I'm Buying AMD Over Nvidia Stock in 2024 (Here's Why)

Summary

TLDRThe video analyzes AMD's position across several key markets - data center GPUs and CPUs, consumer desktop and laptop chips, gaming including discrete GPUs and console SoCs, and embedded applications. It compares AMD's latest products like the MI300 data center GPU and Ryzen 7000 chips to competitors like Nvidia and Intel. The presenter is bullish on AMD taking market share thanks to strong product execution and unprecedented AI/datacenter growth. However Nvidia remains a powerhouse and both companies face supply constraints. The video concludes AMD stock is worth buying over Nvidia due to higher growth, but Nvidia enjoys a competitive edge in core markets.

Takeaways

- 😀 AMD's data center GPUs are poised to take market share from Nvidia due to high demand and long wait times for Nvidia's offerings.

- 👍 AMD's next-gen server CPUs with up to 192 cores could allow them to continue gaining server CPU market share from Intel.

- 💻 The growth of AI is driving increased demand for AMD's consumer desktop and laptop chips.

- 🎮 AMD's Radeon GPUs are slowly taking desktop discrete GPU market share from Nvidia.

- 📉 AMD's gaming revenue is down due to the console market cycle, but overall console chip revenues are higher.

- 🚗 AMD announced new automotive chips, but they seem outdated compared to competitors.

- 🏆 I would buy AMD stock because they will keep gaining market share across multiple high-growth markets.

- 🚀 Data center, consumer CPUs, and automotive are some of AMD's fastest growing markets.

- 😖 Both AMD and Nvidia chips have more demand than supply right now.

- 👍 I have more money invested in Nvidia but AMD's growth makes it a good investment now.

Q & A

What are the key points AMD is making about their new Mi300X chip versus Nvidia's H100?

-AMD claims their Mi300X outperforms the H100 for large language model workloads by 60%, but Nvidia disputes this. After adding optimizations like Nvidia's TensorRT, the H100 is actually faster. The true performance depends on the workload, but AMD being competitive is a big deal.

How much data center GPU revenue is AMD projecting for 2024?

-AMD originally projected $2 billion in 2024 but indicated there is demand for much more than that. They have significant supply and see the potential to exceed $2 billion.

How is AMD gaining server CPU market share from Intel?

-By increasing core counts and shared cache memory. Their 4th gen EPYC chips doubled their server CPU market share since launch. The 5th gen is expected to have up to 192 cores.

Why does AMD expect growth in the PC market and their client revenues?

-The PC market is expected to grow 8-10% in 2024-2025 thanks to new CPUs with AI capabilities. AMD's Ryzen 7000 chips are seeing strong demand already.

How is AMD's gaming revenue impacted by the console market?

-Console chip sales have declined as expected in the console cycle. But higher overall revenues from latest consoles. New consoles likely won't see as much demand as during the pandemic.

What new automotive chips has AMD announced?

-The Ryzen Embedded V2 for infotainment and the Versal chip for ADAS and autonomous driving. But they seem outdated compared to competitors.

Why is the author buying AMD stock over Nvidia?

-Not because AMD beats Nvidia in performance. But because AMD will gain market share in fast growing markets where Nvidia has supply constraints.

How is AMD competing with Nvidia in AI and autonomous driving?

-With their Mi300X GPU vs Nvidia's H100 for AI. And their Versal chip for autonomous driving vs Nvidia's Hyperion.

What are the key markets where AMD competes with Nvidia and Intel?

-Data center, consumer PCs and GPUs, gaming consoles and cards, embedded/automotive.

What are the growth projections for key AMD markets?

-Data center GPUs expected to grow 24% CAGR. Global gaming consoles 5% CAGR. Smart car market 17% CAGR.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

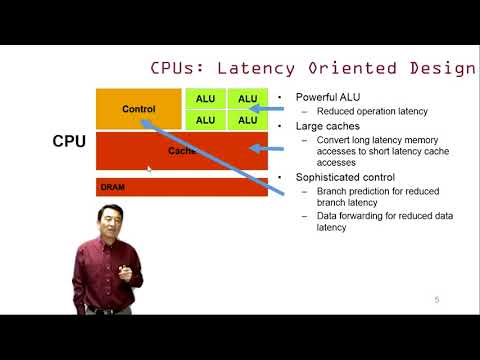

Chapter 1 - Video 2 - CPU vs GPU

Heterogeneous Parallel Programming -1.2 Introduction to Heterogeneous Parallel Computing

IT'S OVER! I Can't Stay Quiet on AMD vs Nvidia Stock (NVDA) Any Longer

7. OCR A Level (H446) SLR2 - 1.1 GPUs and their uses

Resumão – RYZEN 9000 / Driver Intel +268% / 4080M Franks / Fim do HT? / 7600 XT Flopou / MSI bugada

Intel's WORST NIGHTMARE!

5.0 / 5 (0 votes)