C'est quoi le Smart Money Concepts en Trading ? | EP.1

Summary

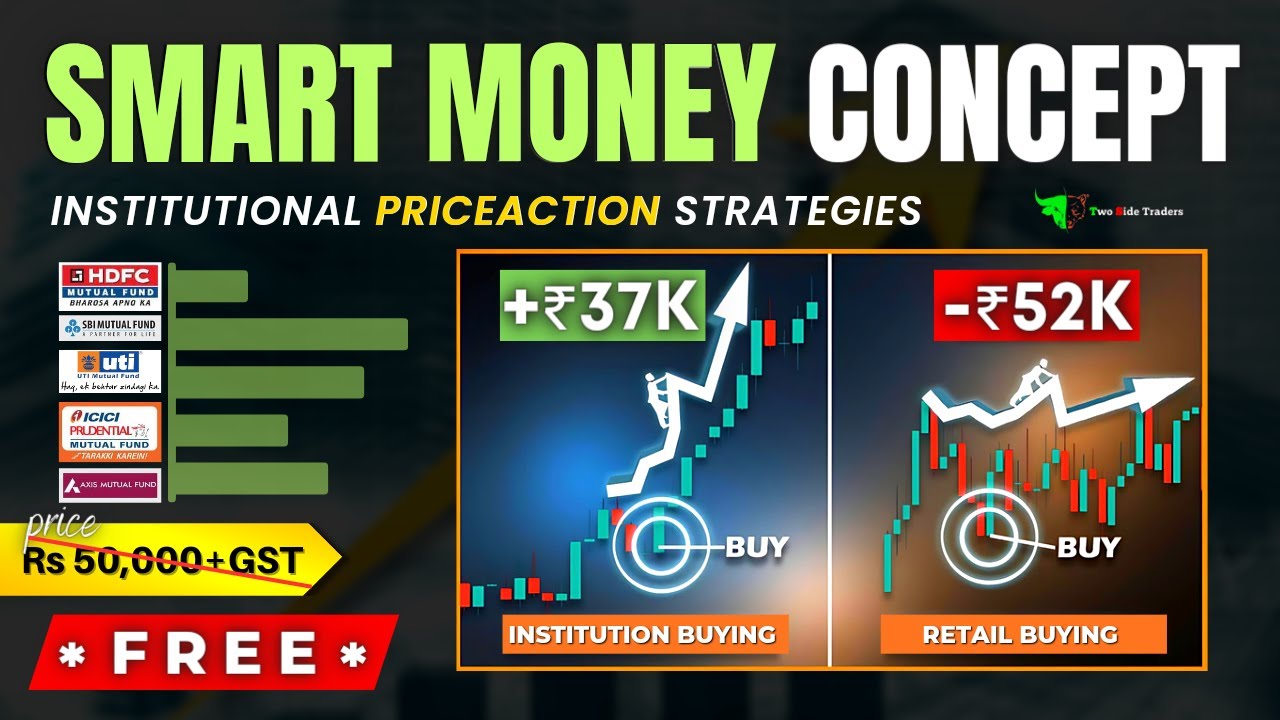

TLDRIn this video, Hugo introduces the Smart Money Concept (SMC), a trading strategy that mimics institutional trading methods. He explains how SMC differs from traditional techniques like trend lines and RSI by focusing on liquidity, which institutional traders seek to execute large orders. Hugo discusses the role of banks and institutional investors in controlling the market, highlighting their use of strategic phases such as accumulation, manipulation, and distribution. He emphasizes that understanding liquidity is key to successful trading and explains how SMC offers a more effective approach than classical charting methods.

Takeaways

- 😀 The Smart Money Concept (SMC) is a trading strategy focused on understanding institutional market movements, developed by ICT (Inner Circle Trader).

- 😀 SMC differs from traditional trading methods like RSI, Trendlines, and Ichimoku, focusing on the actions of banks and large financial institutions.

- 😀 The market is divided into two categories: Smart Money (institutional traders and banks) and Dumb Money (retail traders). The goal of SMC is to trade like the institutions.

- 😀 Retail traders often face frustration as they are manipulated by false breakouts, with the market reversing just before they hit their targets.

- 😀 The core of Smart Money trading is liquidity, which banks and institutions need to execute their large-scale orders.

