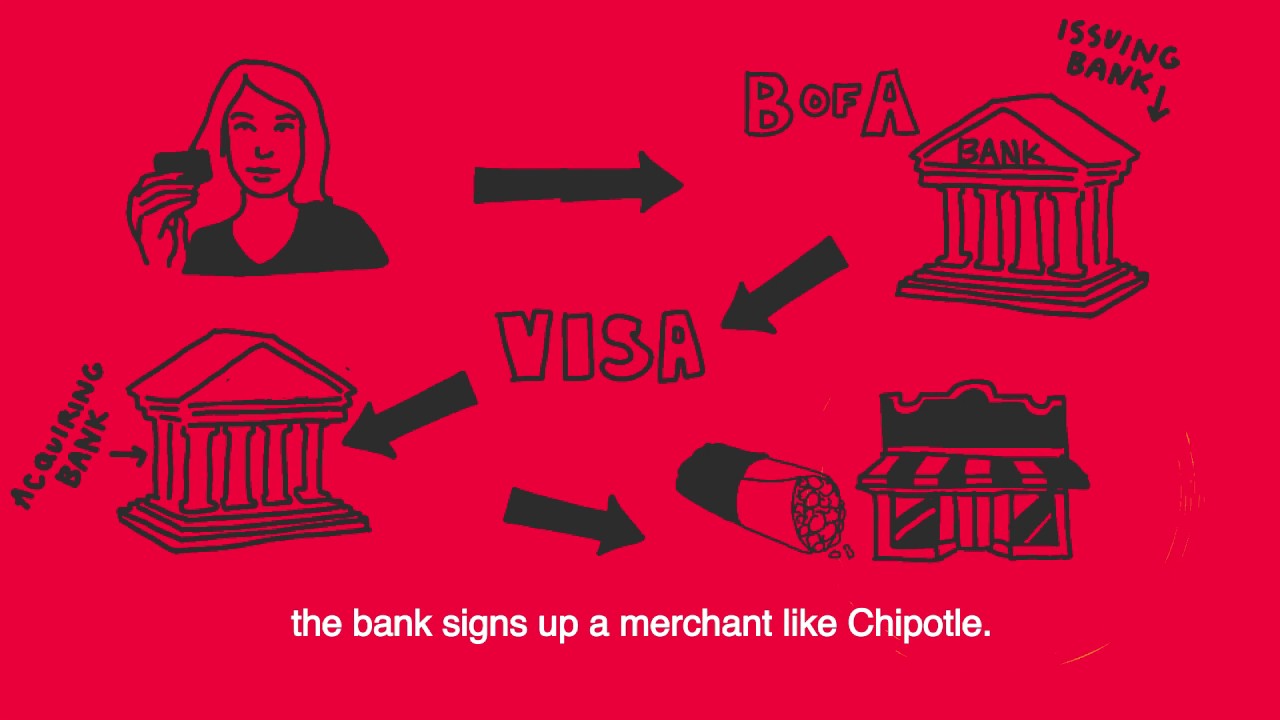

- 📈 The script explains how credit card companies make money through interchange fees paid by vendors.

- 💔 The stigma around credit cards often comes from poor financial management leading to debt.

- 🚫 Key advice is to never spend more than 30% of your credit limit and to avoid canceling credit cards as it can negatively impact your credit score.

- 💼 The script provides a step-by-step guide starting from secured cards for those with no credit to elite tier cards for seasoned users.

- 💼 The benefits of business credit cards are highlighted, suggesting they can offer significant rewards without affecting personal credit scores.

- ✈️ The video mentions strategies for maximizing point redemption, including using in-house travel portals and transfer partners for better value.

Q & A

What is the primary benefit the speaker claims to have gained from mastering credit card use?

-The primary benefit the speaker claims is the ability to optimize credit cards for various lifestyles, from rebuilding credit to earning significant rewards and perks that have improved their quality of life.

Why did the speaker's mother advise against opening credit card offers?

-The speaker's mother advised against opening credit card offers due to her own struggles with credit card debt, which was a result of financial difficulties following the 2008 financial recession.

How did the speaker help his mother overcome her credit card debt?

-The speaker was able to pay off all of his mother's remaining credit card debt, which was one of the proudest moments in his life and transformed a source of stress into a beneficial tool.

What is the significance of the 'Chase Freedom' cards in the speaker's credit card strategy?

-The 'Chase Freedom' cards are significant as they were the speaker's starting point for building credit and accumulating points. They are beginner-friendly cards with no annual fees and helped establish a relationship with Chase for future credit card applications.

What is the recommended strategy for using credit cards according to the speaker?

-The recommended strategy is to pay off the balance in full each month, not to spend more than 30% of the credit limit, avoid canceling credit cards, and ensure to hit welcome bonuses to maximize rewards.

Why does the speaker suggest not to cancel a credit card?

-Canceling a credit card can negatively impact one's credit score by reducing the overall available credit, which can increase the credit utilization ratio.

What is the role of the 'interchange fee' in the credit card ecosystem as explained by the speaker?

-The 'interchange fee' is a fee paid by vendors to banks for the convenience of accepting credit card payments instead of cash. This fee is part of the mechanism that allows banks to offer rewards and benefits to credit card users.

What are the potential benefits of having multiple credit cards as highlighted by the speaker?

-Potential benefits include earning rewards and cash back, building credit for larger financial goals like purchasing a home or car, obtaining travel perks, and having better protection against fraud compared to debit cards.

What is the 'Chase 524 rule' mentioned by the speaker?

-The 'Chase 524 rule' refers to Chase's policy of not approving new credit card applicants who have opened five or more credit cards across all banks in the past 24 months.

How does the speaker suggest using credit card points for maximum value?

-The speaker suggests using credit card points for maximum value by redeeming them through in-house travel portals or transferring them to transfer partners for higher redemption value, especially for airline tickets.

What is the advice for those who are denied credit cards?

-The advice for those denied credit cards is to use the reconsideration line to appeal the decision or ensure that the application meets the bank's criteria, such as having a good credit score and not having recently opened multiple credit cards.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

A Brief History of Credit Cards (or What Happens When You Swipe)

How to Use Credit Cards Wisely | The 6 Golden Rules

You May Be Getting the 30% Credit Utilization Rule Wrong - How it Works & How to Improve It

My NEW 2025 Credit Card Strategy (& 2024 Recap)

What Credit Cards You Should Have by INCOME? [Detailed Review]

Best UPI Credit Card | Kredit.pe Credit Cards | LifeTime Free Credit Card

5.0 / 5 (0 votes)