- 😀 On OTC markets like Forex, every trade requires a counterparty, meaning for retail traders to win, someone must lose.

- 😀 The top banks dominate the Forex market. For example, JP Morgan, UBS, and XTX Markets have the largest shares of the market.

- 😀 Smart Money uses massive liquidity and typically trades on longer timeframes (4H, Daily, Weekly, Monthly) to avoid market noise and execute large orders.

- 😀 Smart Money focuses on liquidity gathering through key phases: accumulation, manipulation, and distribution.

- 😀 Retail traders often use classic chart patterns like head and shoulders or trendlines, which Smart Money uses to trap liquidity and continue the primary trend.

- 😀 The Smart Money Concept provides more context than traditional methods, focusing on price action, market phases, and liquidity, leading to more successful trading results.

Q & A

What is the Smart Money Concept (SMC)?

-The Smart Money Concept (SMC) is a trading strategy that focuses on the behavior of institutional investors, such as banks and private funds. It aims to understand and replicate how these institutions operate in the market, particularly in terms of liquidity manipulation and order placement.

How is the Smart Money Concept related to ICT (Inner Circle Trader)?

-The Smart Money Concept (SMC) was popularized by ICT, or Inner Circle Trader, a trading strategy developed by Michel Udelston. ICT refers to the creator of the method, while SMC is the concept itself. In essence, ICT is the individual who introduced and taught the Smart Money strategy.

What is the difference between retail traders and smart money traders?

-Retail traders are individual investors who typically trade with smaller positions and are more likely to lose money due to market manipulation by larger institutional traders. Smart money traders, on the other hand, are institutional investors, like banks and private funds, who move the market by executing large transactions and manipulating liquidity.

Why do retail traders often lose money in the market?

-Retail traders often lose money because they are frequently manipulated by the market. For example, they might set stop-loss orders behind key support or resistance levels, which the market then targets before reversing and moving in the direction they originally predicted.

How do institutional traders (smart money) take advantage of retail traders?

-Institutional traders manipulate the market to take advantage of retail traders' stop-loss placements. By creating fake breakouts or market traps, they collect liquidity from retail traders who have set stops behind key levels, allowing the institutional traders to enter positions more efficiently.

What is a false breakout in trading?

-A false breakout occurs when the price briefly moves past a support or resistance level, triggering stop-loss orders from retail traders, only to reverse and continue in the original direction of the trend. This often happens as part of a manipulation strategy by institutional traders to collect liquidity.

What role do banks play in the Smart Money Concept?

-Banks play a dominant role in the Smart Money Concept because they control the majority of the Forex market volume. Through their massive trading volumes, banks facilitate the market's liquidity needs, allowing them to execute large orders and move the market in their favor.

What is the importance of liquidity in Smart Money trading?

-Liquidity is critical in Smart Money trading because institutional traders need large volumes of liquidity to enter and exit positions without causing significant price movements. The Smart Money Concept focuses on identifying and capitalizing on areas where liquidity is concentrated, such as stop-loss levels or price accumulation zones.

What are the three main phases of Smart Money market positioning?

-The three main phases of Smart Money market positioning are: 1) Accumulation, where positions are built; 2) Manipulation, where the market is moved to trigger stop-loss orders and induce false signals; and 3) Distribution, where positions are exited aggressively as the market moves in the desired direction.

How do retail traders typically use technical analysis compared to Smart Money traders?

-Retail traders typically use technical analysis tools like trend lines, support and resistance levels, and indicators (e.g., RSI, Ichimoku) to make trading decisions. However, Smart Money traders do not rely on these tools in the same way. Instead, they focus on liquidity areas and market manipulation to enter and exit positions strategically.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

ICT SMT Divergence - Everything to Know About (Secrets)

Smart Money Concept PA 1/3 - FVG, IMB (SMC Tading PL)

DDTR - A Strategy That Manipulates Retail Traders Daily

Smart Money Trading: Top Entry Strategies and Supply/Demand Analysis for Profitable Trading

How Operator TRAPS New Traders | *FREE Advance Price Action Trading | Smart Money Concepts In Hindi

ICT Mentorship Core Content - Month 03 - Institutional Market Structure

5.0 / 5 (0 votes)